By IFCMarkets

All three main US indices end at records

US financial markets resumed the rally on Wednesday as the upbeat Beige Book and data boosted investors’ risk appetite. The dollar rebounded: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, rose 0.5% to 90.994. The S&P 500 gained 0.9% to all-time high 2802.56. The Dow Jones industrial jumped 1.3% closing at new record high 26115.65. Nasdaq composite index rose 1% to fresh record 7298.28. Futures on indices point to higher opening today.

While the stock market rally has elevated equity valuations to historical high levels, market sentiment was boosted by the Fed report the Beige Book indicated the outlook for 2018 “remains optimistic for a majority of contacts across the country.” With fourth earnings season corporate reports positive so far the Federal Reserve report the US industrial production rose an above expected 0.9% in December also buoyed market sentiment. Investor are watching the progress in immigration deal negotiations between the White House and lawmakers. It is the latest hurdle in budget negotiations and a spending agreement is needed before Saturday to avoid a government shutdown.

European stocks pull back on weak data

European stocks pulled back on Wednesday on weak data and corporate reports. The euro extended decline against the dollar while British Pound resumed its climb. The Stoxx Europe 600 closed 0.1% lower. Germany’s DAX 30 fell 0.5% settling at 13183.96. France’s CAC 40 lost 0.4% and UK’s FTSE 100 slipped 0.4% to 7725.43. Markets opened 0.1%-0.4% higher today.

Weak data failed to boost investor optimism: the final reading on euro-zone inflation in December came in line with expectations at 1.4%. However new car sales in the European Union fell in December, with demand falling in all major EU markets except Spain.

China fourth quarter GDP grows 6.8%

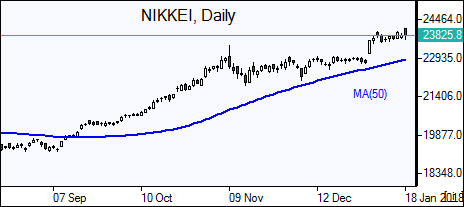

Asian stock indices are mixed today. Nikkei ended 0.4% lower at 23763.37 with yen little changed against the dollar. Chinese stocks are up as China’s economy grew 6.8% in the fourth quarter of 2017 from a year earlier, above expectations and unchanged from the previous quarter’s growth: the Shanghai Composite Index is 0.4% higher and Hong Kong’s Hang Seng Index is up 0.9%. Australia’s All Ordinaries Index lost 0.1% as Australian dollar resumed climb against the greenback on strong job growth though unemployment edged higher.

Oil down

Oil futures prices are lower today ahead of US official stocks report. Prices fell yesterday on expectations for a ninth straight weekly drop in US crude supplies and risks to production in Nigeria. The American Petroleum Institute reported late Wednesday US crude supplies fell 5.1 million barrels last week. March Brent crude rose 0.3% to $69.38 a barrel on Wednesday.

Market Analysis provided by IFCMarkets

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.