The Energy Report

Source: Streetwise Reports 01/16/2018

A junior E&P with prime land in Oklahoma’s STACK play uses a land swap to jump-start its drilling in an area that is seeing off-the-charts production as oil prices continue to rise.

The STACK play in Oklahoma remains one of the hottest areas of oil production in the U.S. The acronym stands for an unwieldy sounding “Sooner Trend Anadarko basin Canadian and Kingfisher counties,” but the area saw widespread oil and gas production in the 1960s through the 1980s via traditional, vertical wells.

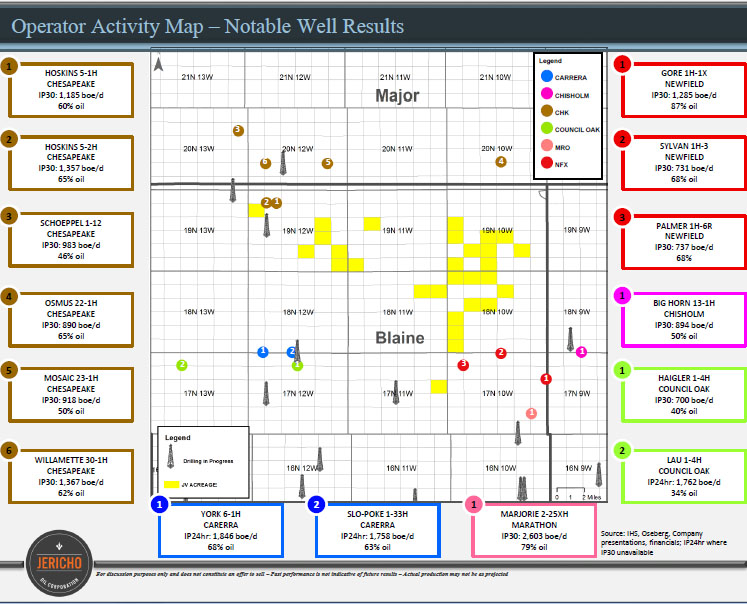

New horizontal drilling technologies are now unlocking vast reserves of oil and gas trapped in the shale, and companies are seeing off-the charts results. IP30s (Initial Production after 30 Days, which means the average daily production rate after 720 hours of production [there are 720 hours in 30 days]) for notable wells in the area range from 700 barrels of oil equivalent per day (boe/d) to as many as 2,600 boe/d.

Numbers like these are seeing companies flock to the STACK. Oil and gas majors like Marathon Oil Corp. (MRO:NYSE), Newfield Exploration Company (NXF:NYSE), Continental Resources (CLR:NYSE), Devon Energy Corp. (DVN:NYSE) and Chesapeake Energy Corp. (CHK:NYSE) all have large positions in the play.

Chaparral Energy Inc. (CHPE:OTC.MKTS), a $1.1 billion market-cap company, is among the latest E&Ps to concentrate its holdings in the STACK. On Dec. 27, the company announced that it has added to its STACK land package with the acquisition of 7,000 net acres, bringing its position to 117,000 net acres. The purchase price of the new acreage is about $8,500 per acre.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Chaparral’s divestiture of its North Burbank and Texas Panhandle assets, analyst John White with ROTH Capital Partners stated in a Dec. 11, 2017, company note, “allows CHPE to focus its capital and operations abilities almost exclusively on accelerating the development of its STACK properties.”

“In our opinion, almost any oil and gas producer will tell you, the best place to look for oil and gas is where it’s already been found. . .that is certainly true of the SCOOP/STACK/MERGE plays of the Anadarko Basin,” the ROTH analyst concluded.

Perhaps the only junior pure-play in the STACK is Jericho Oil Corp. (JCO:TSX.V; JROOF:OTC). The Tulsa-based firm through its Oklahoma STACK Joint Venture has rights to 31% of 8,600 net Mississippian acres in the STACK. The land was acquired for an implied value of approximately $2,300 per acre.

Jericho Oil just announced an acreage swap with privately held Staghorn STACK, LLC, whose land is just west of Jericho’s. Jericho noted that it has elected to “participate in the drilling of the Wardroom well with Staghorn as the Operator and pay its proportionate working interest share of costs related to drilling and completion. The Wardroom well is currently being drilled. It is approximately a 4,500-foot lateral targeting the Meramec formation in the normally-pressured oil window.”

Brian Williamson, Jericho’s CEO, stated, “We are excited about our growing STACK position and to be participating in our first horizontal STACK well targeting the prolific Meramec formation. Our acreage swap agreement ensures Jericho receives critical data for future operated drilling activities, and participation in the drilling of proximate horizontal wells to our footprint, with a proven best-in-class STACK operator.”

Staghorn has not yet released drill results from the Wardroom well; it could take two or three months for the information to become public.

Jericho Oil noted that the land swap also secures “tag-along rights for a portion of its Blaine County STACK JV acreage,” so if Staghorn sells its land, Jericho has the right to sell its acreage alongside Staghorn’s at the same price. In 2017, Staghorn sold 53,000 acres in the STACK to Chisholm Oil & Gas LLC for $625 million, which works out to about $12,000 per acre without adjusting for any of the purchase price going towards current production.

“The tag-along rights are important,” Williamson told Streetwise Reports. “Majors look for the scale and leverage of large land positions and these rights allow us to be included in a much larger land package.”

The price of oil has been rising steadily over the past several months and West Texax Intermediate (WTI) crude oil is now selling for around $65.50 per barrel.

Bob Moriarty profiled Jericho Oil on 321 Gold on Dec. 27, 2017. He noted that Jericho’s land package in the STACK would “allow for up to 160 drill locations.” Looking at the results of three other companies that have drilled in the STACK, “well costs were about $4 million for each of the companies. BOEPD varied from 725-749 and the IRR varied from 65% to an incredible 74%. Jericho and their partner are right in the center of that STACK play,” he stated.

“The Permian basin got both popular and expensive at the same time,” Moriarty concluded. “STACK is a cheaper alternative with excellent potential. Jericho is well positioned with excellent management and some of the strongest investors in energy. Their business plan works and will continue to work for the future. I believe 2018 will be a major move forward for Jericho as they begin to drill their STACK wells.”

Want to read more Energy Report articles like this? Sign up for our free e-newsletter, and you’ll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Patrice Fusillo compiled this article for Streetwise Reports LLC and provides services to Streetwise reports as an employee. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Jericho Oil.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Jericho Oil, a company mentioned in this article.