By IFCMarkets

US stock indices rise despite GDP downgrade

US stock market ended higher on Thursday despite mixed data. The dollar weakened marginally: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, ended 0.05% lower at 93.29. Dow Jones industrial average rose 0.2% to 24782.29. The S&P 500 added 0.2% to 2684.57 led by energy shares up 2.1%. The Nasdaq composite edged up 0.1% to 6965.35.

Only President Donald Trump’s signing is need for the tax bill to be enacted into law after Congress on Wednesday provided final approval of the tax overhaul. Mixed data were shrugged off: The US economy’s pace of growth in the third quarter was lowered to a 3.2% annual rate from 3.3% in the final reading of gross domestic product. The economy expanded at a 3.1% rate in the second quarter. Initial jobless claims rose a higher than expected 20,000 last week, though they remain at historically low levels. On the positive note, the Philadelphia Fed’s Manufacturing Business Outlook Survey jumped to a reading of 26.2 in December from 22.7.

European markets rebound

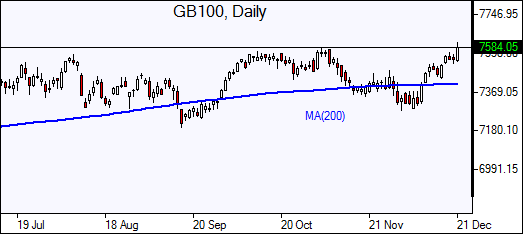

European stocks recovered on Thursday erasing earlier losses ahead of Catalonia’s regional election results. Theeuro extended losses against the dollar while British Pound edged higher. The Stoxx Europe 600 index rose 0.6%. Germany’s DAX 30 added 0.3% to 13109.74. France’s CAC 40 climbed 0.6% and UK’s FTSE 100 rallied 1.1% to record 7603.98. Indices opened 0.2% – 0.3% lower today.

Negative economic data undermined investors confidence: the Ifo business climate index, a leading indicator for economic activity in Europe’s largest economy, dropped to 117.2 in December, down from 117.6 in November.

Asian markets higher ahead of holiday

Asian stock indices are mostly higher in thin trading ahead of holidays. Nikkei rose 0.2% to 22902.76 on continued yen weakness against the dollar. Chinese stocks are falling: the Shanghai Composite Index is 0.1% lower while Hong Kong’s Hang Seng Index is up 0.6%. Australia’s All Ordinaries Index is 0.2% higher despite Australian dollar rally against the greenback.

Oil higher

Oil futures prices are edging higher today. Prices rose yesterday while the multinational chemicals group Ineos said it expects to complete repair work on Forties pipeline around Christmas. Brent for February settlement rose 0.5% to end the session at $64.90 a barrel on Thursday.

Market Analysis provided by IFCMarkets

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.