Daily Forex Market Preview, 17/11/2017

The US house plan passed the much-anticipated tax reforms plans on Thursday. The tax reforms are expected to see corporate tax being cut to 20% from the current 35% including other tweaks in an attempt to make businesses more competitive and attractive in the United States. The bill was passed with 227 votes in favor and 205 votes against.

The tax reforms bill did not garner much attention in the currency markets. On the economic front data, yesterday showed that the Eurozone final CPI was confirmed at 1.4% while core CPI was seen at 0.9%, unchanged from the flash estimates.

Looking ahead, the data today includes a speech by ECB President Mario Draghi. The economic calendar is quiet with the exception of Canada’s inflation data due later in the day.

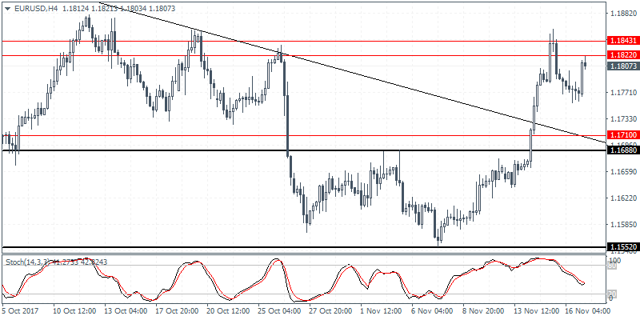

EURUSD intraday analysis

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

EURUSD (1.1807): After retreating from the 1.1800 handle, the EURUSD posted a decline yesterday. However, price action soon reversed the losses in early Asian trading session rallying back to the 1.1800 level. The retracement saw EURUSD briefly attempting to test the resistance level of 1.1843 – 1.1822. With the resistance level holding out, we expect the EURUSD to remain range bound supported above 1.1710 – 1.1688 region. However, with the falling trend line being breached, we expect that an upside breakout in prices.

USDJPY intraday analysis

USDJPY (112.54): The USDJPY continued to extend the declines in early trading session today. This comes amid a brief period of consolidation near the 113.00 support level. It is likely that in the near term, USDJPY could be seen retracing back to 113.00 where resistance could be established. Support to the downside is seen at 112.00 level. On the daily chart, USDJPY is seen breaking out from the rising wedge pattern. The downside target is seen at 110.50 region which could see further declines in store.

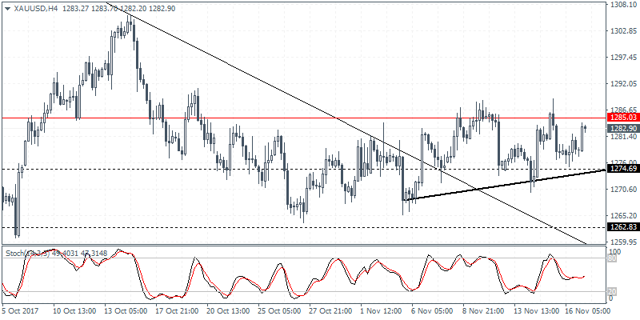

XAUUSD intraday analysis

XAUUSD (1282.90): Gold prices continued to trade flat within the 1285 and 1274 levels. Price action is showing a steady ascending triangle pattern that is being formed. This puts the upside breakout that could push gold prices towards 1295 level. Resistance is seen at 1300 which could be tested upon a successful upside breakout. Alternately, in the event that gold prices slip below 1274, the ascending triangle could be invalidated pushing gold prices lower towards 1262 handle.