By IFCMarkets

SP 500, Dow and Nasdaq close at records

US stocks closed at new record highs on Wednesday with tax reform Congressional deliberations in the focus. The dollar strengthened marginally: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, inched up to 94.87. The S&P 500 gained 0.1% to 2594.38 led by consumer staples and technology shares. The Dow Jones added less than 0.1% to fresh all time high 23563.36. Nasdaqcomposite rose 0.3% to 6789.12.

Investors bet that the tax reform will be adopted, boosting US economy. The Congressional Budget Office said the House Republicans’ tax bill would raise the federal deficit by $300 billion more than lawmakers estimated, exceeding the $1.5 trillion the recently passed budget would require to meet Senate rules. President Donald Trump wants tax overhaul legislation to pass in the Republican-led House of Representatives before the Thanksgiving holiday later this month. A Senate tax-cut bill, differing from the House of Representatives proposal, is expected to be unveiled today.

Financial shares lead European stocks lower

European stocks continued retreating on Wednesday led by financial shares. The euro ended little changed against the dollar while the British Pound resumed the decline. The Stoxx Europe 600 closed lower less than 0.1%. Germany’sDAX 30 ended up less than 0.1% settling at 13382.42. France’s CAC 40 lost 0.2% while UK’s FTSE 100 added 0.2% to 7529.72. Indices opened lower today.

Concerns about non-performing loans and below expectations earnings reports from banks weighed on financial shares. Credit Agricole shares lost 3.6% after disappointing earnings due to weak trading. Italian bank shares fell after sell off on concerns banks may need fresh capital.

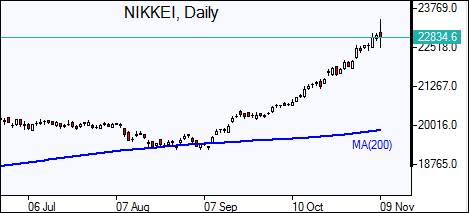

Higher Chinese inflation buoys Asian indices

Asian stock indices are mostly higher after upbeat Wall Street session overnight. Nikkei however fell 0.2% to 22868.71 as yen resumed climbing against the dollar. Chinese stocks are higher buoyed by higher than expected October inflation report: the Shanghai Composite Index is up 0.4% and Hong Kong’s Hang Seng Index is 0.8% higher. Australia’s All Ordinaries Index rose 0.5% despite Australian dollar’s continued gains against the greenback.

Oil steady as US crude inventories rise

Oil futures prices are steady today. Prices ended lower yesterday after the US Energy Information Administration reported domestic crude supplies rose by 2.2 million barrels last week. However gasoline stockpiles fell 3.3 million barrels. Brent crude fell 0.3% to $63.49 a barrel on Wednesday.

Market Analysis provided by IFCMarkets

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.