By IFCMarkets

Energy stocks lead US equities higher

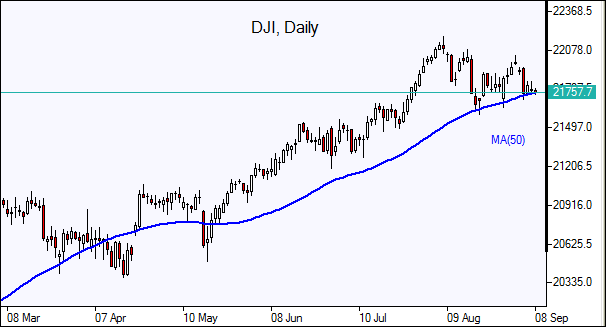

US stocks retreated on Thursday led by telecommunications stocks, financials and consumer discretionary sectors. The dollar fell on the back of sharp euro rise as the European Central Bank left policy unchanged: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, fell 0.8% to 91.523. Dow Jones industrial average lost 0.1% closing at 21784.78 with shares of Walt Disney and Goldman Sachs the biggest decliners. The S&P 500 slipped 0.1% settling at 2465.10. The Nasdaq index managed to gain 0.1% closing at 6397.37.

The confirmation of his support for another rate hike this year by New York Fed President William Dudley did little to support the dollar and Treasury yields. Dudley mentioned easier financial conditions and higher expected inflation as recent weakness in the dollar should lead to firmer prices on imported goods among the reasons for need to continue rate hikes. He also supported the decision to start shrinking Federal Reserve’s $4.5 trillion balance sheet. Cleveland Fed President Loretta Mester, a non voting member of Fed’s policy committee, said she backs a gradual increase of interest rates too.

Growth upgrade supports European indices

European stock indices advanced on Thursday on stronger euro-zone growth report. Euro-zone economy expanded 2.6% in the second quarter, up from the 2.5% rate of growth Eurostat estimated earlier. Both euro and < em> British Pound extended gains against the dollar. The Stoxx Europe 600 closed 0.3% higher. Germany’s DAX 30 outperformed gaining 0.7% to 12296.63. France’s CAC 40 added 0.3% and UK’s FTSE 100 rose 0.3% to 7396.98. Indices opened 0.3% – 0.4% lower today.

Asian markets mixed

Asian stock indices are mostly lower today with investors refraining from big bets ahead of North Korea holiday on Saturday. Many traders expect Pyongyang may launch another missile on Founder’s Day anniversary. Nikkei fell 0.6% to 19274.82 as yen hit 10-month high against the dollar. Markets shrugged off the report Japan’s Q2 GDP was downgrade to an annualized rate of 2.5% from an initial estimate of 4.0%. Chinese stocks are mixed: the Shanghai Composite Index is little changed while Hong Kong’s Hang Seng Index is 0.4% higher. Australia’s All Ordinaries Index is 0.3% lower as the Australian dollar continues the rally against the greenback.

Oil rising

Oil futures prices are inching higher as Hurricane Irma is heading for Florida. Market participants are concerned the damage from Hurricane Harvey was bigger than expected. Prices rose yesterday despite a US official report domestic crude inventories climbed 4.6 million barrels last week. Brent for November settlement rose 0.5% to end the session at $54.49 a barrel on the London-based ICE Futures exchange on Thursday.

Market Analysis provided by IFCMarkets

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.