Article by ForexTime

Investors avoided Sterling during trading on Thursday amid fears of UK Prime Minister Theresa May losing her grip on parliament after Britain’s June 8 election. Recent polls indicate a potential scenario where Theresa May could be short of the seats required to form a government, which has sparked concerns of political instability prior to the Brexit negotiations. With the growing threat of a nightmare “hung parliament” scenario likely to weigh heavily on Sterling, further downside should be expected in the short to medium term.

Focusing on the macroeconomics, UK Manufacturing PMI fell less than expected in May, slightly easing some concerns over the UK economy. Although the firm PMI figure of 56.7 suggests that the manufacturing sector is building some momentum in the second quarter, Sterling bears were unaffected. The fact that short term gains on the GBPUSD were swiftly relinquished after the PMI report continues to highlight how UK politics and Brexit continue to dictate where Sterling trades with economic data almost becoming secondary.

With the UK election only a week away, investors will be paying very close attention to the polls, which should inject Sterling with explosive levels of volatility. With Brexit already having some undesirable impacts on the UK economy, the last thing investors need is a messy Brexit deal that will surely add to the current woes.

Technical traders may pay attention to how the GBPUSD reacts to the tough 1.2775 support level. A breakdown below 1.2775 should encourage a further depreciation lower towards 1.2600.

ADP NFP report in focus

The Greenback struggled to regain its charisma this week with prices sinking towards 97.00 on Wednesday following the mixed batch of economic data from the US which weighed on sentiment. Although there are high expectations over the Federal Reserve raising US interest rates in June, the longer-term hiking path remains clouded and as such, continues to pressure the Dollar.

Dollar weakness is likely to persist moving forward, especially when considering how bears are exploiting the uncertainty over Trump and ongoing political instability in Washington to attack prices ruthlessly. Investors may direct their attention towards the pending ADP NFP Report this afternoon which could provide some minor support for the Dollar if the data released exceeds estimates. From a technical standpoint, the Dollar Index remains heavily bearish on the daily charts. Repeated weakness below 97.00 should encourage a further decline towards 96.00.

Oil bears remain dominant

WTI Crude edged towards $49 on Thursday following reports of US Crude stockpiles extending declines, slightly easing oversupply concerns. Regardless of the recent gains, the lingering disappointment from last week’s OPEC meeting continues to haunt investor attraction towards oil with the upside limited. Sentiment remains firmly bearish towards oil and sellers are likely to exploit the fact that OPEC’s oil output in May rose despite constant talks of balancing the markets. Although OPEC and Non-OPEC members remain committed to bringing global oil inventories down to a five-year average, it remains a question of how US Shale reacts and benefits from OPEC’s actions. I remain bearish on WTI Crude moving forward and a breakdown below $48 should open a path towards $46.

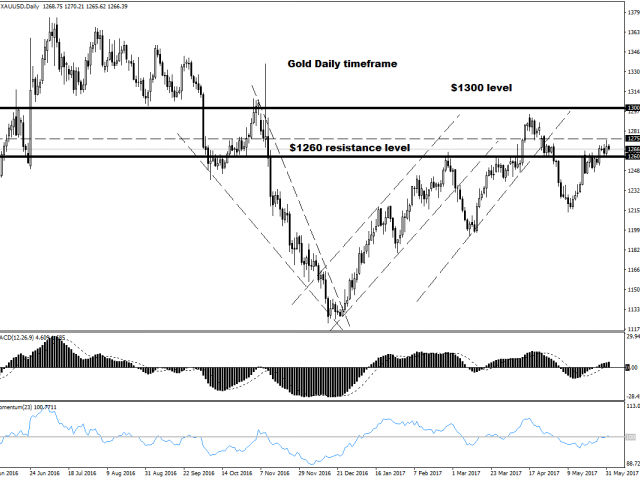

Commodity spotlight – Gold

In times of uncertainty and periods of anxiety, Gold becomes a trader’s popular choice which was seen on Wednesday when the metal lurched towards $1275. Although US rate hike expectations in June have slightly hindered the upside on Gold, short-term bulls are looking beyond this to propel prices higher. Although a positive ADP NFP Report this afternoon could expose the yellow metal to some downside pressure, bulls remain in control above $1260. From a technical standpoint, Gold needs to break above $1275 for the upside to continue.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com