By The Gold Report

Precious metals expert Michael Ballanger discusses what movements in the volatility index mean for the markets.

“Way Back When” is an expression that my grandmother used to use in discussing London during WWII when she and her family would congregate in the underground subway tunnels as soon as the air raid sirens began to go off. I use the expression “way back when” to refer to that point in time where market prices were determined by the natural forces of “inputs” such as demand and supply and where demand was actual orders for delivery and consumption (usage) and supply was inventory stockpiled on freight cars or in warehouses.

These were the days before central bank computers could mysteriously create synthetic inventory and sell it as if it was actually present on those freight cars or in those warehouses; they were also the days before the Working Group on Capital Markets created the infamous “Plunge Protection Team” for the express purpose of preventing a 1987-style market crash through the purchase of S&P futures (synthetic stocks). Never again will we see the margin clerks with their visors and round-rimmed glasses toiling away into the wee hours of the morning with a calculator in hand assessing just who was getting margin calls the next morning; computers do that in real time today so that you don’t have to wait until after dinner to find out if you are insolvent or not.

Furthermore, now that the Price Managers can play Space Invaders on their Bloomberg Terminals, trading gold and stock futures with zero personal liability and never a margin call, the capital markets around the globe have been totally corrupted by such a degree of moral hazard that all those bleeps and beeps and buzzers going off are not the sound of an RPG gamer losing a “life” but the sound of a gold producer laying off staff or a bank calling in a credit line. Market behavior is now creating outcomes that have no bearing on the inputs of demand and supply but rather on “policy,” and every time a politician opens his/her mouth or pens an Op-Ed piece, pattern-recognition algorithms explode out of the gate sending buy and sell signals after analyzing multiple word clouds to high-frequency trading terminals creating untold havoc on prices and in record time.

It is in this manner of price response that incongruities arise, throwing valuations completely out of whack. You analyze a stock or commodity and get a realistic handle on historical demand versus supply, you observe technical price patterns, and then you come to an investment decision. You make the trade and within hours, you are under water and within days you are stopped out at a loss because “Mario Draghi was seen in a restaurant with Angela Merkel eating lobster.” In my opinion, when markets have been relegated to total reliance on the “optics” of a trade (momentum and volume) versus the economic fundamentals of the trade (supply and demand), it leaves markets open to interventions that leave an indelible mark on the integrity of markets. When markets lose integrity, they lose customers and when they lose customers, they die. Such has been the case in precious metals largely since 2009, and that is what I fear is coming for stocks and bonds in the near future.

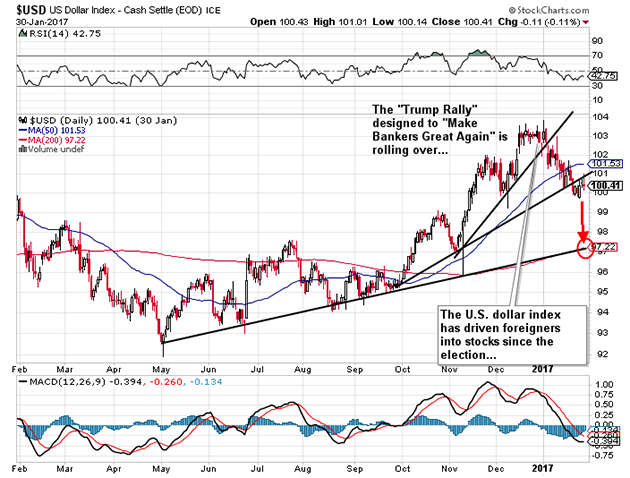

The big news this week revolves around the flapping gums of the new POTUS and how he is continuing to cause disruptions in the narrative focusing on his ability to create jobs, promote growth and limit immigration. The level of vitriol in the Washington landscape now threatens to disconnect the power cords of the political and legislative juggernaut and there is no more obvious an indication of this brewing turmoil than in the VIX (S&P 500 Volatility Index), which has suddenly spiked up from under 10 to 12.03 since the weekend. Looking at the COT report for VIX futures, we are witnessing the largest non-Commercial speculator short position in the history of VIX futures dating back to 2007. It has been well documented that large Speculator positions at levels beyond the norm in most markets have resulted in reversals and I use as an example the record shorts seen in Crimex Gold in December 2015 held by non-Commercial Large Specs. Accordingly, I am opening a long position in the UVXY (ProShares Ultra VIX Short-Term Futures) March $25 calls for $4.50; the number one trading rule for these is to hold them for a maximum of 48 hours and if they are not “onside” by the close on the second day of trading, you pitch them overboard like a dead seagull. If the VIX catches a bid, it will advance through 15 by the end of the week and carry the UVXY through $30.

As for gold, remember that “big, ugly, red candle” from last Friday? I told you on the weekend that traders for the bullion bank behemoths will purposely paint the tape on a Friday just to tilt the Weekly Chart over the edge, and any and all monitors of the weekly charts would construe it as “black bearish” and exit positions. Well, have a look at how things have played out since the Friday close by looking at the chart below.

The $20 advance of the late lows of last week has now got everybody trapped either “out” or “short” going into the FOMC minutes on Wednesday, so to the extent that I am constantly looking for clues that would serve to refute my strategy, look no further than the silver market where we enjoyed a 2.47% advance today versus 1.37% for gold. When silver outperforms gold, it is like watching Fido crush the marrow out of a pork bone while staring at me menacingly daring me to try to take it from him. Silver is my resolute confirmation that I am directionally correct along with the HUI’s (NYSE Arca Gold BUGS Index) 2.93% move as further icing on the cake. That “big, ugly, red candle” chirped about all weekend was thus far a glorious fake-out and one that has the shorts’ heads spinning as they try to figure out why there was no follow through from Friday. The shorts are close to scrambling now as we have moved through option expiration, so the table is set for gold, silver and the miners.

Speaking of the miners, the GDXJ (VanEck Vectors Junior Gold Miners ETF) calls purchased on Friday at $2.45 were pitched overboard on the Monday opening at $3.30 and bought back at 15:55 EST just before the bell at $2.65. At 9:40 this morning, I pitched them as well at $3.30 and waited all day for the dip, which failed to materialize leaving me agitated, cranky and hard-to-get-along-with here on the last day of January and the 31st day of my newly found Jack Daniels Sabbatical, which has me feeling physically wonderful, psychologically strong, and spiritually empowered except for the screaming nightmares that have me clinging to the ceiling by my fingernails while escaping the clutches of Zombie margin clerks closely resembling Phyllis Diller–Rosie O’Donnell clones.

I sense that the all-too-wondrous complacency brought about by muted performances by the VIX and the precious metals in the month of January is about to undergo a stark transformation due to a reconfiguration of market responses to DJT’s policies and tweets. This populist agenda that has, as its primary objective, him actually implementing those campaign promises for his electoral loyalists, which will transpire as a legion of heroin addicts (liberal Democrats) go through an agonizing withdrawal all at the same time after eight years of free injections. The poor Donald has to worry not only about the elitist “machine” in Washington finding a way to unseat him through political chicanery but also his own constituents coming after him with torches and pitchforks if he veers off task for as much as a smoke break.

Alas, this mega-billionaire narcissist is garnering my admiration not so much for banning immigrants from known terrorist-incubating countries but more so for sticking it to the status-quo-loving globalist elites who are happy with their private-school kids managing the “Home Office” by demanding that those exported jobs be returned and interest deductions on their fourth and fifth mansions be eliminated. This Trump character is at the front of the First Armored Division, medals jangling, gun over his shoulder, leading his soldiers into battle and apparently willing to take the first bullet. As alarming as that might be to the Starbucks latte-sipping, Birkenstock-sandal-wearing, iPhone-obsessed liberal youth of today, it is serious “dancin’ music” to the Joe-Bobs of the world who are barreling down the highway on the way to DC, shotgun in tow, Confederate flag a-wavin’ in the wind and F150 pick-up full to the brim with premium beer and all-too-ready to reclaim the “America of my youth.” If only this new invigoration of the American Dream could be reflected in the abstinence of intervention and criminality in the gold and silver arena, it would truly make my day and I would forgive the Donald for the very minor indiscretion of telling us quite graphically how to deal with women.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger’s adherence to the concept of “Hard Assets” allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you’ll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Statements and opinions expressed are the opinions of Michael Ballanger and not of Streetwise Reports or its officers. Michael Ballanger is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. Michael Ballanger was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.

All charts courtesy of Michael Ballanger.