By IFCMarkets

Nasdaq closes at record high for second session

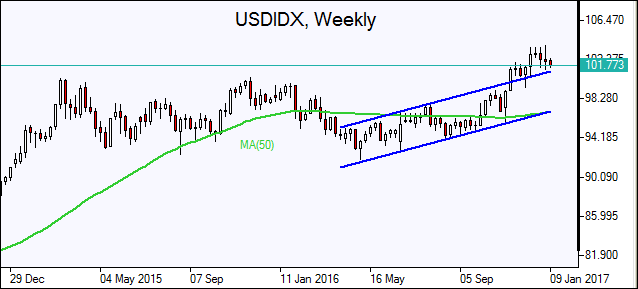

US stocks inched lower on Monday led by energy and utility stocks. The dollar continued consolidation that started after it hit record high on January 3: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, closed 0.34% lower at 101.846. The Dow Jones industrial closed 0.4% lower at 19888.20, further away from the 20000 psychologically significant level. The S&P 500 fell 0.4% settling at 2268.92 with energy, utilities, telecom and consumer staples stocks leading the broad market lower. The Nasdaq index rose 0.2% to new all-time high at 5531.82 lifted by gains in health care and technology stocks.

Stocks retreated in a pause as investors focus on high valuations that need to be justified by improving economic data and corporate earnings. Markets have rallied since November on expectations of accelerating growth based on president-elect Trump’s support for more fiscal stimulus for US economy. Boston Fed President Eric Rosengren’s speech on Monday was hawkish as he forecast “somewhat more regular” increases in short-term interest rates. However, Atlanta Fed President Dennis Lockhart said that the economy is likely to grow at a moderate pace of 2% but that expectations of significantly higher growth are unrealistic. Today at 16:00 CET November Job Openings and Labor Turnover Summary survey results will be published, the outlook is positive for dollar.

European stocks retreat on disappointing corporate news

European stocks ended lower on Monday on disappointing corporate updates. The euro strengthened against the dollar while the British Pound slumped after British Prime Minister Theresa May’s remark she was confident the UK could get a good deal on both trade and immigration but the country couldn’t just keep “bits of EU membership” was deemed as signaling hard exit from the EU. The Stoxx Europe 600 index fell 0.5%. The DAX 30 lost 0.3% to 11563.99. France’s CAC 40 dropped 0.5% while UK’s FTSE 100 added 0.4% to 7237.77.

Shares of Lufthansa dropped 5.8%, after the German airline said late Friday that fuel costs will rise this year and didn’t provide an earnings forecast for 2017. Fresenius Medical Care stocks sank 6.8% after the dialysis provider warned that its US business could be hurt by planned reduction in US public assistance programs for renal disease patients. However Volkswagen shares gained 4.9% after the German car maker reported higher sales last year. In economic news, German industrial production rose slightly less than expected in November, but exports surged from the previous month, indicating expansion in overall economic activity in the fourth quarter. No important economic data are expected today in euro-zone.

Australian economy contracts in third quarter

Asian stocks are mixed today. Nikkei ended 0.88% lower at 19283.00 today as yen edged higher against the dollar amid investor concerns Trump may further criticize Asian manufacturers at his first news conference on Wednesday since election victory. The Shanghai Composite Index is down 0.3% while Hong Kong’s Hang Seng index is 0.6% higher after data showed consumer inflation slowed in December. Australia’s All Ordinaries Index is 0.8% lower after the country’s economy contracted in the third quarter and for the first time since early 2011.

Oil prices inch higher

Oil futures prices prices are edging higher today on hopes output cuts would implemented by major producers in 2017 as agreed last November despite doubts over full implementation. Prices fell the previous day on reported rising output in Iran, Iraq and North America. The announcement by US Department of Energy on Monday of a sale for crude from its Strategic Petroleum Reserve, with bids for 8 million barrels of light, sweet oil due by January 17 was an additional negative factor for oil. March Brent crude fell 3.8% to $54.94 a barrel on London’s ICE Futures exchange on Monday.

Market Analysis provided by IFCMarkets

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.