By Lukman Otunuga, Research Analyst, ForexTime

The mighty Dollar has been bruised and battered by G10 currencies this month as investors question the strength of the U.S economic recovery in the face of rising coronavirus cases across multiple states.

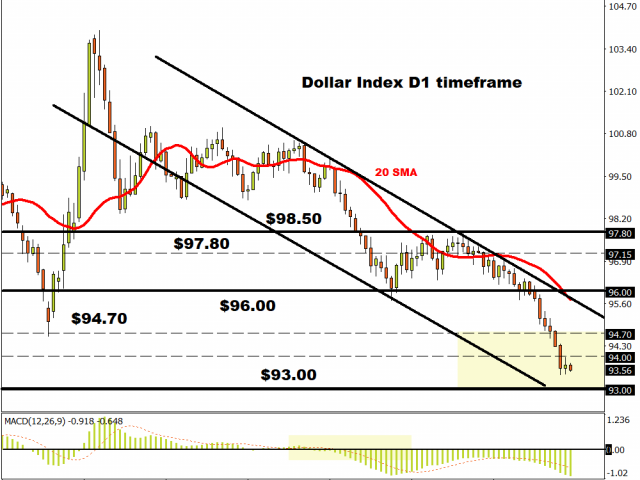

Other negative factors including worsening US-China tensions, uncertainty surrounding November’s presidential elections and shaky economic data have compounded to the Dollar’s pain and misery. With the Dollar Index (DXY) on track for its biggest one month decline since April 2011, it is fair to say that bears remain in the driving seat.

King Dollar could be instore for more punishment this evening if the Federal Reserve reinforces its dovish message and expresses concerns over the US economy. While the central bank is widely expected to keep interest rates unchanged at near zero, much of the attention will be directed towards the policy statement and speech by Fed Chairman Jerome Powell. Given how data from unemployment claims still remains a cause for concern, Powell may reiterate that the Fed will do whatever it can to support the recovery – meaning interest rates may be left at near-zero for even longer.

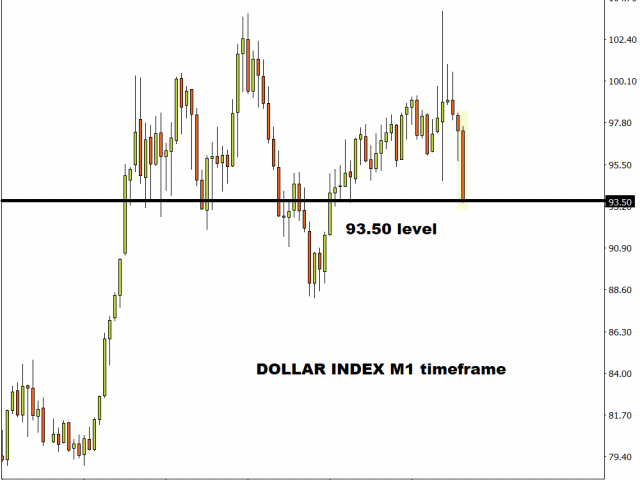

Looking at the technical picture, the DXY fulfills the prerequisites of a bearish trend on the daily timeframe. Prices are trading within a bearish channel, the MACD has crossed to the downside while the candlesticks are trading well below the 20 Simple Moving Average. If 94.00 proves to be reliable resistance, the DXY may slip back towards 93.50 and 93.00, respectively. A breakdown below 93.00 could open the doors back to levels not seen since August 2018 below 92.20.

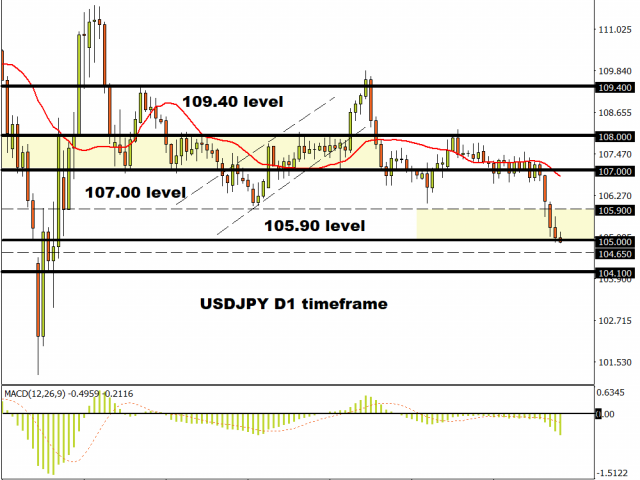

USDJPY eyes 104.65 level

Yesterday we discussed the possibility of the USDJPY testing 104.65 after breaking below the 105.00 support level. Prices are under pressure on Wednesday morning and could trend lower if the Dollar weakens ahead of the Federal Reserve policy meeting. Sustained weakness below the 105.00 dynamic resistance could trigger a selloff towards 104.65 and 104.10.

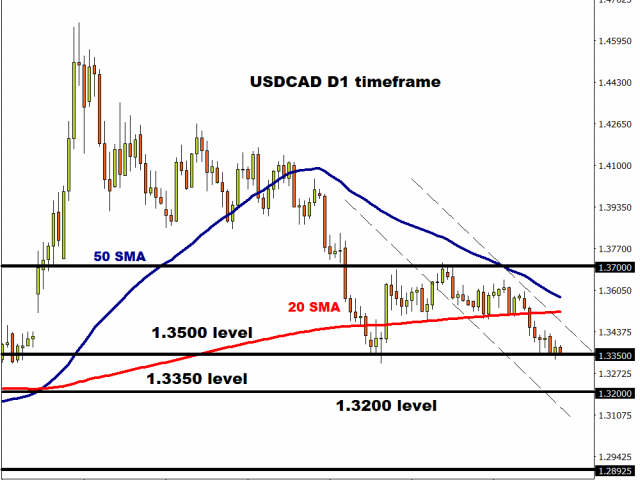

USDCAD breakdown setup in play

The USDCAD is gearing for a breakdown below the 1.3350 on the daily timeframe. Prices are trading comfortably below the 20 and 50 Simple Moving Average while there have been consistently lower lows and lower highs. A solid breakdown below this support could trigger a decline straight towards 1.3200 which is 150 pips away.

AUDUSD rides higher on Dollar weakness

Expect the Australian Dollar to appreciating against a broadly weaker Dollar in the short term. The daily charts suggest that bulls still have some stamina with a breakout above 0.7150 opening a path towards 0.7300. If 0.7150 proves to be a stubborn resistance, prices may decline back towards the 0.6960 regions.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Article by ForexTime

Article by ForexTime

ForexTime Ltd (FXTM) is an award winning international online forex broker regulated by CySEC 185/12 www.forextime.com