Article By RoboForex.com

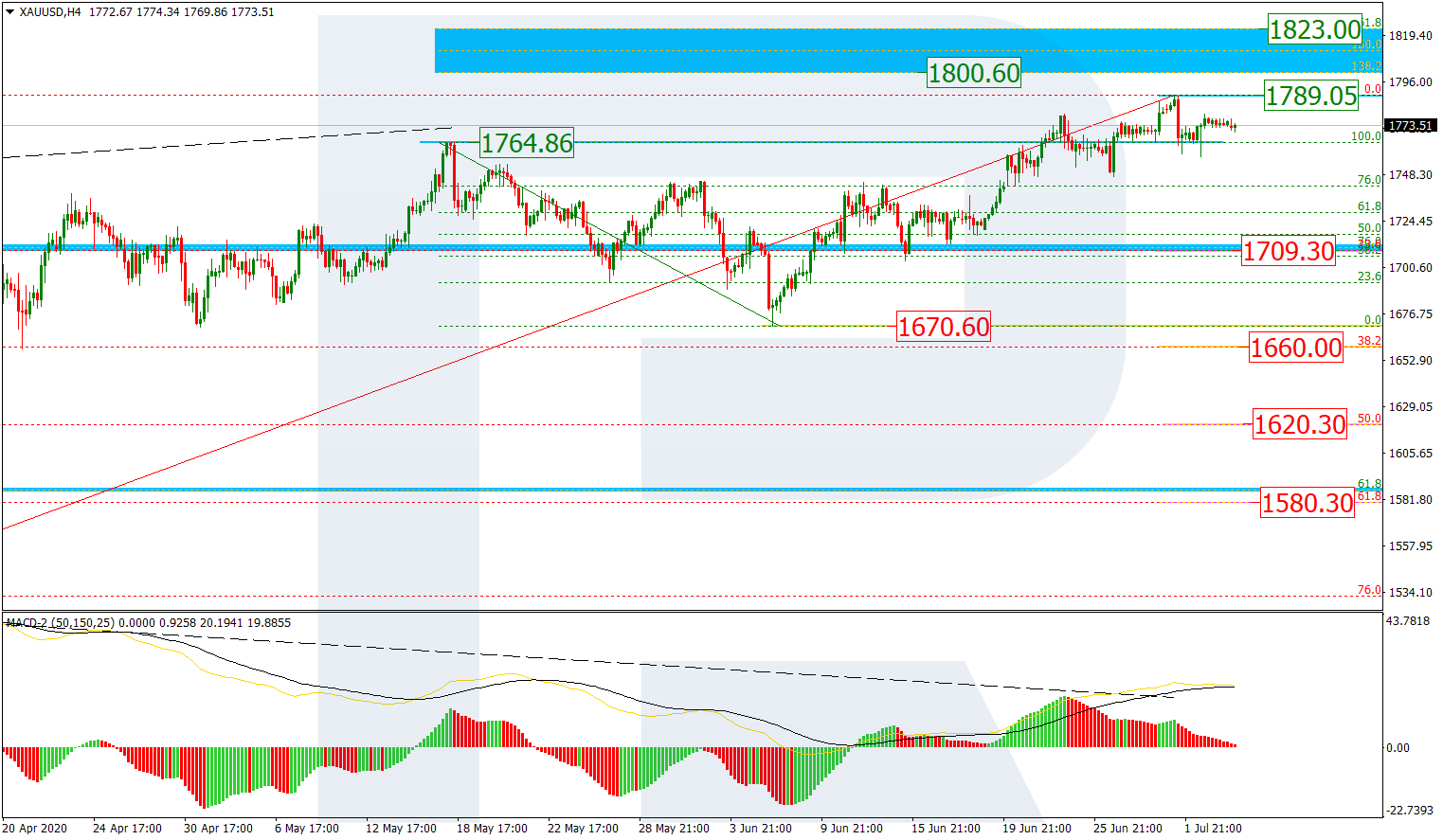

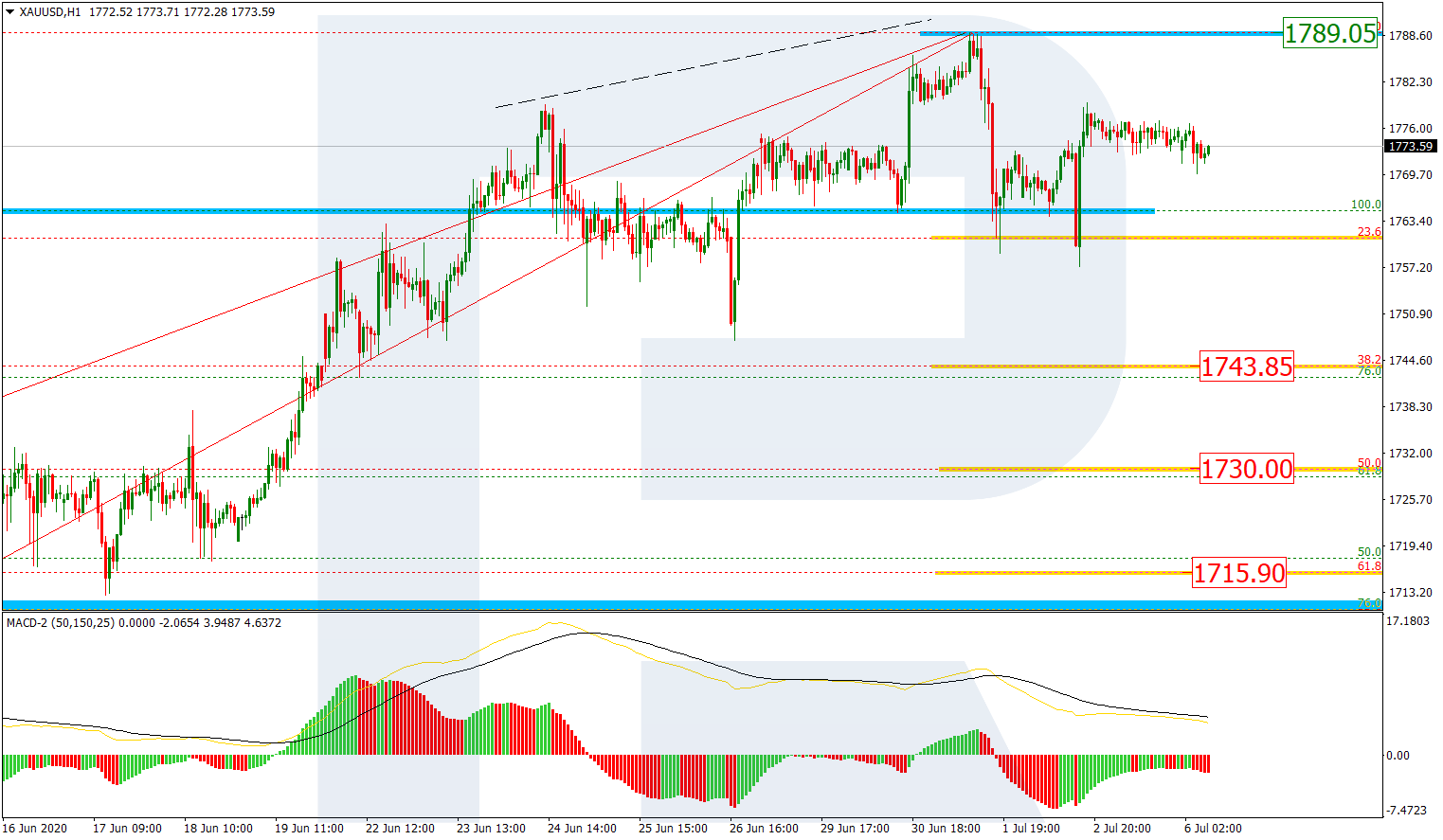

XAUUSD, “Gold vs US Dollar”

From the technical point of view, the H4 chart shows that XAUUSD is moving above the broken high at 1764.86. This situation means that the pair has fixed above the high at 1789.05 in order to continue the ascending tendency towards the post-correctional extension area between 138.2% and 161.8% fibo at 1800.60 and 1822.70 respectively. However, a divergence on MACD and low market volatility indicate a possible reversal or pullback. The key support is at 1670.60. The first correctional target may be 23.6% fibo at 1709.30, while the next ones are 38.2%, 50.0%, and 61.8% fibo at 1660.00, 1620.30, and 1580.30 respectively.

As we can see in the H1 chart, there was a local divergence on MACD, which made the pair start a new decline that has already tested 23.6% fibo. Later, the decline may continue to reach 38.2%, 50.0%, and 61.8% fibo at 1743.85, 1730.00, and 1715.90 respectively.

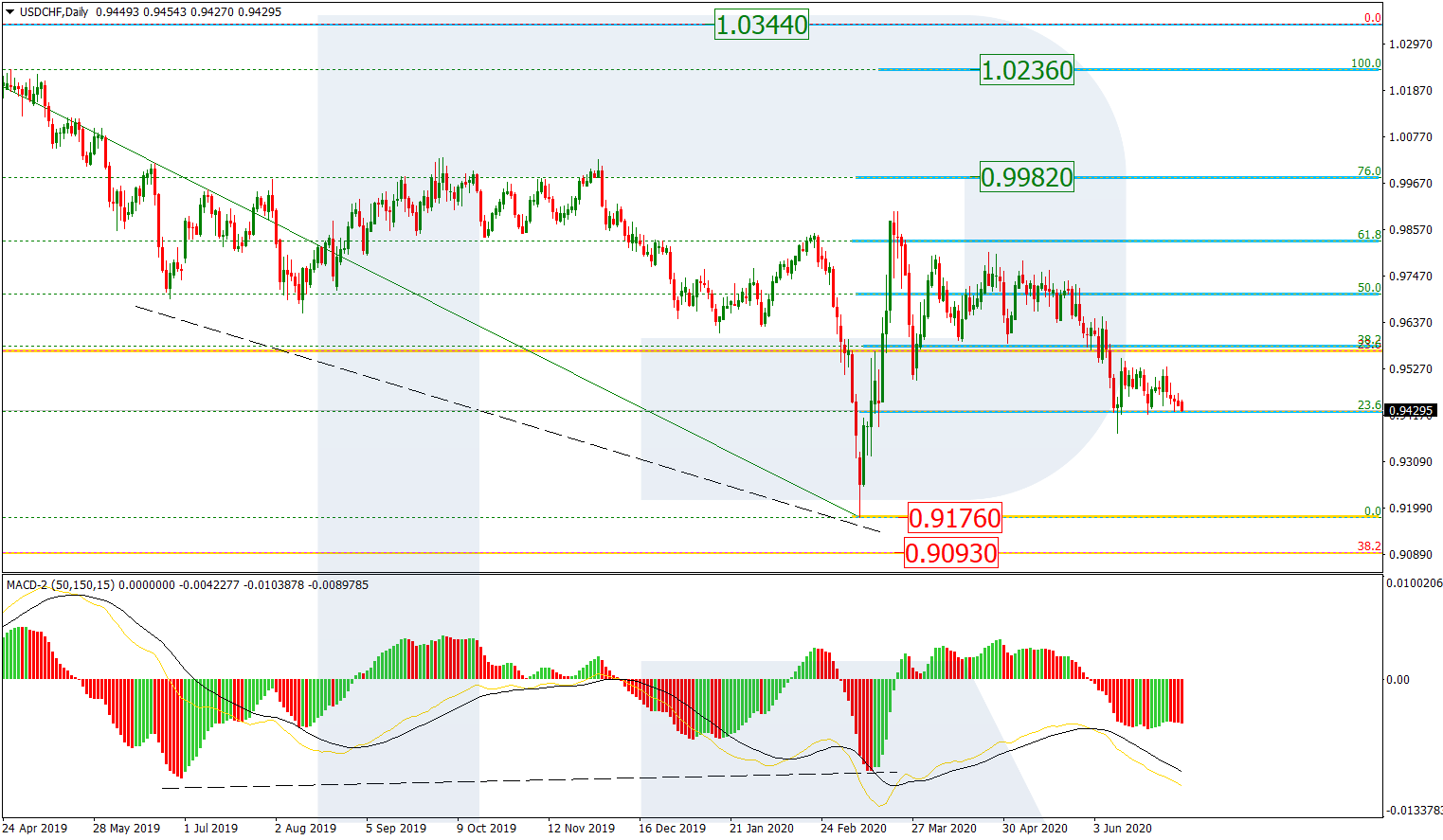

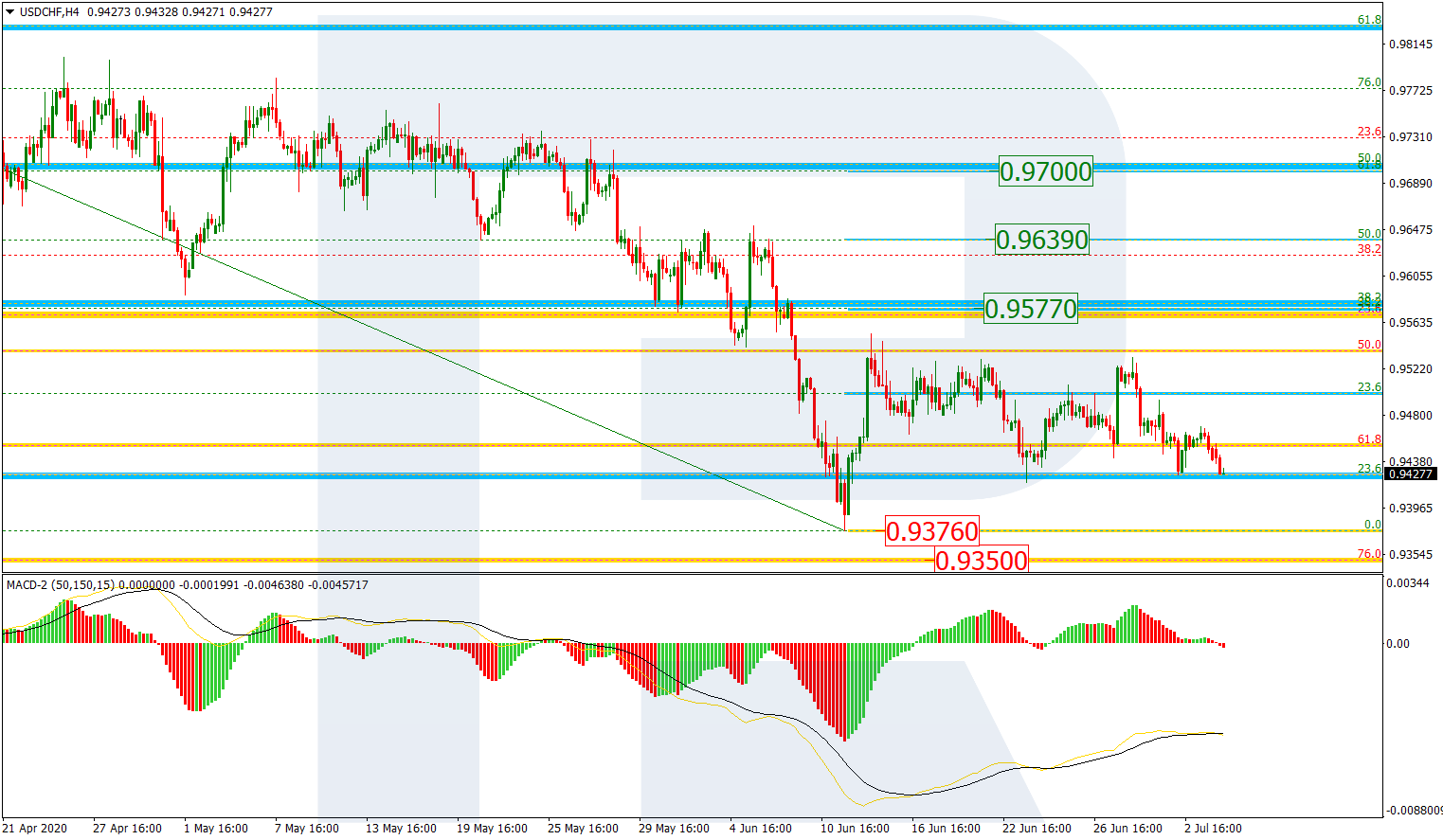

USDCHF, “US Dollar vs Swiss Franc”

As we can see in the daily chart, after quickly reaching 61.8% fibo, USDCHF has returned to 61.8% fibo. Although the current dynamics is descending, the previous divergence may not be over yet, which means that the pair still has a chance to form a new rising impulse towards the mid-term 76.0% at 0.9982 and then the fractal high at 1.0236.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

The situation in the H4 chart hasn’t changed much over a week. The chart is still showing attempts of the price to break a short-term correctional Triangle pattern to the downside, which means that the market wants to continue the bearish tendency towards the mid-term 76.0% fibo at 0.9350 after breaking the low at 0.9376. However, as usual, one shouldn’t exclude another scenario, according to which the instrument may form a new rising impulse after finishing the correction and testing the low. In this case, the asset may move towards 38.2%, 50.0%, and 61.8% fibo at 0.9577, 0.9639, and 0.9700 respectively.

Article By RoboForex.com

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex LP bears no responsibility for trading results based on trading recommendations described in these analytical reviews.