What’s up Gold? Gold bulls fail to regain control after the Fed

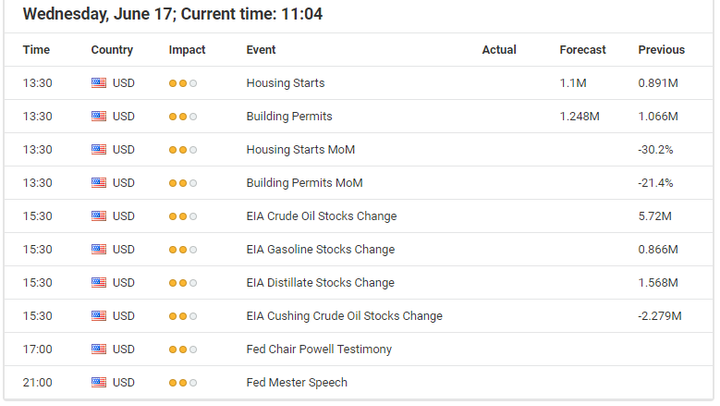

Source: Economic Events June 17, 2020 – Admiral Markets’ Forex Calendar

After the Fed reinforced its dovish stance last Wednesday, and the Fed dot plot suggesting that it will keep interest rates at 0% at least through the end of 2022 while continuing to buy USTs and MBS at the current pace, we see a willingness to flatten the 2-10-year-US-yield curve once again. Because of this, Gold’s technical side has brightened once again.

But after an initial bullish stint, Gold suddenly dropped, and reaching 1,700 USD because its focus again.

This is surprising, as Equities dropped heavily too, alongside the Dow Jones Industrial Average dropping 6.9% on Thursday the day after the Fed, marking its 27th largest 1-day decline in history. The volatility index VIX spiked 48% that same day as well, making it the 7th largest 1-day percentage increase in history.

For us, it seems as if the Gold weakness may be driven by two factors:

Free Reports:

- Margin Calls kicking in after Equities saw an enormous run from its March and yearly lows, while precious metals like Gold and Silver saw heavy gains, and no funding to finance Equity positions.

- The Fed’s balance sheet only increased by 4 billion USD over the last week, pointing to what is, by far, the smallest increase since February 2020.

That said, in our opinion it should be only a question of time to see the Fed increase the pace of its QE again, which should then act as a very bullish driver for Gold. As long as the precious metal trades above 1,660 USD, this could set the path up to the current all-time high of around 1,920 USD.

On the other hand: a drop below 1,660 USD could trigger a deeper correction, driving Gold below 1,600 USD, even though such a move should be considered only short-term:

Source: Admiral Markets MT5 with MT5-SE Add-on Gold Daily chart (between March 18, 2019, to June 16, 2020). Accessed: June 16, 2020, at 10:00pm GMT – Please note: Past performance is not a reliable indicator of future results, or future performance.

In 2015, the value of Gold fell by 10.4%, in 2016, it increased by 8.1%, in 2017, it increased by 13.1%, in 2018, it fell by 1.6%, in 2019, it increased by 18.9%, meaning that after five years, it was up by 28%.

Discover the world’s #1 multi-asset platform

Admiral Markets offers professional traders the ability to trade with a custom, upgraded version of MetaTrader 5, allowing you to experience trading at a significantly higher, more rewarding level. Experience benefits such as the addition of the Market Heat Map, so you can compare various currency pairs to see which ones might be lucrative investments, access real-time trading data, and so much more. Click the banner below to start your FREE download of MT5 Supreme Edition!

Disclaimer: The given data provides additional information regarding all analysis, estimates, prognosis, forecasts or other similar assessments or information (hereinafter “Analysis”) published on the website of Admiral Markets. Before making any investment decisions please pay close attention to the following:

- This is a marketing communication. The analysis is published for informative purposes only and are in no way to be construed as investment advice or recommendation. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research, and that it is not subject to any prohibition on dealing ahead of the dissemination of investment research.

- Any investment decision is made by each client alone whereas Admiral Markets shall not be responsible for any loss or damage arising from any such decision, whether or not based on the Analysis.

- Each of the Analysis is prepared by an independent analyst (Jens Klatt, Professional Trader and Analyst, hereinafter “Author”) based on the Author’s personal estimations.

- To ensure that the interests of the clients would be protected and objectivity of the Analysis would not be damaged Admiral Markets has established relevant internal procedures for prevention and management of conflicts of interest.

- Whilst every reasonable effort is taken to ensure that all sources of the Analysis are reliable and that all information is presented, as much as possible, in an understandable, timely, precise and complete manner, Admiral Markets does not guarantee the accuracy or completeness of any information contained within the Analysis. The presented figures refer that refer to any past performance is not a reliable indicator of future results.

- The contents of the Analysis should not be construed as an express or implied promise, guarantee or implication by Admiral Markets that the client shall profit from the strategies therein or that losses in connection therewith may or shall be limited.

- Any kind of previous or modeled performance of financial instruments indicated within the Publication should not be construed as an express or implied promise, guarantee or implication by Admiral Markets for any future performance. The value of the financial instrument may both increase and decrease and the preservation of the asset value is not guaranteed.

- The projections included in the Analysis may be subject to additional fees, taxes or other charges, depending on the subject of the Publication. The price list applicable to the services provided by Admiral Markets is publicly available from the website of Admiral Markets.

Leveraged products (including contracts for difference) are speculative in nature and may result in losses or profit. Before you start trading, you should make sure that you understand all the risks