By Orbex

EURCHF Surges Higher on Stimulus Hopes

The euro climbed to an 11-week high against the Swiss franc after the European Commission proposed a 750 billion euro recovery plan. Optimism grows as the EU’s 27 nations are expected to settle their differences and seal the deal in the coming weeks. Should everything go smoothly from now on, confidence in the single currency could be restored.

With Swiss franc long positions near a four-year high according to CFTC data, EURCHF’s short-covering could trigger a rapid ascent. 1.7100 from last March is the immediate resistance.

On the downside, 1.0580 around the 30-day moving average is a key support to the rebound.

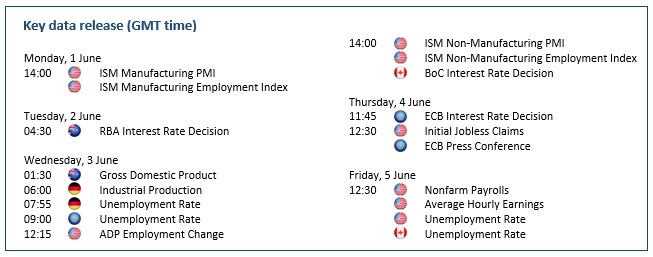

USDCAD Heads Lower Ahead of BoC Meeting

The US dollar has broken below its near two-month consolidation range as its Canadian counterpart rallied across the board. The V-shaped recovery in the oil markets which has reached a 5-week high has offered strong support to the loonie.

The Bank of Canada is expected to keep its policy interest rate at 0.25% this week. However, Governor Stephen Poloz has not excluded more stimulus to support the recovery.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

The risk of dovish guidance could weigh on the loonie’s advance. The pair is under pressure after a breakout below the 1.3850 floor. As the rate starts to drift lower, 1.4050 is the immediate resistance.

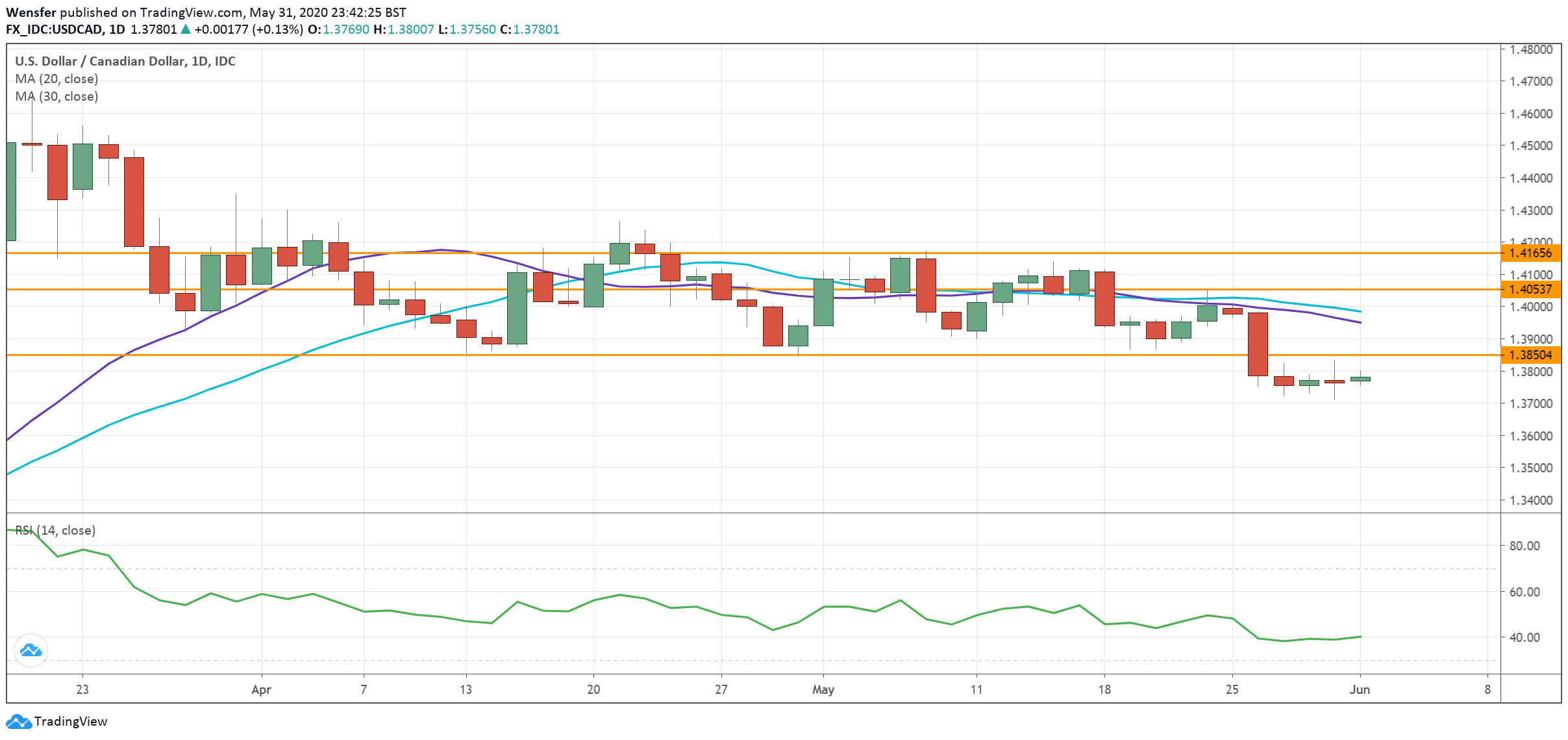

USDJPY Pulls Back on Disappointing Data

Worsening US economic data have capped the greenback’s advance. The first quarter GDP sank 5% against a consensus of 4.8%.

Should this week’s manufacturing and jobs data paint a similarly grim picture, markets could shun the dollar unless the Fed comes up with even stronger commitment.

In the meantime, the US is pondering sanctions against China over a new Hong Kong legislation law, and the safe-haven Japanese yen may see more bids as Sino-US relations hit new lows.

USDJPY has failed to rally above the psychological level of 108.00. May’s low of 106.00 is a major support to keep the dollar afloat.

AUDJPY Rises on RBA’s Optimism

The Australian dollar continues on its way up as the country starts to resume its normal life. Despite a grim economic forecast of a 6% contraction and a 9% unemployment rate, the RBA has suggested the recession to be less severe than previously thought.

The central bank is likely to stay confident at its next meeting and maintain its current course of action without additional QE measures. This would further support the Aussie in the medium term.

Sentiment remains bullish after the pair rallied above the March high of 71.40. 70.00 near the moving averages is the first line of defense in case of a pullback.

By Orbex