By Money Metals News Service

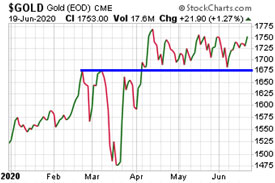

Gold prices have been trading within a well-defined $100 range over the past two months. Gold’s chart shows strong support at $1,675/oz and a zone of resistance at $1,750-$1,775.

A breakout above the trading range could quickly send gold prices to $1,900/oz – where they would challenge their former all-time highs set in 2011.

Seasonally, the month of June tends to be weak.

It wouldn’t be surprising if short sellers in the futures market managed to drive prices back down toward the bottom of the range one more time.

That said, gold prices are closer to breaking out than breaking down from this high-level consolidation. And given that this year has been extraordinarily atypical for all markets, we wouldn’t necessarily expect typical summer doldrums to afflict precious metals.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Silver has support at $17.00/oz and overhead resistance at $19.00. Silver prices ran up to the $19.00 level in late February (just before the crash) and did so again at the end of May.

A breakout above $19.00 and then above $20.00 would finally put silver on the map of mainstream investors – especially since it would likely coincide with record-high gold prices.

With silver being more affordable to retail buyers of limited means, and more vulnerable to supply shortfalls, we expect it will outperform gold during the coming public participation upleg.

The Money Metals News Service provides market news and crisp commentary for investors following the precious metals markets.

The Money Metals News Service provides market news and crisp commentary for investors following the precious metals markets.