By IFCMarkets

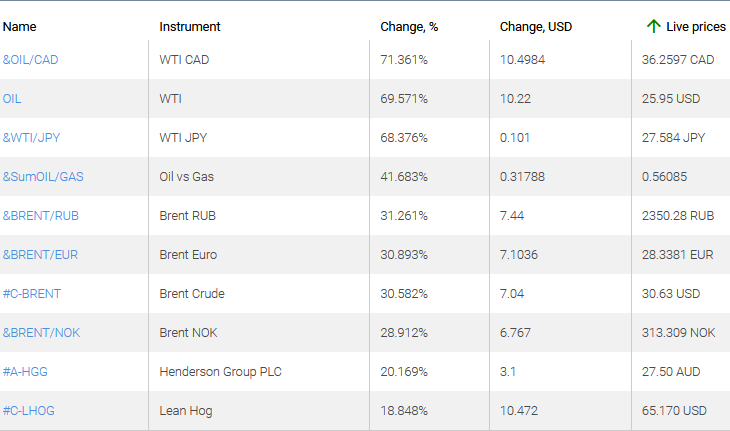

Top Gainers – The World Market

The world oil prices continued to increase for the 2nd week in a row. Since May 1, OPEC + countries have limited production by 10 million barrels per day. Some US shale companies joined them. A number of countries have reported a mitigation of quarantine requirements in the wake of the coronavirus pandemic from May 11-12. All this contributed to an increase in oil demand. Accordingly, oil and trading instruments based on it became the top gainers and losers. Amidst the risks of another escalation of the USA-China trade war, the yen and the Swiss franc strengthened as heaven currencies.

1. &OIL/CAD – a personal composite instrument West Texas Intermediate (WTI) oil against the Canadian dollar.

2. OIL – American Light Sweet Crude Oil West Texas Intermediate (WTI).

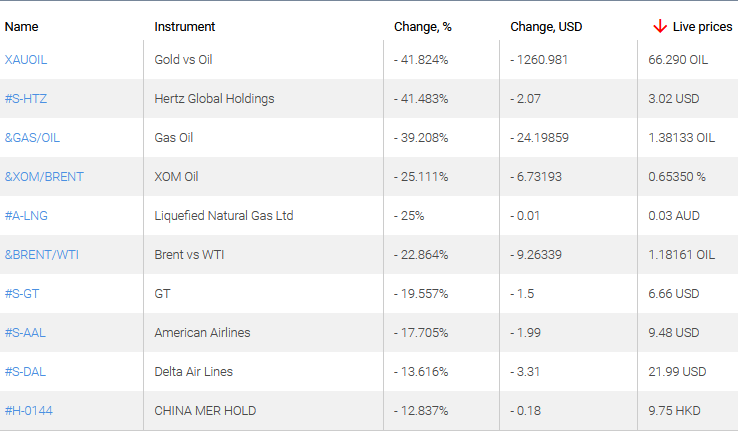

Top Losers – The World Market

1. Hertz Global Holdings, Inc. – an American car rental company.

2. XAUOIL – a gold instrument Gold against WTI oil.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

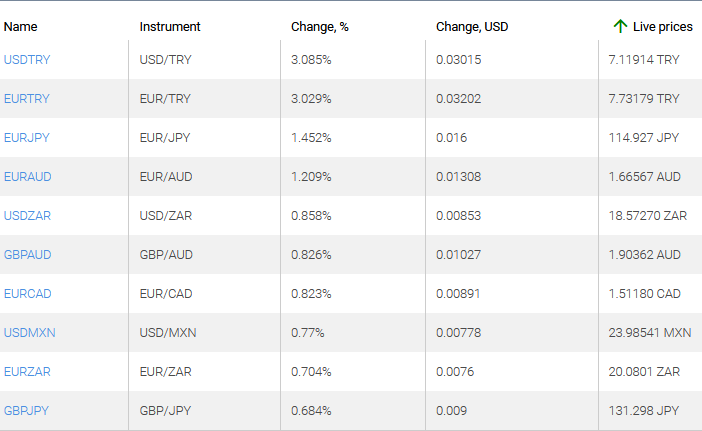

Top Gainers – Foreign Exchange Market (Forex)

1. USDTRY, EURTRY – the growth of these charts means the strengthening of the US dollar and the euro against the Turkish lira.

2. EURJPY, EURAUD – the growth of these charts means the weakening of the Japanese yen and the Australian dollar against the euro.

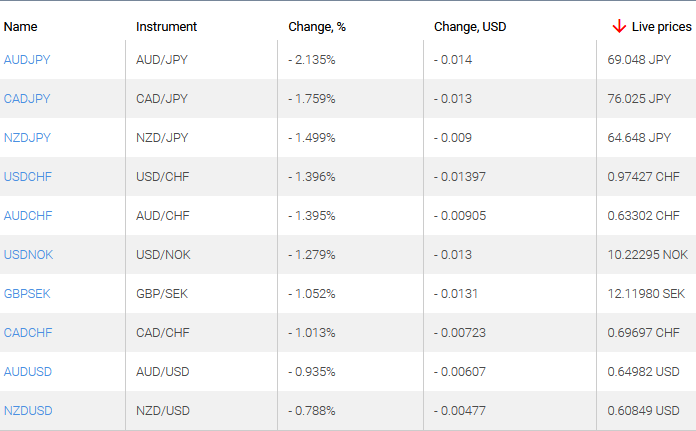

Top Losers – Foreign Exchange Market (Forex)

1. AUDJPY, CADJPY – the fall of these charts means the strengthening of the Japanese yen against the Australian and Canadian dollars.

2. USDCHF, AUDCHF – the fall of these charts means the weakening of the American and Australian dollars against the Swiss franc.

Market Analysis provided by IFCMarkets

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.