By Orbex

The monthly consumer price index data will be coming out later today. General estimates point to a modest increase in inflation during the month of October.

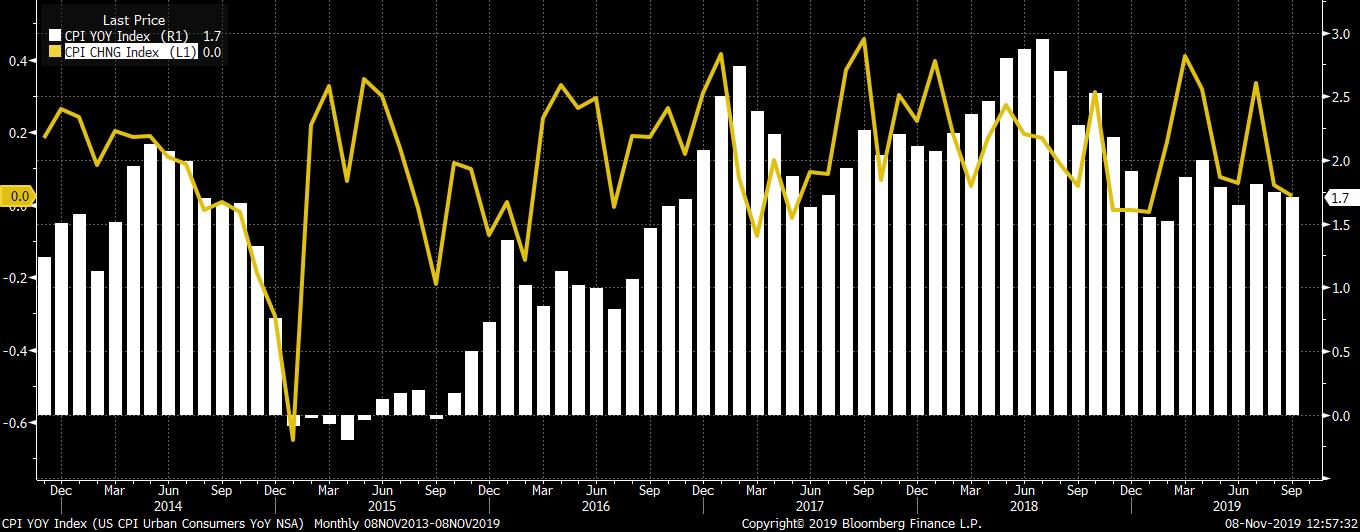

Economists forecast that consumer prices will rise 0.3% on the month. Meanwhile, core CPI, which excludes the volatile food and energy prices, will rise by 0.2%.

This marks a modest increase from the month before. Headline CPI was flat in September while core CPI rose just 0.1%.

Despite the forecasts showing an increase on the month, on a yearly basis, no changes are expected for the annual inflation rate. CPI, on a year over year basis, will remain steady at 1.7%. Annual core CPI will also remain steady at 2.4%. Both these counts mark an unchanged print from the previous month’s reading.

With no changes coming up on the annual inflation rate, the headline CPI remains below the Fed’s 2% inflation target rate. Although at 1.7% inflation is close to the Fed’s target, officials are willing to let inflation overshoot target.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

This is in order for consumer prices to make up for the stubbornly low rate of increase currently.

The Fed cut rates in October. And this will likely take a bit of time to pass through into other areas. But with officials signaling that they are done with rate cuts this year, it will be interesting to see how consumer prices will fare in the coming months.

The inflation report might not do much for the markets today. But they will be critical in shaping the expectations of the Fed’s monetary policy.

Despite the central bank signaling that it was done with rate cuts, the markets are still inclining towards at least two more rate cuts in the next year. The expectations will certainly build up if inflation maintains the same current trend.

Modest Increase in Gasoline Prices

The basis for an increase in inflation comes with a rise in gasoline prices. However, the increase wasn’t so much. On average, gasoline prices in the United States rose a mere 1.8% during the month of October.

However, offsetting the gains in the gasoline prices was the rather flat print in crude oil. Brent futures were flat during October following a modest increase in the previous month.

Consumer prices in the United States are benign. However, if global data is something to go by, the recent increase in inflation from China is something to consider. Last weekend, China’s inflation report saw consumer prices rising to an eight-year high.

In October, China’s consumer prices rose 3.8% from the year before. This was one of the fastest increases in consumer prices in over seven years.

With inflation trends mirroring each other with some lag, one could expect to see a potential increase in the US inflation rate as well.

Besides gasoline prices, consumer prices are also another thing to consider.

Recent trends in the US economy show that consumer spending has been steady, although losing momentum.

The US labor market remains strong with the unemployment rate at historic lows. Still, there is evidence of a squeeze in the markets. Recent monthly payrolls report indicate that the pace of jobs added during the month is slowing.

Wage growth also remains somewhat benign. While this puts a bit of more spending power into the consumer, the price pressures are missing.

By Orbex