By Orbex

The US Federal Reserve President Jerome Powell continued with this second day of testimony to Congress. The Fed chair is optimistic that the rate cuts from the central bank will help to revive growth in the United States.

Speaking to lawmakers, Powell indicated that he doesn’t see any bubbles in the markets. But the market reaction was muted to his comments.

A modest risk-on sentiment continues, and gold prices gained in the backdrop. A lack of fresh news on the trade talks front has also hit sentiment a bit.

Eurozone GDP Confirmed at 0.2%

The third quarter revision to the GDP figures for the eurozone came in without any surprises. The economy grew at a pace of 0.2% in the third quarter period ending September 2019. This was in line with the general forecasts.

It was also an unchanged print from the preliminary estimates given a few weeks ago. The data managed to push the euro slightly higher on the day.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

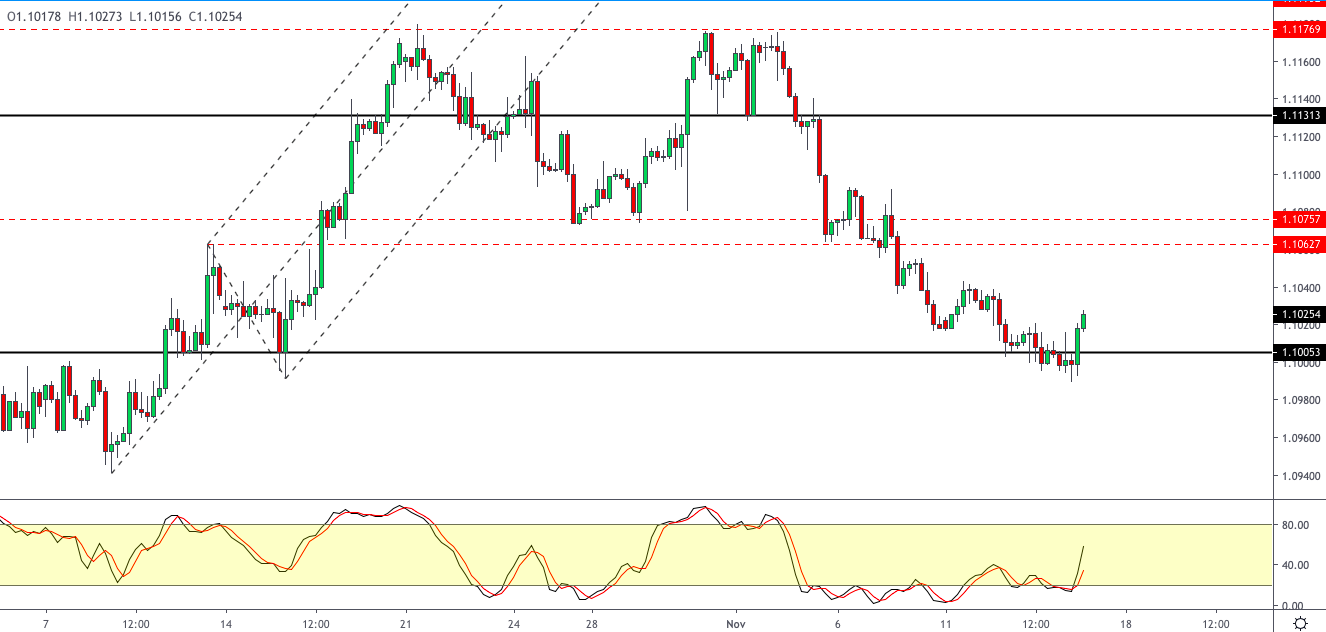

EURUSD to Maintain the Upside

The common currency rebounded from the support level at 1.1000 where it was consolidating over the past few sessions. The rebound off this support comes as the Stochastics oscillator signals a bullish confirmation.

The resistance level at 1.1062 will be key to the upside for the moment.

Sterling Inches Higher Despite Weak Retail Sales

The monthly retail sales report for the UK disappointed. Data showed that retail sales fell 0.1% on the month in October. This was below estimates of a 0.2% increase and down from a flat price in the previous month.

The weak retail sales will likely dampen the growth for the region during the month.

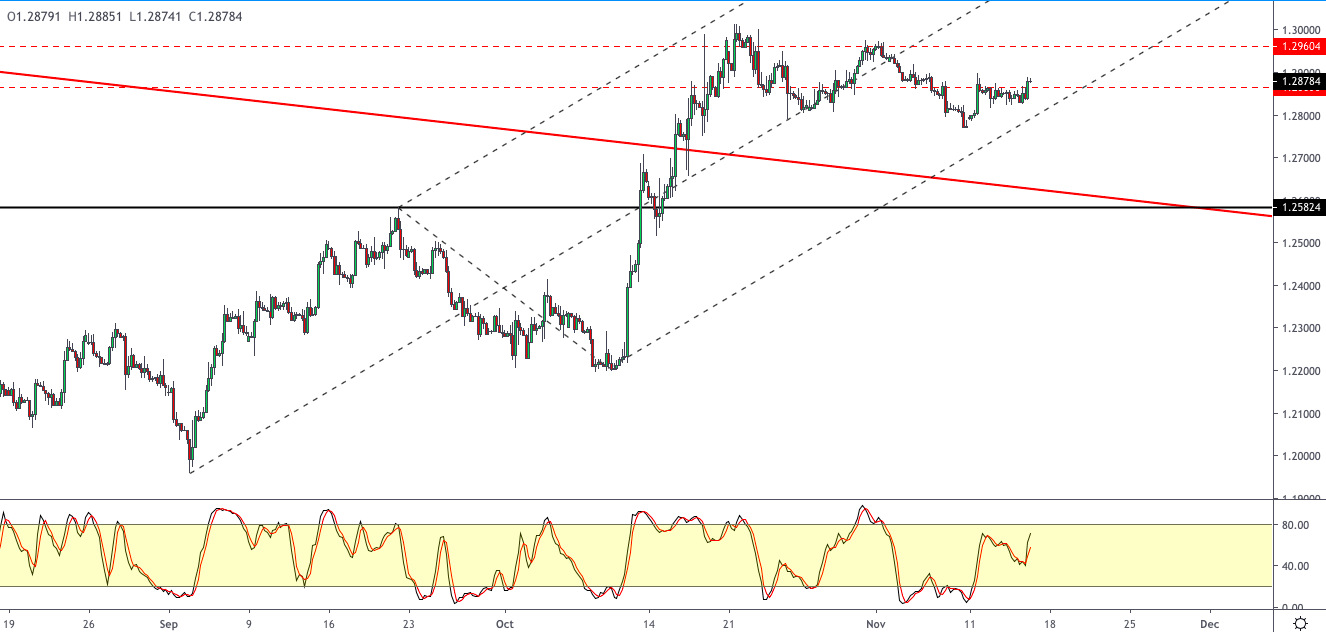

GBPUSD Breakouts Off Resistance

Cable broke to the upside breaching the resistance level of 1.2865. The current gains come amid renewal in the momentum.

Price action could, however, remain range-bound. The upside is limited to the resistance level of 1.2960 region in the near term. Further direction will gain momentum only on a breakout above this level.

Gold Gains as Trade Talks Hit a Stalemate

The precious metal was maintaining the upside on Thursday as the US and China trade talks hit a stalemate. There was no major news from the trade talks which has become one of the key points for investors.

Risk sentiment is back on as equities are retreating from the gains made earlier since last week.

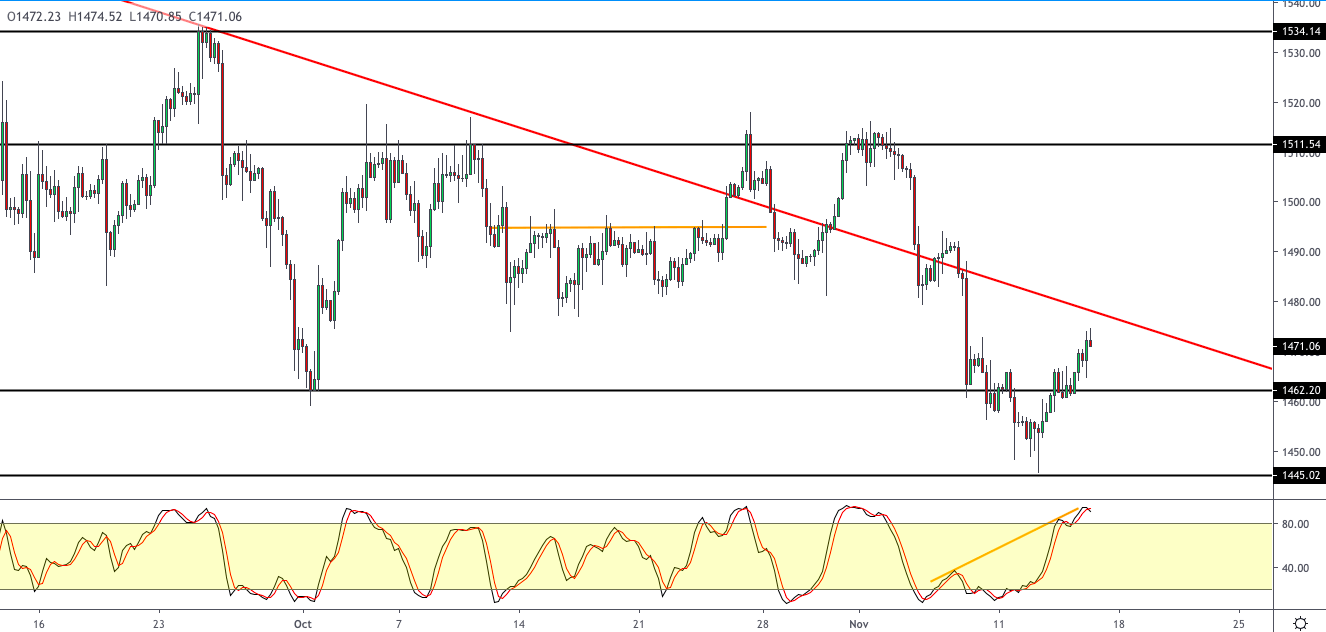

XAUUSD Rises but Mind the Divergence

The precious metal has been rising steadily after breaching the support/resistance level of 1462. Price action is signaling a hidden bearish divergence.

This could potentially see the precious metal sliding back to the support area. If gold prices fail to break down lower, then the weekly chart will signal a doji that could indicate a reversal from last week’s declines.

By Orbex