By Orbex

The US dollar index was trading in the green on Tuesday. This comes a day after prices fell, snapping a five-day gain.

Economic data from the United States was sparse. President Trump spoke late Tuesday at the Economic Club of New York. Besides a few references to the Fed, there wasn’t much about the trade talks.

German Investor Sentiment Rises in November

Investor sentiment in Germany rose more than expected in November. The ZEW economic sentiment index rose to -2.1, up from -22.8 from the previous month. The data also came out better than the forecasts of -13.2.

For the rest of the eurozone, the economic index rose to -1.0 from -23.5 previously.

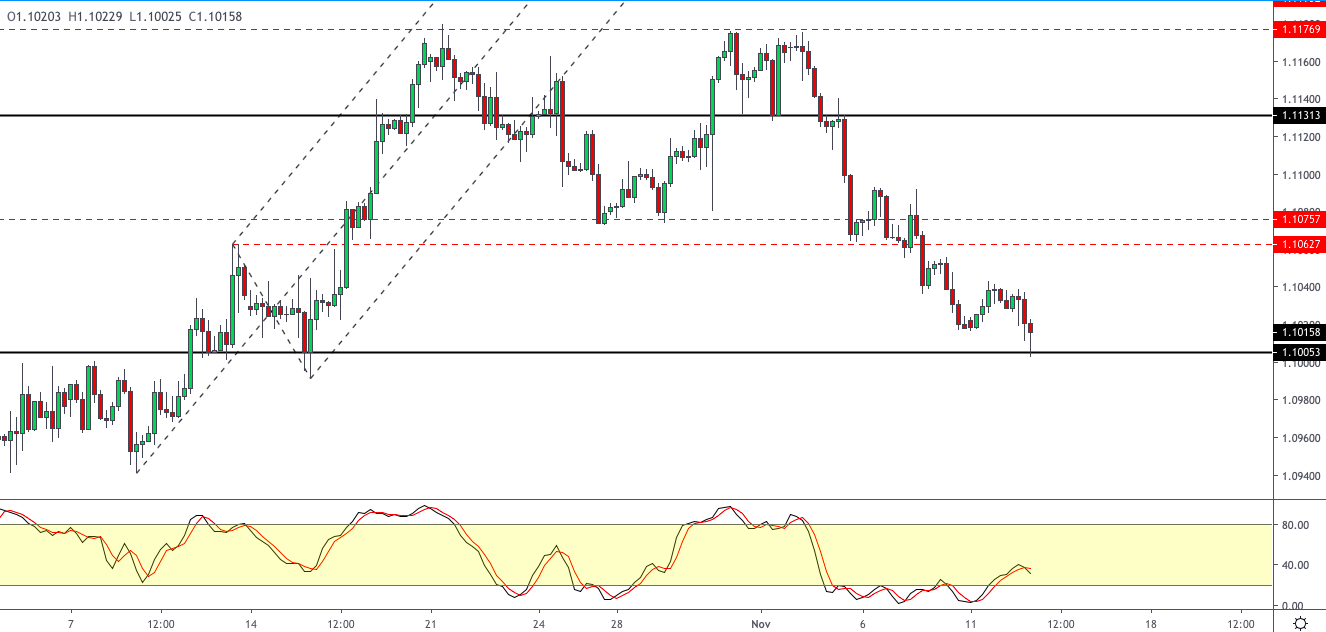

EURUSD Testing Support

The EURUSD continued to decline. Price action remains weak, testing the support area of 1.1000.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

However, on the 4-hour chart, the Stochastics oscillator is forming a bullish divergence. If price bounces to the upside, the common currency will test the resistance area of 1.1075 – 1.1062 level.

UK Unemployment Rate Falls to 3.8%

The latest labor market data in the United Kingdom saw the unemployment rate falling to 3.8%. The unemployment rate was better than the estimates of 3.9%.

However, the claimant count change rose to 33k, which was more than the estimates of 24.2k. Average hourly earnings dipped slightly to 3.6%.

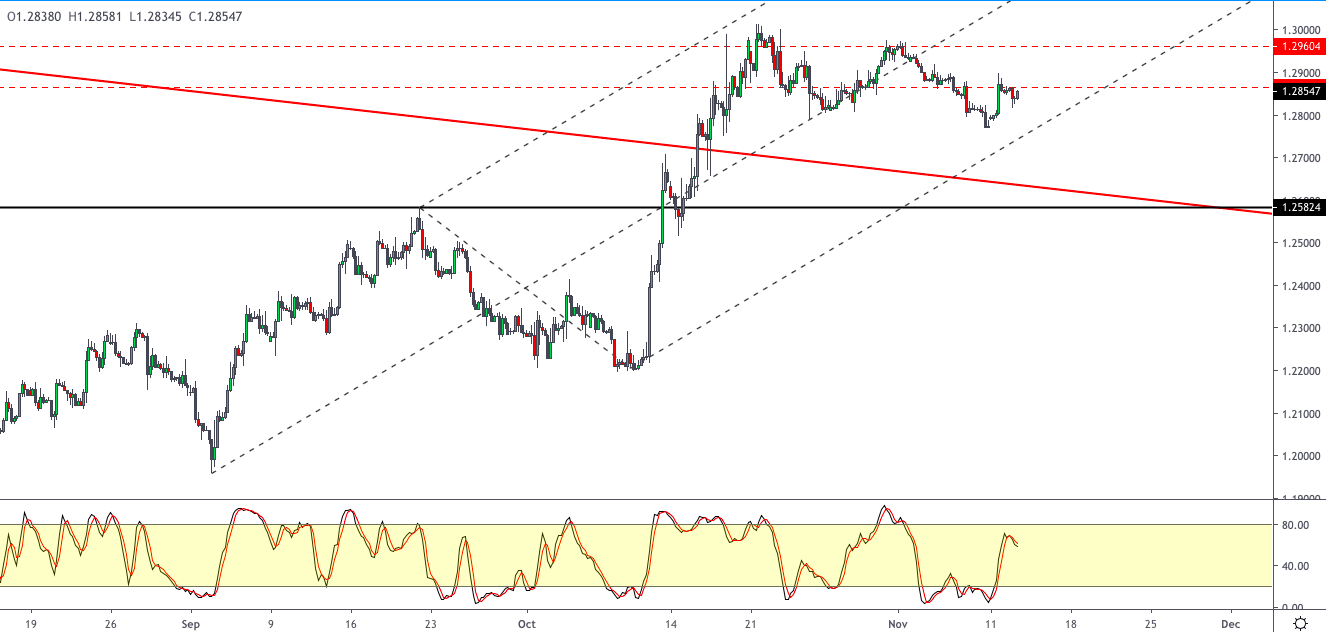

GBPUSD Retesting Resistance

The pound sterling is retesting the resistance level of 1.2864. If prices breakout above this level, the currency pair will be rising to test the next level higher at 1.2960. Price action is likely to remain range-bound in the near term.

To the downside, GBPUSD will need to clear the minor support at 1.2808 for any declines.

OPEC Decides to Maintain Production Cuts

OPEC member nations and Russia confirmed that the current production cuts will continue through to next year. The report comes ahead of the OPEC meeting due in December.

The nations will take a review of the production cuts that will last until March 2020. The report dismisses earlier claims about efforts to cut production further. Oil prices were muted to the news.

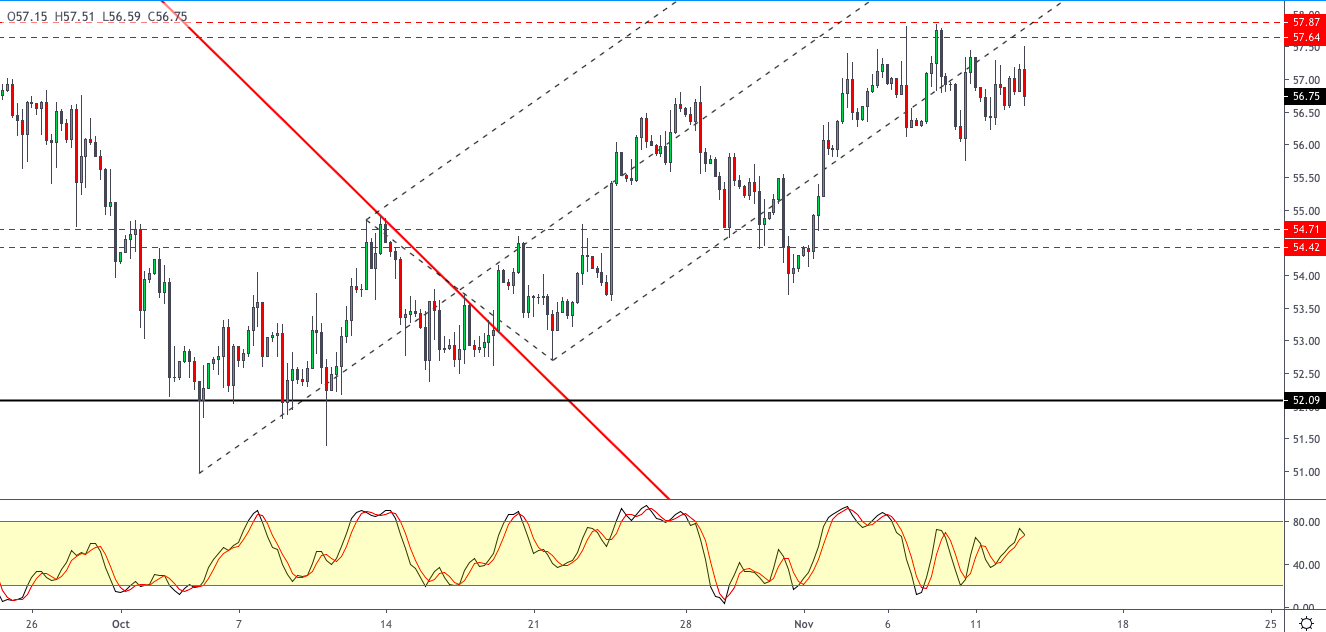

WTI Crude Oil Trades Mixed Near the Top

Crude oil prices were trading mixed near the resistance area of the 57.64 – 57.87 region. Price action remains very choppy at the current levels. Failure to breakout above this level could signal a correction lower. This will bring oil prices back to the lower support at 54.71 – 54.42 level. The weekly crude oil inventory report is due to come out in two days.

By Orbex