By The Gold Report

Source: The Critical Investor for Streetwise Reports 11/08/2019

The Critical Investor does a deep dive into this explorer’s drill program at its Yukon silver project.

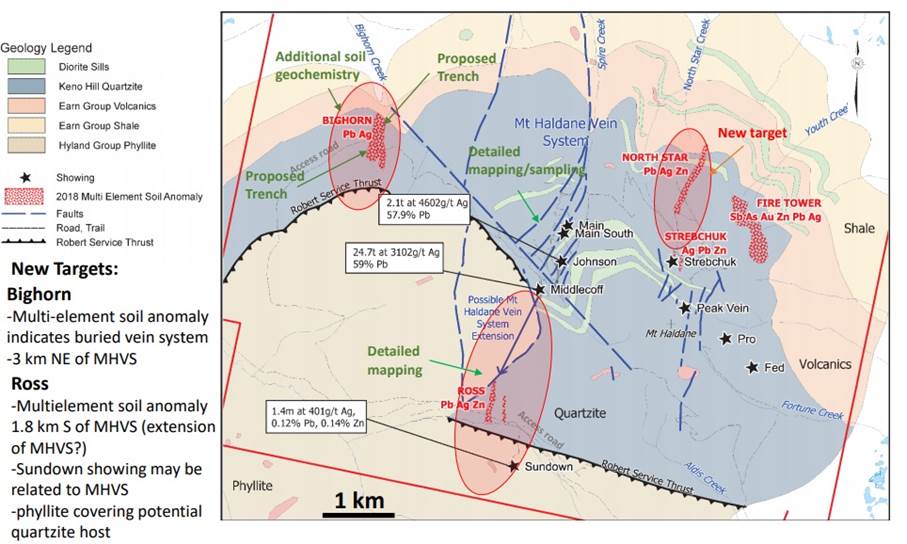

All cashed up after raising C$1.1 million in an oversubscribed financing in July, Alianza Minerals Ltd. (ANZ:TSX.V) was ready for its 2019 Phase II drill program at its flagship Haldane silver project, after the Phase I drill target defining program was completed earlier this summer, and drilling began in late August. The main focus for management were the new stepout targets like the Bighorn and Ross anomalies, and the extension of Mount Haldane Veins System (MHVS) targets, to indicate size potential, and are presented in red below:

A total of 963 meters was cored in four holes. It took quite a while, according to management the assay lab was relatively slow, an issue several explorers are dealing with this year.

On October 22, 2019, the company reported drilling had confirmed the presence of new silver-bearing vein targets at the Bighorn Zone. The first two holes of the program tested the Ross and Bighorn targets. One hole was completed at each of the Ross and Bighorn anomalies, with two holes targeting the A and B veins of the Middlecoff Zone in the Mt. Haldane Vein System target area.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

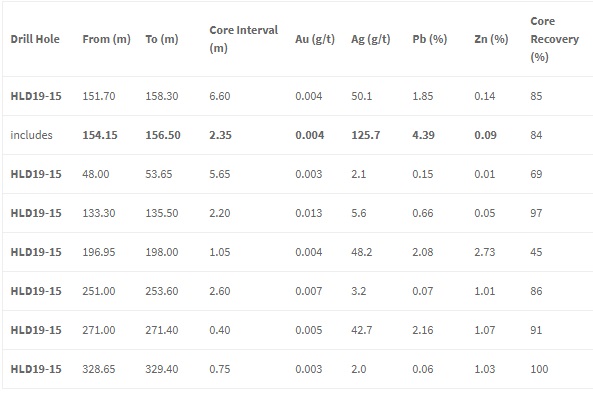

Highlights of the first hole HLD19-15 at the Bighorn Anomaly include 125 g/t Ag and 4.4% Pb over 2.35m from 154.15m depth.

In itself this is not an economic intercept, as it would be a gold equivalent of 2.35m @ 3.5g/t AuEq (for underground, 5-6g/t Au at 2m wide at least is considered economic), but the fact it hit this kind of mineralization that far out of known mineralization is considered promising by management.

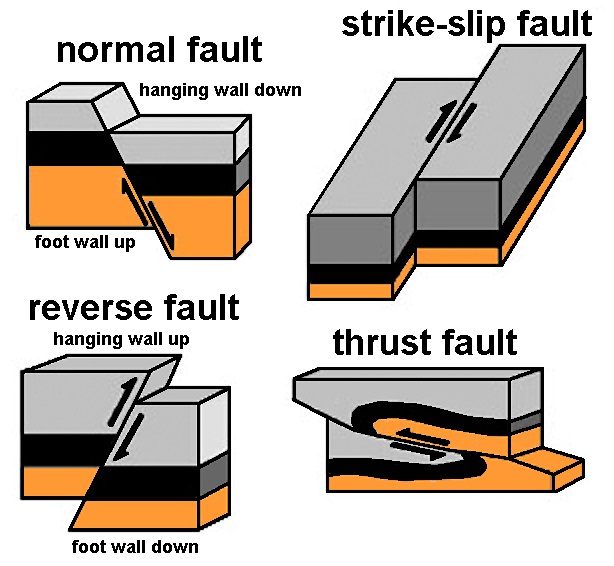

The hole HLD19-14 at the Ross anomaly did intersect zones of anomalous veining and disseminated mineralization in rocks overlying the prospective lower Keno Hill quartzite unit, but didn’t return significant values. It is believed by management that these are the manifestation of the target structures and that they may form cohesive veins at depth in the permissive units. According to the news release:

“The first hole of the program tested the Ross Anomaly, a 300m by 100 m Pb-Zn-Ag soil anomaly, approximately 3 km along trend from the Middlecoff Zone on the Mt Haldane Vein System. The anomaly sits in schist and phyllite of the Upper Keno Hill Formation (Sourdough Member) in the immediate hanging wall to the contact with the Lower Keno Hill quartzite.”

For some more understanding of geological concepts, here is an image explaining the concept of a hanging wall, at the same time describing four different basic fault concepts:

The news release continues:

“The Lower Keno Hill consists of massive quartzite and phyllitic quartzite, which are much better hosts for the vein-fault style of mineralization present on the Haldane Property and elsewhere in the Keno Hill District.

The hole intersected quartzite below 180 m suggesting the initial target may exist deeper on the section.”

As there is quite a bit of faulting going on at Keno Hill, this might very well be the case. CEO Jason Weber had the following to say about the first results: “The first-ever drill hole at the Bighorn Zone, almost three kilometers from known mineralization, successfully intersected at least four mineralized structures confirming a new zone for systematic follow-up drilling. The Ross hole, which also tested a new area, returned only anomalous lead and silver values, but appears to have intersected weak structures that may be conducive to forming veins in the more brittle Lower Keno Hill Quartzite that lies below.”

After asking a bit further about Ross, Jason commented: “It was great to get the result at Bighorn, and a bit frustrating that we were in the wrong rocks at Ross to form veins, but it looks like potential vein structures are located deeper here so the target isn’t dead at all. These results weren’t bad for the first ever holes at these targets. Obviously we would have liked some high-grade intersections but it is a great start nonetheless.”

Of course this is pure exploration, you look for all kinds of indicators of mineralization, you theorize about geological and mineralized concepts, you drill, you get new data, you fine tune or even overturn your original thesis, and you continue, until the target is killed or you hit economic mineralization. To me this is a solid start, as Alianza hit mineralization at three out of the first four holes. For comparison, the famous Hemlo and especially Eskay deposits were found only after dozens and dozens of drill holes, at the 76th and 109th attempt respectively to be precise.

At the Bighorn Zone, hole HLD19-15 was drilled from west to east near the center of the 900m by 150m, north-south trending, Pb-Ag-Sn soil anomaly.

The drill hole intersected four significant north trending, steep faults, plus several smaller faults all with associated mineralization. The most significant of these faults occurred at 150159m depth. This fault appears to correlate with a silicified breccia/fault zone on surface. I consider this as a very interesting indication of mineralized zones extending to surface, and this zone is of course also still open at depth. Management believed that locally poor core recovery within these faults may have negatively impacted some results, but as far as I can see this doesn’t seem to occur often or at relatively long intercepts.

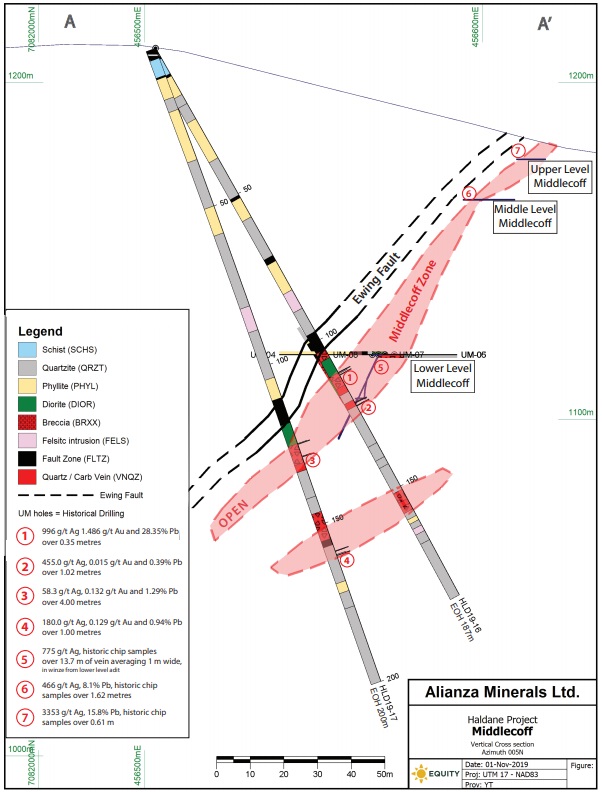

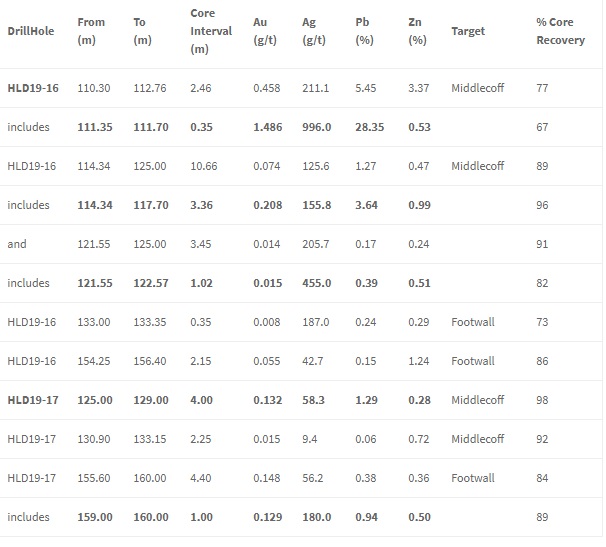

On November 1, 2019, the second batch of results of two holes was released. Holes HLD19-16 and HLD19-17 targeted the Middlecoff Zone along strike from a high-grade silver-bearing vein that had seen some interesting historical underground sampling at an average of 775 g/t Ag over 13.7 meters of strike in the past. Hole HLD19-16 targeted this zone along a shallow plunge and intersected significant mineralization in the Middlecoff Zone from 110.30 to 125.00 meters downhole.

The highlight here obviously was a very narrow but also very high grade 0.35m section of 996 g/t silver and 1.486 g/t gold. To put this in perspective, in order to mine underground a rule of thumb is that conventional mining equipment needs at least 2m to operate effectively, as already hinted on earlier. In this case it would mean a gold equivalent of 2m @4.3g/t AuEq, so it is still not economic, but it is a promising start for such a stepout. I liked the other intercepts a bit deeper as well, which seem to indicate fairly consistent dispersion of about 400-450g/t Ag over 1m normalized on average, which can be seen in this table of results for HLD19-16 and HLD19-17:

Hole HLD19-17 intersected a geologically similar section below the Ewing fault, but structures and veins are not as well-developed as in hole HLD19-16. The returned results were less significant as well, suggesting in my view less potential going at depth in this particular location. However, the Middlecoff veinfaults intersected in the current drilling and limited historical underground workings remain very much open to depth and in both directions along strike below the Ewing Fault.

CEO Jason Weber had this to say:

“Drilling at the Middlecoff Zone has confirmed the presence of a wide structure capable of hosting high-grade silver mineralization in a series of anastomosing faults. We are just starting to understand the orientation of the high-grade shoots that were targeted since the 1920s, and with the new information from this drilling we can adjust our interpretation and target drilling in subsequent phases.”

After following up with him on this, he commented more in-depth on the results, the geology and the potential:

“The importance here lies in the fact that we are building continuity in the mineralization from the high-grade mineralization encountered underground in the 1960s. We have expanded the Middlecoff Zone to the south. The geometry has been tricky to figure out so far, but it looks like the host structure thickens in hole 16 and there may be a relatively flat high-grade shoot seen in hole 16, but not 17. We thought there could be a steep high-grade shoot but doesn’t mean below that it doesn’t thicken again. The vein-structure is still present but at lower grades. This is still heavily oxidized mineralization.

“In the main faults, mineralization is mostly oxidized so you don’t see much in the way of sulphide, just the weathered oxide minerals making it difficult to tell what the original mineral species were. That said, we know that there is a high-grade vein at the top of the Middlecoff that is different, carrying gold (about 1.5 g/t Au), with elevated copper and antimony. Looking at that chemistry it may be due to a sulphosalt mineralit is great to see some of this really high-grade material. We know these structures that host mineralization are big, we know that the system produces very high grades so it is now a matter of finding where the veins could be thicker and higher grade.”

The oxidized and fractured nature made me wonder about the type of mining, and I asked Jason what is possible regarding this rock competence. According to him, this is the same scenario that exists elsewhere in the Keno District. Importantly, as you follow these vein-faults to depth (300 meters or more of vertical extent is not unheard of in the district) the oxidation decreases.

Aside from the section I received from him, I wondered if there will be more sections and maps coming soon, so it will be easier to interpret potential mineralization as an investor. I also asked him when drilling resumes, and what number of holes and meters drilled he has in mind, on what targets. He continued:

“We are working on a plan map to show the zone with respect to the three sets of underground workings and drilling to better illustrate it, although this is proving to be a challenge. The challenge is drill holes, and all three levels of underground workings catch the Middlecoff at different elevations so it doesn’t look like they join up projected to surface on a plan map. That is complicated by the Ewing fault which overlies the zone (and may cut it off in places).

“The next step is to get this and the workings into a workable format (sections and plans, 3D) so we can try to use the underground data in conjunction with the drilling to vector the next set of holes. This will be done over the winter and we will be back out there in the spring for the next drill program as soon as weather allows. I want to spend some more time with the data and incorporate what we have learned this year before outlining what the next program will be, but it is safe to say it will be heavily weighted on drilling. I would expect we would want to test Middlecoff and Bighorn again to expand on what we have identified there, and to test the idea that the target may be deeper at Ross.”

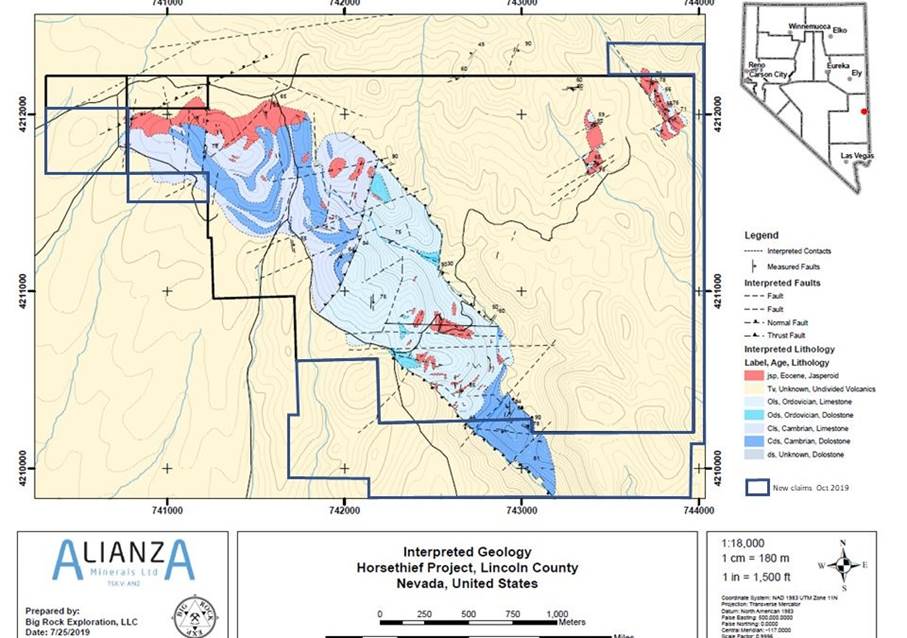

Besides Haldane and as a reminder, Alianza also has a JV with Hochschild in Nevada. Hochschild has optioned three Nevada sediment-hosted gold properties from Alianza. The BP and Bellview properties are located in the southern extension of the Carlin Trend, while the Horsethief property represents an off-trend gold target located 26 km east of Pioche, Nev. The Horsethief property is considered the most prospective by Alianza, and is the focus of attention.

Highlights of the latest program on Horsethief were reported on October 30, 2019, and include the discovery of new gold-bearing jasperoid, the identification of favorable carbonate host stratigraphy, and the mapping of alteration and structural features that may act as pathways for gold-bearing fluids at Horsethief.

CEO Jason Weber was clearly enthusiastic about the reconnaissance (early stage) program results: “The 2019 exploration program was extremely successful, identifying new mineralized occurrences of jasperoid and prospective carbonate stratigraphy, illustrating potential for Horsethief to host a large gold-bearing system. However, the most interesting outcome was the identification of these features at or near the contact between Cambrian and Ordovician-aged rocks, which, are known to host large sediment-hosted gold deposits such as the Long Canyon Gold Mine.”

As a result, an additional 26 claims were staked to cover the jasperoid occurrence as well as prospective stratigraphy identified in the southern portion of the property. Jasperoid can be an important source of gold bearing mineralization, and Nevada is known for these occurrences, sometimes resulting in significant gold deposits. Alianza believes that jasperoid found to date may represent the lateral or vertical extents of a gold-bearing system at Horsethief which is what will be targeted in the drilling program planned for 2020.

Jasperoid breccias from Horsethief have returned gold values up to 1.221g/t (21.94g/t historically) from surface grab samples. Shallow historical drilling has tested the jasperoid exposures with one hole returning 0.79 g/t gold over 39.6m and four holes ending in mineralization.

Horsethief hosts five primary drill targets; four target areas defined by surface exposures of altered carbonate rocks and one target at depth, interpreted from induced polarization (IP) and resistivity geophysical surveys. Exploration at Horsethief is targeting sediment-hosted gold mineralization in a window of Cambrian and Ordovician carbonate rocks overlain by volcanic flows and pyroclastics. Work by prior operators included mapping and sampling hematite-rich jasperoid breccia outcrops and shallow drilling. Historical drilling, generally 100 meters or less in depth, returned multiple intervals of gold mineralization including 13.7 meters averaging 1.2 g/t gold besides the jasperoid exposure drilling mentioned above. Subsequent geophysical surveys (Induced Polarization chargeability and resistivity) indicate that stratigraphy and potentially mineralized targets dip to the east under the volcanic cover and below the extent of prior drilling.

Management is working with Hochschild’s technical team to prioritize these targets for a 2,500 meter drilling program in 2020. The original plan was to start drilling Horsethief in October/November of this year, but since Hochschild reshuffled some priorities on exploration, this has been rescheduled for early next year unfortunately, since the silver price is doing relatively well lately.

Jasperoid Breccia outcrops; Horsethief North area

Conclusion

The first set of stepout drilling results from Haldane looks promising, as it extended known mineralized zones by quite a bit, although not directly hitting economic mineralization. As this would be fairly rare in itself and there are many targets to test, it is still early exploration days for Alianza Minerals, and I am looking forward to follow-up stepout/infill drilling after the winter break at Haldane. Horsethief doesn’t have a winter break like Haldane as it is in Nevada, but has to wait for operator Hochschild in order to see the start of drilling. When this will start early as they can next year, I expect a steady flow of drill results, doubling the chances on hitting something of economic interest. Stay tuned.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website http://www.criticalinvestor.eu to get an email notice of my new articles soon after they are published.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclaimer:

The author is not a registered investment advisor, and currently has a long position in this stock. Alianza Minerals is a sponsoring company. All facts are to be checked by the reader. For more information go to www.alianzaminerals.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Streetwise Reports Disclosure:

1) The Critical Investor’s disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts and graphics provided by the author.

( Companies Mentioned: ANZ:TSX.V,

)