By Dmitriy Gurkovskiy, Chief Analyst at RoboForex

The Euro and the Pound are still under pressure of possible political turmoil. Matteo Salvini, the Deputy Prime Minister of Italy, called for fresh elections. There exists an opinion that the Italian government consisting only of “Lega Nord” party members may get in hot water with the European Union. However, there are no substantive reasons for changes in the government right now, that’s why the European currency barely responds to this news and continues trading sideways. Still, one shouldn’t exclude a possibility of the Euro rate decline in the nearest future against the background of events in Italy. Right now, the Euro is rebounding from the descending channel’s upside border with the resistance level being near 1.1200.

The British Pound, which got very close to the lowest levels since 2017, is still under pressure from “no-deal” Brexit and the British Prime Minister Boris Johnson, who may call for national elections right after the Brexit. If the date for elections is fixed in the nearest future, the falling Pound may boost its decline and fix below the support level at 1.2000. Moreover, a lot of traders believe that “no-deal” exit may result in higher volatility and risks of further decline towards parity with the American currency.

As we can see in the H4 chart, EURUSD has broken 1.1185 to the downside and may continue falling with the short-term target at 1.1130. After that, the instrument may be corrected to return to 1.1185 and then form one more ascending structure to reach 1.1130. Still, this scenario may no longer be valid if the price breaks 1.1225 to the upside. From the technical point of view, this scenario is confirmed by MACD Oscillator, as its signal line is steadily moving downwards. After the line breaks 0, the downtrend is expected to boost and reach the first target at 1.1130.

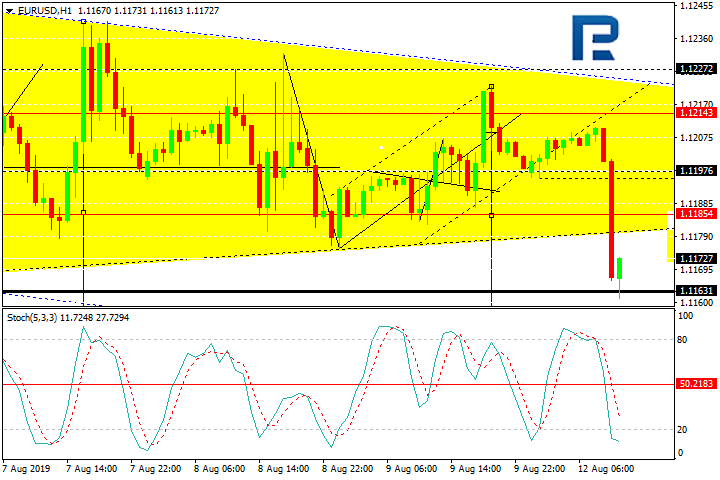

In the H1 chart, EURUSD is moving downwards; it has broken 1.1185 to the downside, but may yet return to this level. If the price rebounds from this level, the pair may continue falling and forming the third descending wave towards 1.1130. However, this scenario may be canceled if the price breaks 1.1225 to the upside. From the technical point of view, this scenario is confirmed by Stochastic Oscillator, as its signal is moving below 0 inside the “oversold area”. After the line leaves the area, the instrument may grow to test 1.1185 from below and then resume trading inside the downtrend.

Disclaimer

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Any predictions contained herein are based on the authors’ particular opinion. This analysis shall not be treated as trading advice. RoboForex shall not be held liable for the results of the trades arising from relying upon trading recommendations and reviews contained herein.