Article By RoboForex.com

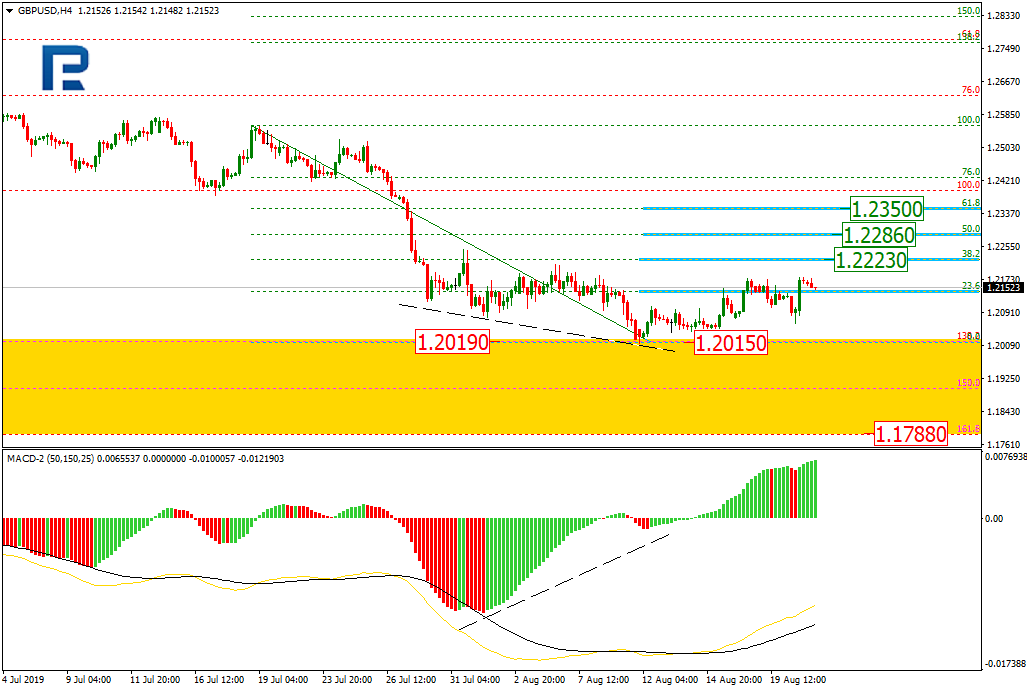

GBPUSD, “Great Britain Pound vs US Dollar”

As we can see in the H4 chart, there was a convergence on MACD after the pair had reached the post-correctional extension area between 138.2% and 161.8% fibo at 1.2019 and 1.1788 respectively, which indicated a new pullback. By now, the pullback has reached 23.6% fibo and may continue towards 38.2%, 50.0%, and 61.8% fibo at 1.2230, 1.2286, and 1.2350 respectively. The support is the low at 1.2015.

The short-term scenario is shown on the H1 chart. Here, there is a local convergence, which may indicate a slowdown in the correctional uptrend towards 38.2% and 50.0% fibo at 1.2223 and 1.2286 respectively.

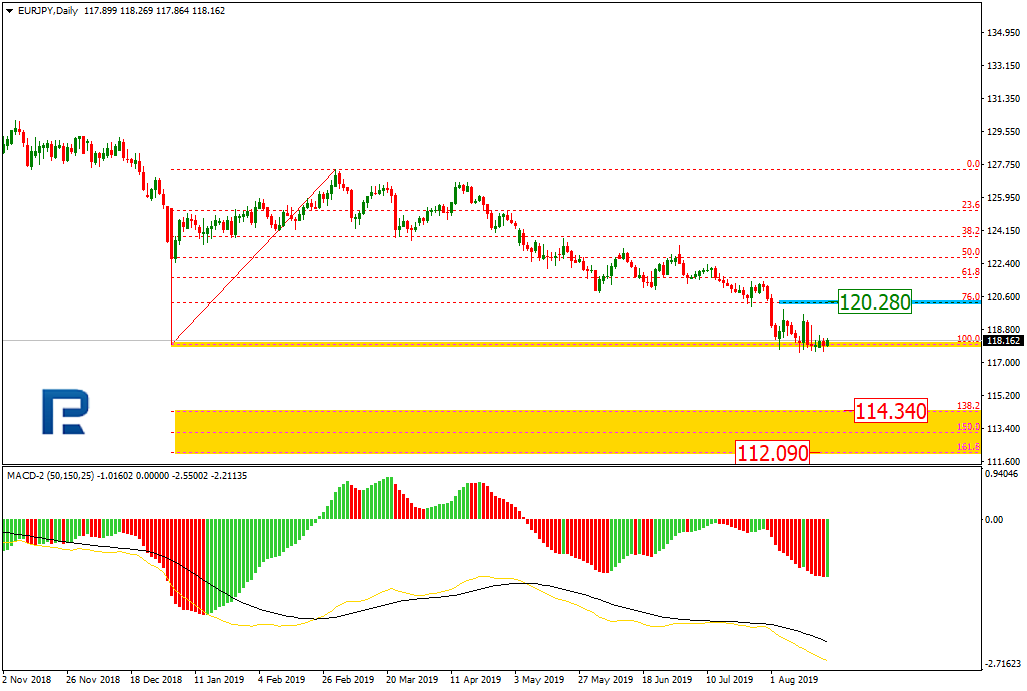

EURJPY, “Euro vs. Japanese Yen”

As we can see in the daily chart, EURJPY is still testing the long-term low again. After breaking the low and fixing below it, the descending tendency may continue towards the post-correctional extension area between 138.2% and 161.8% fibo at 114.34 and 112.09 respectively. The resistance is close to 76.0% fibo at 120.28.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

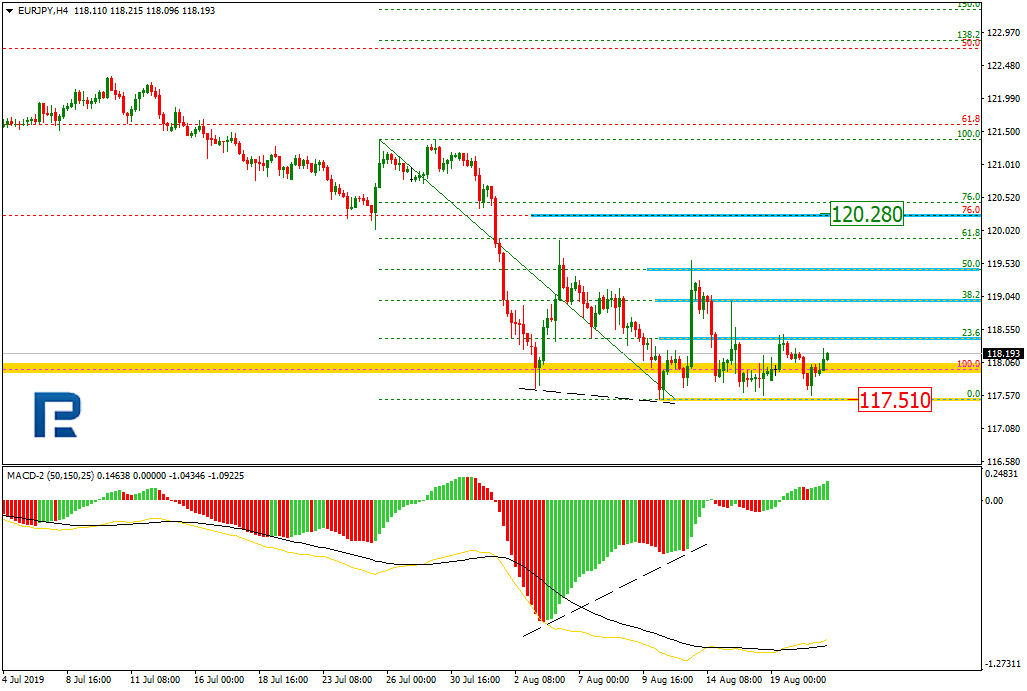

In the H4 chart, after being corrected to the upside by 50.0%, the pair is trading downwards to reach the low at 117.51.

Article By RoboForex.com

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex LP bears no responsibility for trading results based on trading recommendations described in these analytical reviews.