By CountingPips.com – Receive our weekly COT Reports by Email

Here are the latest links to our coverage of the Commitment of Traders data changes.

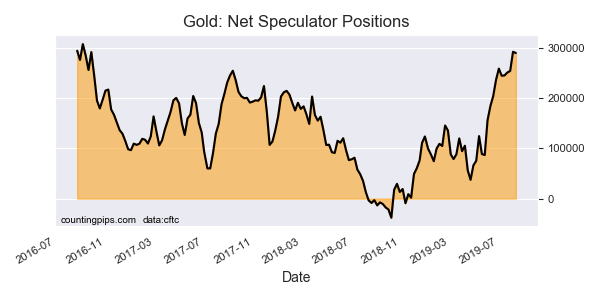

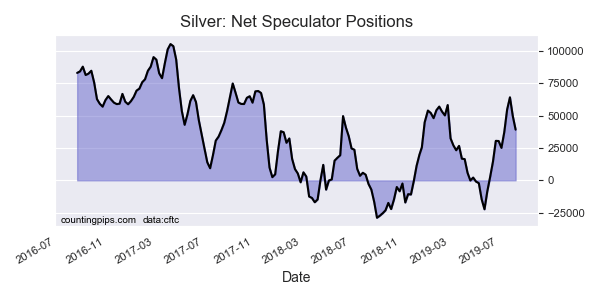

This week in the COT data, precious metals speculators cut back on their Gold and Silver positions after both have had very strong gains in the past few months. Gold speculators edged their bullish bets lower while Silver speculators sharply reduced their bullish bets for a 2nd week.

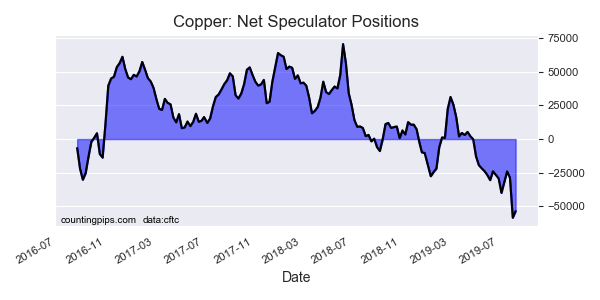

Copper speculators, meanwhile, pulled back on their bearish bets this week. Last week, Copper bearish positions had risen by the most on record for one week (-29,694 contracts) to a new all-time record high bearish position of -58,449 contracts.

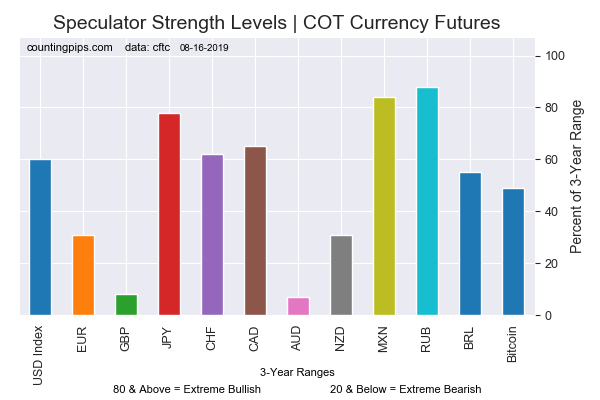

In currencies, the USD Index speculators trimmed their bullish bets for the first time in seven weeks. Japanese yen bets improved for a 4th week and rose by over +14,000 net contracts for a second straight week.

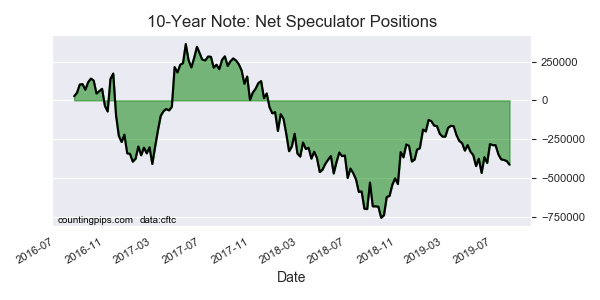

The 10-Year Bond speculators continued to push their bearish bets higher for a fifth straight week. Despite the speculative bearishness, the 10-Year Note price has continued to rise sharply higher while the 10-year yield has fallen to all the way down to 1.55 percent.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

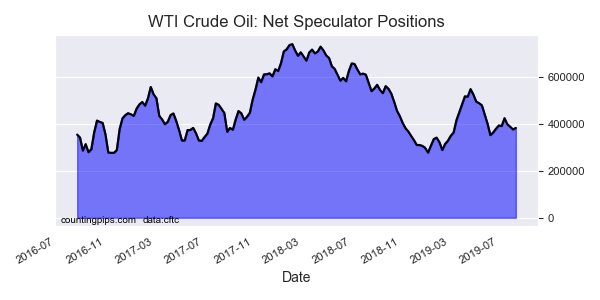

Finally, the WTI Crude Oil speculators added to their bullish bets this week after positions had fallen in the previous three straight weeks.

Speculators trim US Dollar Index bets, push Japanese Yen bullish bets higher

Large currency speculators reduced their net positions in the US Dollar Index futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday. See full article.

WTI Crude Oil Speculators pushed their bullish bets slightly higher this week

The large speculator contracts of WTI crude futures totaled a net position of 382,144 contracts, according to the latest data this week. This was a change of 6,503 contracts from the previous weekly total. See full article.

10-Year Note Speculators added to their bearish bets for 5th week

Large speculator contracts of the 10-Year Bond futures totaled a net position of -414,346 contracts, according to the latest data this week. This was a change of -23,460 contracts from the previous weekly total. See full article.

Gold Speculators edged their bullish bets lower this week

Large precious metals speculator contracts of the Gold futures totaled a net position of 290,090 contracts, according to the latest data this week. This was a change of -2,455 contracts from the previous weekly total. See full article.

Silver Speculators reduced their bullish bets for a 2nd week

Large precious metals speculator contracts of the silver futures totaled a net position of 39,269 contracts, according to the latest data this week. This was a change of -10,563 contracts from the previous weekly total. See full article.

Copper Speculators trim bearish bets after last week’s surge

Metals speculator contracts of the copper futures totaled a net position of -53,600 contracts, according to the latest data this week. This was a change of 4,849 contracts from the previous weekly total. See full article.

Article By CountingPips.com – Receive our weekly COT Reports by Email

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).

Find CFTC criteria here: (http://www.cftc.gov/MarketReports/CommitmentsofTraders/ExplanatoryNotes/index.htm).