By IFCMarkets

Higher Chinese beef demand bullish for live cattle prices

China’s beef imports jumped in June. Will the LCATTLE price continue rebounding?

China’s beef imports jumped to an all-time high in June. China is the world’s top meat consumer, and pork is the most commonly consumed meat. However, pig inventories plunged 26% in June from a year earlier, decimated by the spread of African swine fever (ASF). The ASF virus is driving up pork prices, with consumers turning to cheaper protein substitutes, including beef. China’s beef purchases in foreign markets rose 63% in June from a year earlier to 160,467 tons. Higher Chinese demand for beef is bullish for live cattle prices.

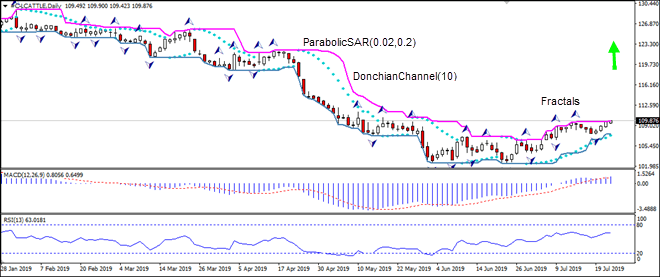

On the daily timeframe the LCATTLE:D1 is retracing higher after hitting 24-month low in the end of May.

- The Parabolic indicator gives a buy signal.

- The Donchian channel indicates uptrend: it is narrowing up.

- The MACD indicator gives a bullish signal: it is above the signal line and the gap is widening.

- The RSI oscillator is rising but has not reached the overbought zone yet.

We believe the bullish momentum will continue after the price breaches above the upper boundary of Donchian channel at 109.91. This level can be used as an entry point for placing a pending order to buy. The stop loss can be placed below the last fractal low at 107.58. After placing the order, the stop loss is to be moved every day to the next fractal low, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (107.58) without reaching the order (109.91), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Technical Analysis Summary

| Order | Buy |

| Buy stop | Above 109.91 |

| Stop loss | Below 107.58 |

Market Analysis provided by IFCMarkets

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.