WTI Crude Oil Speculators sharply lowered their bullish oil bets

June 1st – By CountingPips.com – Receive our weekly COT Reports by Email

WTI Crude Oil Non-Commercial Speculator Positions:

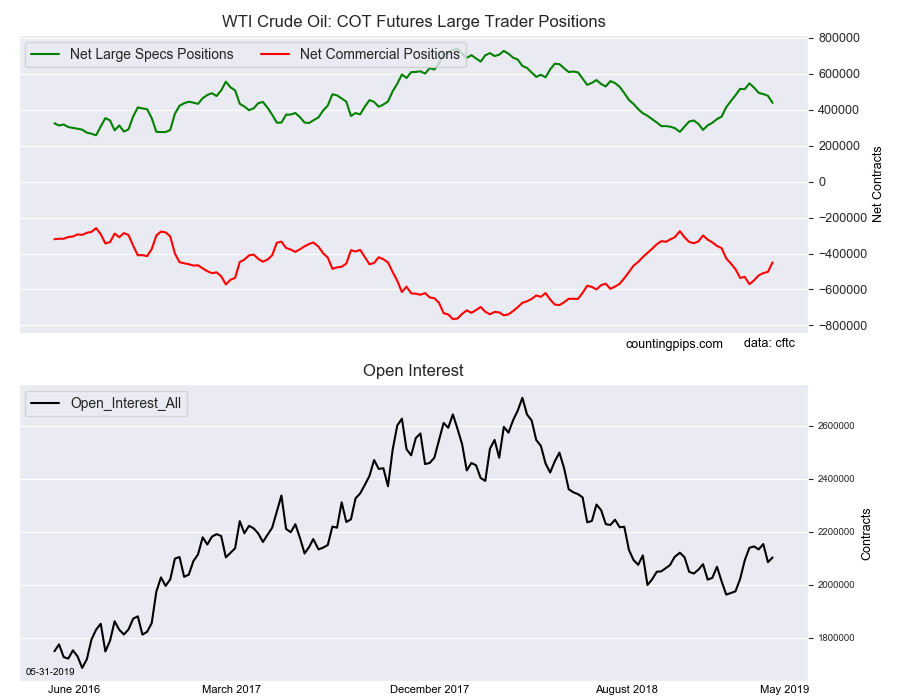

Large energy speculators cut back on their bullish net positions in the WTI Crude Oil futures markets again this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday.

The non-commercial futures contracts of WTI Crude Oil futures, traded by large speculators and hedge funds, totaled a net position of 438,938 contracts in the data reported through Tuesday May 28th. This was a weekly lowering of -39,460 net contracts from the previous week which had a total of 478,398 net contracts.

The week’s net position was the result of the gross bullish position (longs) falling by -21,546 contracts (to a weekly total of 564,433 contracts) while the gross bearish position (shorts) rose by 17,914 contracts for the week (to a total of 125,495 contracts).

Speculator positions dropped for a fifth straight week and by a total of -108,421 contracts over this period. Crude oil bets had really picked up steam in March and April after a cool off in the early part of the year. Bullish positions topped out on April 23rd after rising for nine out of the previous ten weeks to a total of +547,359 contracts and the best level in approximately seven months.

Free Reports:

The current standing for spec positions remains in a relatively strong bullish level despite the recent setbacks.

WTI Crude Oil Commercial Positions:

The commercial traders position, hedgers or traders engaged in buying and selling for business purposes, totaled a net position of -449,077 contracts on the week. This was a weekly uptick of 52,809 contracts from the total net of -501,886 contracts reported the previous week.

WTI Crude Oil Futures:

Over the same weekly reporting time-frame, from Tuesday to Tuesday, the WTI Crude Oil Futures (Front Month) closed at approximately $59.14 which was a drop of $-3.99 from the previous close of $63.13, according to unofficial market data.

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) as well as the commercial traders (hedgers & traders for business purposes) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).

Find CFTC criteria here: (http://www.cftc.gov/MarketReports/CommitmentsofTraders/ExplanatoryNotes/index.htm).

Article By CountingPips.com – Receive our weekly COT Reports by Email