By IFCMarkets

Accelerating services revenue growth bullish for Apple

Apple counts on services revenue growth to become another major driver of growth. Will the Apple stock price continue rebounding?

Apple reported second quarter revenue of $58 billion, down 5% from the same quarter a year ago, over a month ago. And while iPhone revenue came in at $31.05 billion, also down but making up over 53% of Apple’s entire revenue, services division hit an all-time high of $11.5 billion in revenue. A month before the report, the company announced several new software initiatives including News Plus, Apple Arcade, and Apple TV Plus. The Apple Arcade and Apple TV Plus services are expected to launch this fall, and Apple counts on continuing double-digit growth of services revenue to drive overall revenue growth as revenue and units sold of Apple’s flagship product iPhone are under strain because of US-China trade dispute.

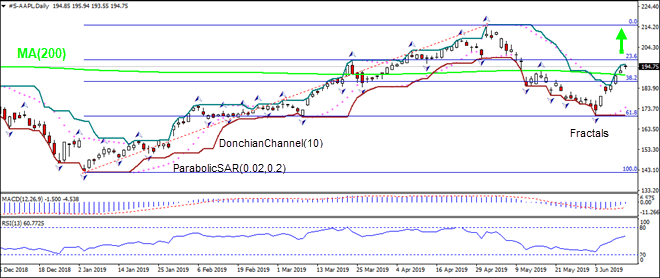

On the daily timeframe the S-AAPL: D1 has closed above the 200-day moving average MA(200) and Fibonacci 38.2. This is bullish.

- The Parabolic indicator gives a buy signal.

- The Donchian channel indicates uptrend: it has widened up.

- The MACD indicator gives a bullish signal: it is below the signal line and the gap is narrowing.

- The RSI oscillator is rising but has not reached the oversold zone yet.

We believe the bullish momentum will continue after the price breaches above the upper boundary of Donchian channel at 195.94. This level can be used as an entry point for placing a pending order to buy. The stop loss can be placed below the fractal low at 170.38. After placing the order, the stop loss is to be moved every day to the next fractal low, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (170.38) without reaching the order (195.94), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Technical Analysis Summary

| Position | Buy |

| Buy stop | Above 195.94 |

| Stop loss | Below 170.38 |

Market Analysis provided by IFCMarkets

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.