By CountingPips.com – Receive our weekly COT Reports by Email

Here are this week’s links to the latest Commitment of Traders data changes that were released on Friday.

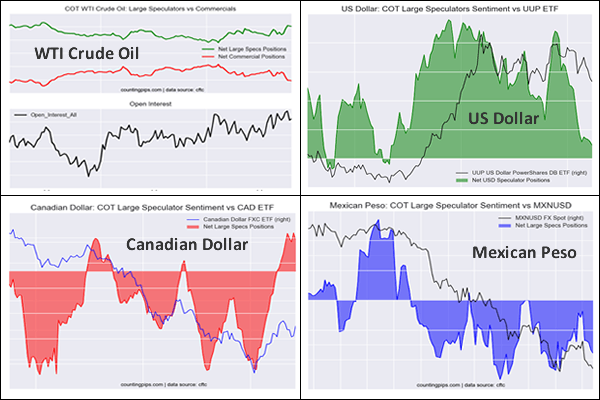

- US Dollar Index Speculators trimmed bullish bets for 2nd week. Peso bets jump

- WTI Crude Oil Speculators pushed their bullish bets higher for 6th week

- 10-Year Note Speculators edged their bearish bets slightly higher

- Gold Speculators sharply raised their bullish bets this week

- Bitcoin Speculators trimmed their bearish bets lower for 3rd week

- S&P500 Mini Speculators lifted their bets back into a bullish net position

- Silver Speculators bullish positions rebounded after 3 down weeks

- Copper Speculators dropped their bullish bets to lowest in 5 weeks

US Dollar Index Speculators trimmed bullish bets for 2nd week. Peso bets jump

Large currency speculators decreased their net positions in the US Dollar Index futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday. See full article.

WTI Crude Oil Speculators pushed their bullish bets higher for 6th week

The large speculator contracts of WTI crude futures totaled a net position of 448,619 contracts, according to the latest data this week. This was a change of 33,873 contracts from the previous weekly total. See full article.

10-Year Note Speculators edged their bearish bets slightly higher

Large speculator contracts of the 10-Year Bond futures totaled a net position of -166,293 contracts, according to the latest data this week. This was a change of -2,319 contracts from the previous weekly total. See full article.

Gold Speculators sharply raised their bullish bets this week

Large precious metals speculator contracts of the Gold futures totaled a net position of 119,741 contracts, according to the latest data this week. This was a change of 31,345 contracts from the previous weekly total. See full article.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Bitcoin Speculators trimmed their bearish bets lower for 3rd week

Cryptocurrency speculator contracts of the Bitcoin futures totaled a net position of -1,244 contracts, according to the latest data this week. This was a change of 42 contracts from the previous weekly total. See full article.

S&P500 Mini Speculators lifted their bets back into a bullish net position

Large stock market speculator contracts of the S&P500 mini futures totaled a net position of 24,139 contracts, according to the latest data this week. This was a change of 72,173 contracts from the previous weekly total. See full article.

Silver Speculators bullish positions rebounded after 3 down weeks

Large precious metals speculator contracts of the silver futures totaled a net position of 26,189 contracts, according to the latest data this week. This was a change of 2,879 contracts from the previous weekly total. See full article.

Copper Speculators dropped their bullish bets to lowest in 5 weeks

Metals speculator contracts of the copper futures totaled a net position of 1,942 contracts, according to the latest data this week. This was a change of -14,413 contracts from the previous weekly total. See full article.

Article By CountingPips.com – Receive our weekly COT Reports by Email

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).

Find CFTC criteria here: (http://www.cftc.gov/MarketReports/CommitmentsofTraders/ExplanatoryNotes/index.htm).