By The Gold Report

Source: Maurice Jackson for Streetwise Reports 03/18/2019

Matt Gili, CEO of Nevada Copper, talks with Maurice Jackson of Proven and Probable about his company’s progress toward beginning copper production by the end of the year.

Maurice Jackson: Joining us for a conversation is Matt Gili, president, CEO and director of Nevada Copper Corp. (NCU:TSX), which is on target to U.S. copper production by Q4 2019.

Nevada Copper has a number of successes to share with reader. But, before you share the unique value preposition of Nevada Copper, Mr. Gili, for readers who may not be familiar with the supply and demand fundamentals regarding copper, please provide us with a 10,000-foot overview.

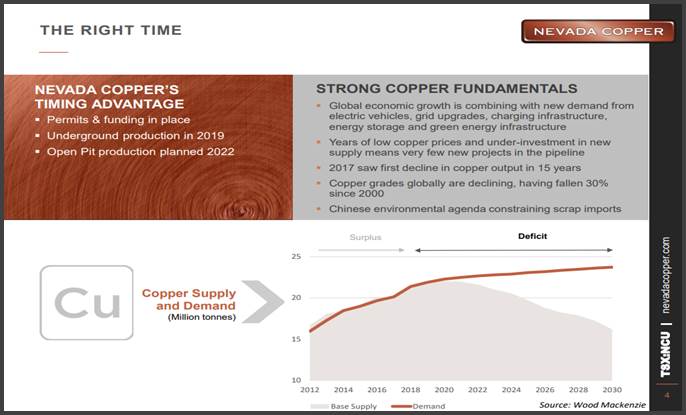

Matt Gili: When you look at the copper fundamentals, we see a very steady and predictable increase in demand of copper, modest amount, 1.5% per year. We see the move towards electrification of vehicles consuming more copper. We see other things that are offsetting that, but overall, a steady predictable 1.5% increase in the global demand for copper. Where the story really gets exciting, from the Nevada Copper standpoint, is with regards to the supply for copper. What we’re seeing is a lot of restrictions in future supply. We’re seeing a lot of difficulties on bringing on a future supply and backed up by work done by Wood Mackenzie and others, we’re projecting that by 2025, the world will be in a supply deficit of upwards of 6 million tonnes of copper per year. This just really supports what we’re doing in Nevada Copper in setting up the next copper mine.

Maurice Jackson: Now that we have an overview of the supply and demand fundamentals for copper, Matt, let’s discuss how someone listening may position himself prudently as a beneficiary. For someone new to the story, can you give us a very quick overview of Nevada Copper?

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

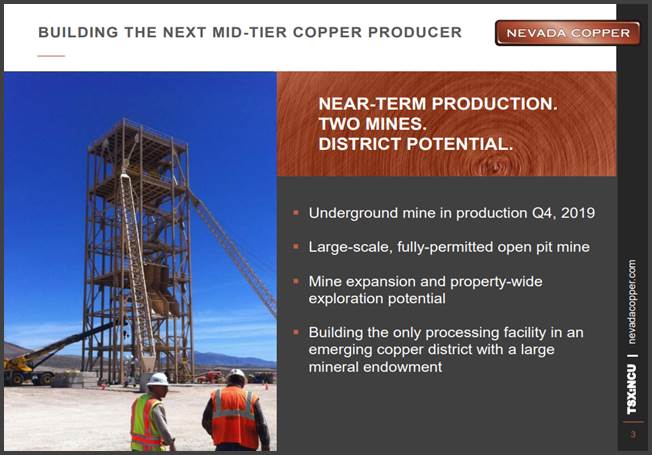

Matt Gili: Certainly. Nevada Copper, who’s Nevada Copper? We have an asset in Nevada called Pumpkin Hollow. This is our chief asset. It consists of two deposits: an underground deposit and an open-pit deposit for copper. We’re currently in the construction phase for the underground project with production from that underground project coming online later this year. I think we’ll talk more about that later. Regarding the open pit, we’re currently in the process of wrapping up the prefeasibility study for the open pit. You’ll see that being published in April of this year. Then, we have a regional land package of well over 15,000 acres that we are looking at really understanding, really unlocking the full value from that land package. That’s really Nevada Copper, building a copper mine coming into production later this year, with a lot of expansion into an open-pit mine, as well as regional exploration.

Maurice Jackson: Let’s provide readers the latest updates on Nevada Copper, as the company has been very proactive on a number of fronts. Please provide us with an update on the construction progress. I would like to begin with the multi-million dollar question, are we on track to enter production in Q4 of this year?

Matt Gili: Yes, Maurice, we are on track to enter production in Q4 of this year. We are very proud of that. The team’s doing a fantastic job. We have construction activities both on surface with Sedgman building the process plants, as well as underground cementation, both sinking shaft and doing lateral development on our main shaft. All that’s coming together very nicely. We are absolutely on track for commissioning of the plant in the fourth quarter of this year.

Maurice Jackson: As Nevada Copper is preparing for production this year, have you increased your staffing to meet the growing demands?

Matt Gili: That’s a really good question and yes, we have. We’ve increased our staffing. It’s an operational readiness question that you’re asking. This is where I want to stress to you and readers that this concept of operational readiness is foremost in our thoughts and how we’re planning for really becoming, not just building a great mine, but operating a great mine. When you look at the staffing, so far, our staffing, by design, is quite modest. We’re looking at a total workforce of Nevada Copper employees of around 30. That is because this is our model, a very lean, efficient operation. We utilize high-quality, expert service providers as necessary, to make sure that we are operating very efficiently.

Maurice Jackson: Is Nevada Copper still actively recruiting and if so, what positions?

Matt Gili: Yes, we are actively recruiting. Most of our positions open are technical and specialist positions, and would be part of the management team. I absolutely encourage anyone interested in what we’re recruiting for to contact the Nevada Copper website. You’ll see the complete listing of opening jobs there, as well as information on how to apply for any of these positions if you’re interested.

Maurice Jackson: Pumpkin Hollow is unique in that you have both an underground and an open-pit mine. Let’s discuss exploration and expansion potential. What initiatives is Nevada Copper taking to optimize the full potential of the Pumpkin Hollow project?

Matt Gili: We are in the process of constructing the underground, which has a large amount of upside potential. We’ll really only explore that upside potential when we’re underground, after we’re in production. We really look forward to updates on that front in 2020, and the reason for that is very simple. It’s just much more efficient to drill out the prospective areas of the underground from the underground; the holes are shorter. It’s just much easier. That’s really where the underground sits right now, in a holding pattern as far as expansion potential. When you look at the open pit, that’s where a lot of great energy is going into expanding the open pit, understanding the open pit better, really getting that ore body knowledge to allow you to build a world-class operation. That is part of the PFS, which is coming out in April of this year.

That PFS will include the drilling campaign that we completed in 2018, the 26 hole drilling campaign. It will include those results in the resource model. That’s going to give you an even better idea of the full potential of the open pit. The real excitement that we have is with regards to the region itself, a large region, relatively unexplored, but with large amounts of historical copper production, as well as great physical outcroppings of copper mineralization. This is really where we’re going to focus our efforts during 2019, to really get a chance, now that we’ve tied up this land package, to understand what we have.

Maurice Jackson: Speaking of the region, there was a regional survey conducted that led you to staking more land. Can you share the results with us?

Matt Gili: We staked a section a land that we refer to as the Teddy Boy Claims. This is about 5,700 acres of land to our northeast. We are very glad to have this in our portfolio. The criteria for that selection was we brought together experts on this region and experts in copper mineralization. They identified that as a really prospective area and where we should be really focused on. We’ve staked that land, secured it for our ability to explore over the next several years.

Maurice Jackson: Does Nevada Copper plan to drill the new area at some point this year?

Matt Gili: We plan on drilling this year. I really haven’t put out the entire drill program for 2019. We’re still pulling that together and analyzing where to best spend the monies we have available for exploration. We would like to drill that this year. Some more prospective holes, really not an in-depth blanket campaign, but probe a few really interesting areas over there and get a better idea for the drill campaign.

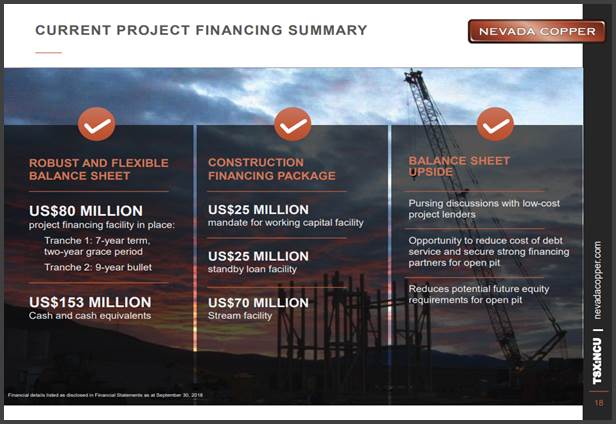

Maurice Jackson: It’s one thing to have tonnage and grade, but you must equally have astute business acumen to make the numbers work. Now, Nevada Copper is in discussions regarding an ECA-backed project finance facility to further optimize the balance sheet, as well as lining up a working capital facility and further offtake agreements to improve the economics of Pumpkin Hollow. Please provide us with the details.

Matt Gili: You kind of said it all. I can’t really provide you with any more details, but I can surely stress what you’ve just said, Maurice. We are in discussions with this export, credit agency style backed project financing. This is going to provide us the opportunity to substantially reduce the cost of our debt service, as well as attract strong and robust financial partners for potential future open-pit developments. Something we’re very excited about and it’s part of really creating Nevada Copper as a world-class company.

Maurice Jackson: Let’s get into some numbers. Please share your capital structure.

Matt Gili: The capital structure is well defined. We have $8 million in long-term debt. We have $153 million of cash or cash equivalents. When you look at the financing package specifically for the underground, we’re fully financed, including the working capital facility to take us through operation ramp up. The inputs into that are an equity raise that we did in the middle of last year, as well as a streaming deposit with regards to a stream arrangement on the precious metals strictly from the underground deposit. We also have a $25-million subordinated debt package. Really a standby loan facility that we can use if necessary.

Maurice Jackson: In closing, I have a multilayered question. What is the next unanswered question for Nevada Copper? When can we expect a response? What determines success?

Matt Gili: I would not classify our successful completion of underground construction and bringing them in operation as an unanswered question. That is going to happen, and I’m very proud of the activities that have happened so far. The real unanswered question for the investors out there, is what is the true potential of the open pit? There’s been a lot of great work done, a lot of exploration done, last year. That’s all been incorporated. I’m really going to be excited when the PFS is released and we can share the details of the open pit potential with the public. They are going to be very impressed and they’re going to see the picture. They’re going to see what we see when we get so excited about Nevada Copper.

Maurice Jackson: Speaking of the prefeasibility study, give us a timeline on that, sir.

Matt Gili: We’ll release that in April. I’m being careful. I don’t want to be too specific. It will be in April of this year. Next month.

Maurice Jackson: Mr. Gili, last question. What did I forget to ask?

Matt Gili: Maurice, forget to ask? You’re always very thorough, so I wouldn’t say you forgot to ask anything. What I would say is I want to reiterate something that we at Nevada Copper have been thinking about over the last month. Unfortunately, for the world, the last month has been a month marred with tragedies, with risk and with unexpected events. What we’re really stressing, with Nevada Copper, is the risk management of Nevada Copper. We are an operation that is on private land. We’re not waiting for any permits. We’re not waiting for records of decision. We’re utilizing EPC contractors, who have that fixed price nature, reduced risks. We’re building a dry stack tailing facility. We’ll never have a wet tailing storage facility at Pumpkin Holland. We’re doing this all with a proven, experienced team of mine builders and operators. Really wrapping that up, that concept of low risk, risk mitigation. We are going to build and operate the next mine and there’s very little risk to that execution.

Maurice Jackson: Matt, if investors want to get more information about Nevada Copper, please share the website address.

Matt Gili: Absolutely, www.nevadacopper.com. We love to get your input. You’ll see our investor presentations there in our latest news. Let us know what you think.

Maurice Jackson: For our audience, we wish to remind you that Nevada Copper trades on the TSX symbol, NCU, and on the OTC symbol NEVDF. For additional inquiries, please contact Richard Matthews at (877) 648-8266 or you may email [email protected]. Nevada Copper is a sponsor and we are proud shareholders for the virtues conveyed in today’s message.

Last but not least, please visit our website, provenandprobable.com, for mining insights and bullion sales. You may reach us at [email protected].

Matt Gili of Nevada Copper, thank you for joining us today on Proven and Probable.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Nevada Copper. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Nevada Copper is a sponsor of Proven and Probable. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Images provided by the author.

( Companies Mentioned: NCU:TSX,

)