By The Gold Report

Source: Clive Maund for Streetwise Reports 02/02/2019

Technical analyst Clive Maund charts this company that is monetizing some of its water rights.

Persistent low metals prices in recent years have crushed many explorers and turned a lot of them into “basket cases” where at best they limp along just paying their bills and are often heavily in debt. This seems to have been the case with Quaterra Resources Inc. (QTA:TSX.V; QTRRF:OTCQX) where in the rare event of a new employee being taken on, he would be handed an unsigned (because the author is no longer around to sign it) copy of Charles Dickens’ “Hard Times” on induction day, just to get him into the right frame of mind.

With Quaterra, based on its having a range of copper projects and the copper price and its stock price being moribund for many months, it has been easy to jump to the conclusion that it could go “belly up” at any time, but this overlooks the fact that the company is in possession of valuable water rights that are much in demand, and in fact the value of the company’s water rights greatly exceeds the company’s market valuation, which should mean that either the stock price will improve or it will get bought up. There has been a positive development with respect to this which is that the company has already sold some of its water rights and should be in receipt of the proceeds soon, which means that it is solvent and can if it wishes proceed to advance its projects.

If I walked up to you and said “Excuse me, would you mind if I give you a $100 bill in exchange for a $20,” you would probably look at me as if I was nuts, and then, after holding the $100 up to the light and checking out the watermark etc, agree to the exchange. This is similar to the situation we have now in Quaterra Resources where we have a company worth 49 cents a shareand don’t take it from me, that’s Fundamental Research Corp’s fair value estimateselling at about US$0.06 cents a share. Alright, some things could theoretically go wrongthe check that the company is due for its recent sale of water rights or land with water rights for $6.23 million could bounce, Al Qaeda could poison their remaining water etc, but what are the chances of these things happening? they are minuscule, and viewed rationally, the current valuation of Quaterra is just plain nuts.

Let’s just consider some of these numbers briefly, because there is no need for us to get bogged down in needless detail. At the current stock price (8 cents) the company is valued at about $12 million, they have a check due for $6.23 million for a recent sale of water rights, extrapolating from which their remaining water rights can be fairly valued at $20 million, their copper projects are estimated to be worth a very substantial sum, so adding all this up, we have the company valued by the market at $12 million, while its assets have a total value in excess of $100 million, and that’s without taking into consideration that other mining companies surrounding their properties might want to buy them up, and without taking into account that the copper price could rise a lot from its current low level in the midst of a commodities bull market. So this is what is known in the trade as a “no brainer.” It was market analyst Joseph Granville who said many years ago that “There is more maintained stupidity in this business than in probably any other business in the world”how right he wasand isand this undervaluation of Quaterra Resources is a classic example of it.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

You can almost hear the cogs and wheels turning in some investor’s brains as they slowly put 2 and 2 together to realize that due to these water rights, Quaterra is very undervalued here, and can either sell the water rights to advance it projects, hopefully as metals prices improve, or sit back and wait to be bought up by some larger company wanting to get its hands on its assets (so to speak).

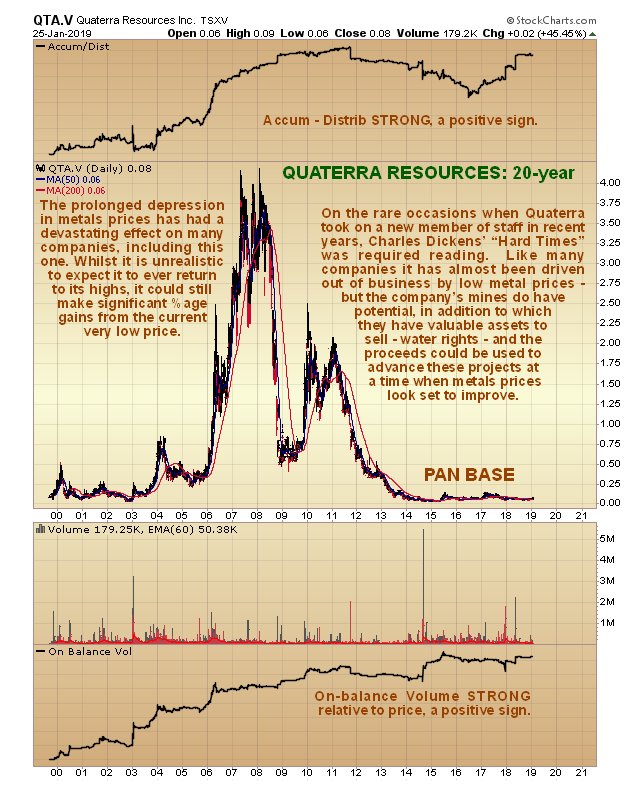

Let’s now proceed to see what the charts are saying about it. We’ll start with the long-term chart which looks positively Dickensian in that Quaterra is now so cheap it clearly has to “make do and mend.” Whilst it would be hopelessly unrealistic to expect the stock to ever approach its highs again, it is clear that even if it only advanced partway towards them it would result in substantial percentage gains from the current dismally low price, and that is possible since the price isand has been since late 2014tracking sideways marking out a potential low Pan base. Volume indicators are positive, which increases the chances of a new bullmarket getting going.

On the 5-year chart we can examine this potential base pattern in much more detail. This chart opens it out and on it we can see that the price has been fluctuating in a range broadly bounded by about 15 cents on the upside and 4 or 5 cents on the downside. It has been down near to the support at the bottom of this range for a year now marking out another cyclical intermediate base, which positive volume indicators suggest is going to lead at least to another run at the upper boundary of the range and it broke higher and ran at the resistance level in the 9 cent area on January 25 and looks set to break above this level in due course, a development made much more likely by the fact that more investors are cottoning on to how undervalued this company is.

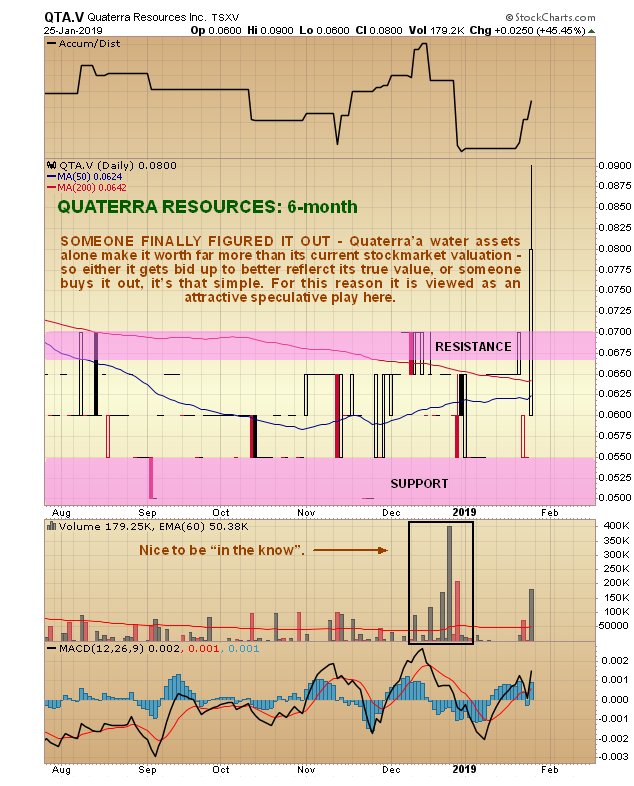

Finally, the 6-month chart enables us to see recent action in detail; in particular Jan. 25th’s break higher on increased volume. Observe how the groundwork for this breakout was actually done during December when increased buying pressure soaked up much of the remaining available supply at the very low price prevailing then. Near-term it looks like the price will consolidate at the resistance at this level, perhaps backing off some, before proceeding to break above it, since the company will soon be in receipt of considerable funds from its sale of some of its water rights.

The conclusion is that, while Quaterra is not suited to all investors on account of its being a very low priced speculative play, it looks attractive here for those subscribers who are comfortable with holding or trading this type of stock. Quaterra trades on the US OTC market in light but acceptable volumes. One anomaly requires explaining. As there are 204 million shares in issue (257 million fully diluted), you would expect to see heavier trading in the stock, yet it seems to be thinly traded. The reason for this is that many of the bigger holders of its stock are long-time shareholders who hold large blocks of stock and are not minded to sell, so in effect it is tightly held.

Quaterra Resources website.

Quaterra Resources Inc, QTA.V, QTRRF on OTC, trading at C$0.08, $0.06 at 12 noon on 28th January 2019.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years’ experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Read what other experts are saying about:

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Disclosure:

1) Clive Maund: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. CliveMaund.com disclosures below. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Quatera Resources. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Quaterra Resources, a company mentioned in this article.

Charts provided by the author.

CliveMaund.com Disclosure:

The above represents the opinion and analysis of Mr Maund, based on data available to him, at the time of writing. Mr. Maund’s opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund’s opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.

( Companies Mentioned: QTA:TSX.V; QTRRF:OTCQX,

)