By IFCMarkets

Dollar strengthens despite slower services expansion

US stock market extended gains on Tuesday on upbeat corporate reports. The S&P 500 added 0.5% to 2737.70. Dow Jones rose 0.7% to 25411.52. The Nasdaq gained 0.7% to 7431.50. The dollar strengthening continued despite Institute for Supply Management’s nonmanufacturing index showing US services sector expanded at a slower pace in January. The live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, rose 0.3% to 96.04 and is higher currently. Futures on US stock indexes point to lower openings today.

FTSE 100 still outperforms European Indices

European stocks ended solidly higher on Tuesday led by energy and bank shares. Both the EUR/USD and GBP/USD continued falling and are lower currently. The Stoxx Europe 600 gained 1.4%. The German DAX 30 rose 1.7% to 11367.98, France’s CAC 40 advanced 1.7% and UK’s FTSE 100 rallied 2.0% to 7177.37.

Asian indices advance

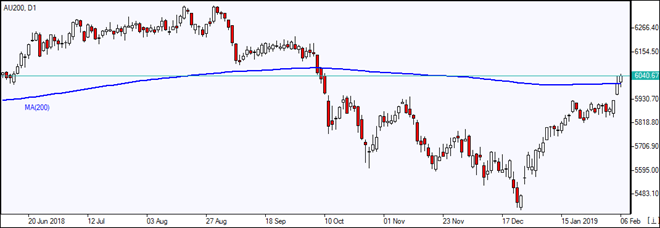

Asian stock indices are gaining today amid reports US Trade Representative Robert Lighthizer and Treasury Secretary Stephen Mnuchin plan to travel to Beijing next week for trade talks. Nikkei added 0.1% to 20874.06 while yen resumed its climb against the dollar. Chinese and Hong Kong’s markets are closed for Lunar New Year. Australia’s All Ordinaries Index gained 0.3% as the Australian dollar resume its slide against the greenback.

Brent retreats

Brent futures prices are extending losses today. Prices ended lower yesterday. The American Petroleum Institute late Tuesday report indicated US crude inventories rose by 2.5 million barrels last week as did gasoline inventories. April Brent lost 0.9% to $61.98 a barrel on Tuesday. Today at 16:30 CET the Energy Information Administration will release US Crude Oil Inventories.

Market Analysis provided by IFCMarkets

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.