By IFCMarkets

On Monday the US stock exchanges did not work due to the President’s Day holiday

The ICE US Dollar index almost did not change. Now futures on US stock indexes are being traded with a slight decrease. Significant macroeconomic statistics is not expected to be published in the United States today.

Quotations for EURUSD slightly increased on Monday

The activity of market participants was minimal due to the lack of American investors. The British pound strengthened on Monday for the 2nd day in a row due to yet another hope of reaching an agreement on Brexit, as well as due to the publication of good data on retail sales in the UK. European stock index EU 50 updated 4-month high. This was facilitated by good corporate data. The consumer sector company Reckitt Benckiser published a positive quarterly report and its shares rose by 4.6%. Today at 11:00 CET business activity indicators for February will be published in ZEW Germany , production data in construction for the entire Eurozone for December. Later the announcements of two ECB representatives is expected. The data on unemployment for January will be published in the UK.

The head of the Bank of Japan spoke at the parliament

The Japanese currency showed a slight weakening after the head of the Bank of Japan, Haruhiko Kuroda annonced that the easing of monetary policy could continue. This will happen if excessive strengthening of the yen will hinder the economic development of the country. The Bank of Japan confirmed its inflation target at 2%. Now it is much lower and amounts to 0.3%. Increase of stock index Nikkei slowed amid falling SoftBank shares by 3.3% due to a moderately negative article in the reputable Wall Street Journal. Australian dollar rate slightly decreased after the publication of the materials of the February of the Reserve Bank of Australia meeting. They are marked by economic uncertainty. Investors have decided that this means the possibility of reducing rates to stimulate the economy.

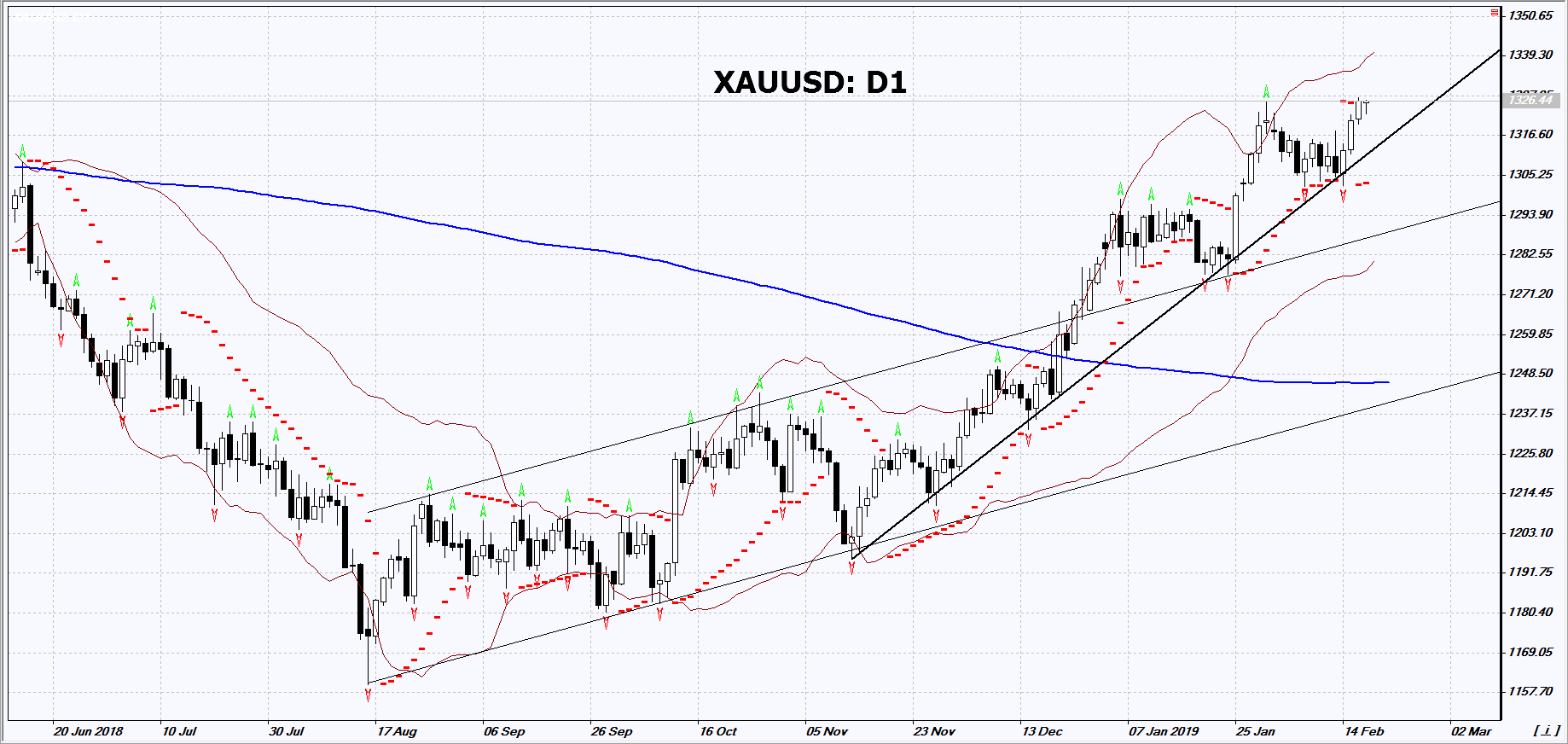

Gold quotations updated 10-month high

Gold rises in price along with the growth of the US dollar index. Palladium has updated the historical maximum. Investors usually consider precious metals as an alternative to dollar assets and the trend of simultaneous growth is rarely seen.

Market Analysis provided by IFCMarkets

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.