By CountingPips.com – Receive our weekly COT Reports by Email

The CFTC put out their latest Commitment of Traders data release on Friday for data that is updated through December 24th. The releases were delayed over a month due to the government shutdown and are now going to being released twice a week to catch up to current data.

Here are this week’s links to our reports on some of the major market:

- Currencies: US Dollar Index Speculators trimmed bets in December, CAD bets dropped

- WTI Crude Oil Speculators trimmed bullish net positions

- 10-Year Note Speculators strongly pared their bearish bets in December

- Gold Speculators sharply raised their bullish bets in December

- Bitcoin Speculators pared their bearish bets through December

- S&P500 Mini Speculators were cutting back on their bullish bets

- Silver Speculators boosted their bullish bets to 6-month high in December

- Copper Speculators added to their bearish bets in late December

Currencies: US Dollar Index Speculators trimmed bets in December, CAD bets dropped

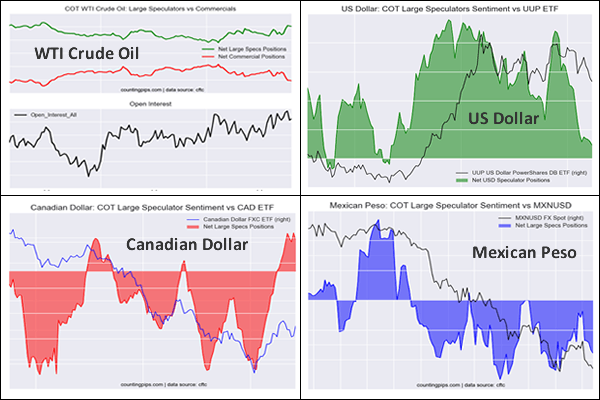

Large currency speculators cut back on their net positions in the US Dollar Index futures markets this week, according to the latest Commitment of Traders (COT) data released by the Commodity Futures Trading Commission (CFTC) on Friday. See full article.

WTI Crude Oil Speculators trimmed bullish net positions in late December

The large speculator contracts of WTI crude futures totaled a net position of 306,312 contracts, according to the latest data this week. This was a change of -3,296 contracts from the previous weekly total. See full article.

10-Year Note Speculators strongly pared their bearish bets in December

Large speculator contracts of the 10-Year Bond futures totaled a net position of -317,632 contracts, according to the latest data this week. This was a change of 63,147 contracts from the previous weekly total. See full article.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Gold Speculators sharply raised their bullish bets in December

Large precious metals speculator contracts of the Gold futures totaled a net position of 110,985 contracts, according to the latest data this week. This was a change of 35,025 contracts from the previous weekly total. See full article.

Bitcoin Speculators pared their bearish bets through December

Cryptocurrency speculator contracts of the Bitcoin futures totaled a net position of -1,142 contracts, according to the latest data this week. This was a change of 200 contracts from the previous weekly total. See full article.

S&P500 Mini Speculators were cutting back on their bullish bets in December

Large stock market speculator contracts of the S&P500 mini futures totaled a net position of 170,218 contracts, according to the latest data this week. This was a change of -40,048 contracts from the previous weekly total. See full article.

Silver Speculators boosted their bullish bets to 6-month high in December

Large precious metals speculator contracts of the silver futures totaled a net position of 25,550 contracts, according to the latest data this week. This was a change of 5,719 contracts from the previous weekly total. See full article.

Copper Speculators added to their bearish bets in late December

Metals speculator contracts of the copper futures totaled a net position of -9,852 contracts, according to the latest data this week. This was a change of -7,174 contracts from the previous weekly total. See full article.

Article By CountingPips.com – Receive our weekly COT Reports by Email

*COT Report: The COT data, released weekly to the public each Friday, is updated through the most recent Tuesday (data is 3 days old) and shows a quick view of how large speculators or non-commercials (for-profit traders) were positioned in the futures markets.

The CFTC categorizes trader positions according to commercial hedgers (traders who use futures contracts for hedging as part of the business), non-commercials (large traders who speculate to realize trading profits) and nonreportable traders (usually small traders/speculators).

Find CFTC criteria here: (http://www.cftc.gov/MarketReports/CommitmentsofTraders/ExplanatoryNotes/index.htm).