By IFCMarkets

Positive euro-zone data bullish for EU50

Consumer confidence in Germany improved for February. Will the EU50 advance continue?

The consumer confidence improved in Germany unexpectedly: the GfK consumer confidence index rose to 10.8 going into February 2019 from an upwardly revised 10.5 in January. It was the highest reading since May 2018, and beat market expectations of a decline to 10.3. The improvement was due to improved income expectations and increased willingness to buy. At the same time French economic growth slowed in the fourth quarter because of the impact of anti-government protests. However, the negative impact of protests was widely expected. Germany is euro-zone’s largest economy, and positive German data are bullish for EU50.

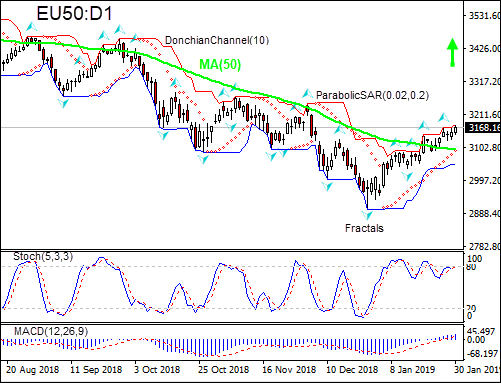

On the daily timeframe EU50: D1 is retracing higher after hitting 41-month low in the end of December 2018, and has risen above the 50-day moving average MA(50).

- The Parabolic indicator has formed a buy signal.

- The Donchian channel indicates no trend yet: it is flat.

- The MACD indicator is above the signal line with the gap widening. This is a bullish signal.

- The Stochastic oscillator is about breach into the overbought zone.

We believe the bullish momentum will continue after the price breaches above the upper Donchian boundary at 3177.64. This level can be used as an entry point for placing a pending order to buy. The stop loss can be placed below the lower Donchian channel at 3049.31. After placing the pending order the stop loss is to be moved every day to the next fractal low, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop-loss level (3049.31) without reaching the order (23177.64) we recommend cancelling the order: the market sustains internal changes which were not taken into account.

Technical Analysis Summary

| Position | Buy |

| Buy Stop | Above 3177.64 |

| Stop loss | Below 3049.31 |

Market Analysis provided by IFCMarkets

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.