By IFCMarkets

Nasdaq logs 7th straight gain

US stock market pulled back slightly on Wednesday on weaker than expected earnings reports. The S&P 500 slipped 0.03% to 2857.70. The Dow Jones industrial average lost 0.2% to 25583.75. Nasdaq composite index however gained 0.1% to 78838.33.The dollar weakening persisted: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, lost 0.1% to 95.049 but is higher currently. Stock index futures indicate lower openings today.

Earnings reports and tariff news remain main market drivers. So far 80% of US corporations have reported quarterly results, and S&P 500 companies have produced earnings growth of 24% and sales gains of 9.8%, according to FactSet data. There were no major economic data releases yesterday, today the producer price index report will be released at 14:30 CET, a decline is expected and a stronger than expected report may boost the dollar.

FTSE 100 opens lower than main European indices

European stocks retreated on Wednesday on mixed corporate reports. The British Pound accelerated the slide against the dollar while euro turned higher but both are lower currently. The Stoxx Europe 600 lost 0.2%. Germany’s DAX 30 ended 0.1% lower at 12633.54. France’s CAC 40 fell 0.4% but UK’s FTSE 100 gained 0.8% to 7776.65. Indices opened 0.1% – 0.4% lower today.

Healthcare companies led losses as Denmark based Novo Nordisk tumbled 6% as it warned of worsened outlook despite earnings beat. The drug maker Lundbeck’s 14% drop was the biggest in Europe on earnings miss. No major economic data were released yesterday, today at 10:00 CET the European Central Bank publishes its Economic Bulletin.

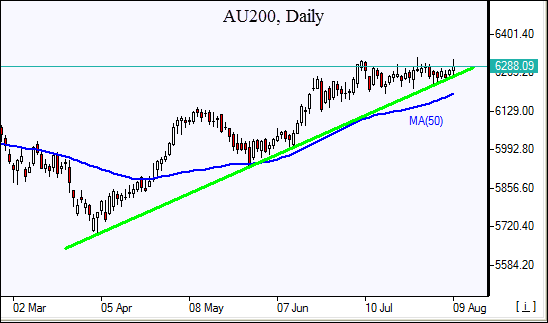

Chinese stocks rally lead Asian indices

Asian stock indices are mostly higher today led by a rally on China’s exchanges. Nikkei however ended 0.2% lower at 22598.39 despite the resumed yen slide against the dollar. China’s stocks are higher on talk of possible government support for technology companies and more infrastructure spending: the Shanghai Composite Index is up 1.9% and Hong Kong’sHang Seng Index is 0.9% higher. Australia’s All Ordinaries Index gained 0.5% as Australian dollar declines against the greenback.

Brent steady

Brent futures prices are steady today. Prices fell yesterday after the Energy Information Administration reported smaller-than-expected drawdown in crude stockpile: US domestic crude supplies declined by 1.35 million barrels last week when 2.3 million barrels drop was forecast. Prices ended sharply lower yesterday: October Brent crude fell 3.2% to $72.28 a barrel on Wednesday.

Market Analysis provided by IFCMarkets

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.