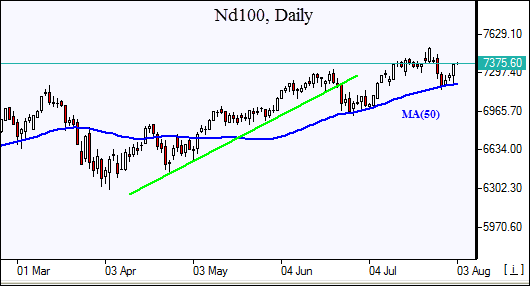

US market rebounds led by technology

By IFCMarkets

Another strong US jobs report is expected today

US stock market ended higher Thursday led by technology shares as Apple’s market capitalization exceeded $1 trillion. TheS&P 500 gained 0.5% to 2827.22. Dow Jones industrial average however slipped 0.03% to 25326.16. The Nasdaqcomposite rallied 1.2% to 7802.69. The dollar strengthening accelerated: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, rose 0.5% to 95.136 and is higher currently. Stock index futures indicate mixed openings today.

Apple’s 3% rally boosted market sentiment despite escalating US-China trade tensions after President Donald Trump proposed a higher 25% tariff on $200 billion worth of Chinese imports. July nonfarm payrolls will be in focus today, the Bureau of Labor Statistics reports the change in nonfarm payrolls at 14:30 CET.

European indices open higher

European stocks extended losses on Thursday led by automaker shares. The British Pound joined euro’s sharp decline against the dollar with Pound lower currently while euro is edging higher. The Stoxx Europe 600 index lost 0.8%. Germany’sDAX 30 tumbled 1.5% to 12546.33. France’s CAC 40 lost 0.7% and UK’s FTSE 100 fell 1% to 7575.93. Indices opened 0.1% – 0.3% higher today.

Pound fell despite the unanimous vote of nine members of the Bank of England policy-setting committee in favor of a quarter of a percentage point rate increase. Interest rates were raised from 0.50% to 0.75% as widely expected, It was BOE’s second hike in roughly a decade. However the central bank warned that ”the economic outlook could be influenced significantly by the response of households, businesses and financial markets to developments related to the process of EU withdrawal,” commonly known as Brexit.

Chinese stocks selloff persists

Asian stock indices are mostly lower today with trade tensions still high after continued exchange of threats by the US and China. Nikkei ended 0.1% higher at 2525.18 as yen turned lower against the dollar. Chinese stocks are falling as Caixin reported the services PMI slipped implying growth in China’s service sector slowed in July: the Shanghai Composite Index is 1% lower and Hong Kong’s Hang Seng Index is down 0.3%. Australia’s All Ordinaries Index is down 0.1% while Australian dollar’s slide against the greenback continues.

Brent dips on rising global supplies

Brent futures prices are edging lower today on the prospect of rising global supplies. Prices ended higher yesterday after energy market data provider Genscape reported data showing a dip in stockpiles at the domestic delivery hub at Cushing, Oklahoma. Brent for October settlement closed 1.5% higher at $73.45 a barrel on Thursday.

Market Analysis provided by IFCMarkets

Free Reports:

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.