Hong Kong 50: Technical Analysis – Weaker Hong Kong data bearish for HK50

By IFCMarkets

Weaker Hong Kong data bearish for HK50

Hong Kong’s economic expansion slowed in the second quarter and activities in private sector contracted in July. Will the HK50 continue declining?

Recent Hong Kong economic data were negative on balance after the inflation acceleration and almost 10% over year rise in retail sales in June. The balance of trade deficit widened in June on bigger rise in imports than exports, and business activity in private sector contracted fourth consecutive month in July. And the government reported the GDP growth slowed in the second quarter to 3.5% over year after upwardly revised 4.6% expansion in the first three months of 2018. The slowdown in exports due to uncertainty because of US-China trade dispute were cited as the main reason for slower growth. Weaker economic data are bearish for HK50.

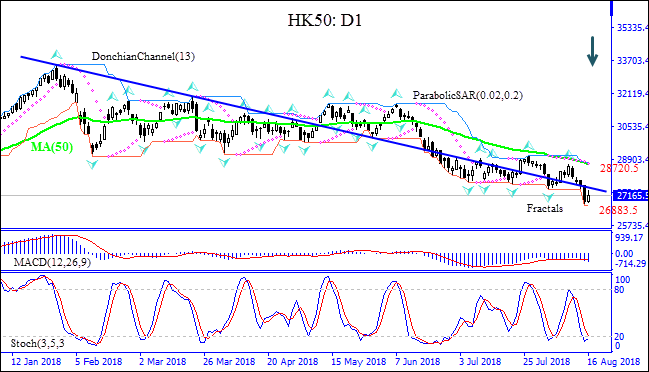

On the daily timeframe the HK50: D1 is below the 50-day moving average MA(50) which is falling, and the price has breached below the support line.

- The Parabolic indicator gives a sell signal.

- The Donchian channel indicates downtrend: it is tilted lower.

- The MACD indicator gives a bearish signal: it is below the signal line and the gap is widening.

- The Stochastic oscillator has breached into oversold zone, this is bullish.

We believe the bearish momentum will continue after the price breaches below the lower boundary of Donchian channel at 26883.50. This level can be used as an entry point for placing a pending order to sell. The stop loss can be placed above the upper Donchian channel at 28720.50. After placing the order, the stop loss is to be moved every day to the next fractal high, following Parabolic signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. If the price meets the stop loss level (28720.50) without reaching the order (26883.50), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Technical Analysis Summary

| Position | Sell |

| Sell stop | Below 26883.50 |

| Stop loss | Above 28720.50 |

Market Analysis provided by IFCMarkets

Free Reports: