Crude Oil has been a major play for some traders over the past few months. With price, rotation ranges near $5~$7 and upside pressure driving a price assent from below $45 to nearly $75 peaks. This upside price move has been tremendous.

Over the past few weeks, many things have changed in the fundamentals of the Oil market. Supply continues to outpace demand, trade tariffs and slowing global economies are now starting to become real concerns, foreign suppliers have continued to increase production, US Dollar continues to strengthen and social/political unrest is starting to become more evident in many foreign nations.

In fact, we felt so strongly that big downside move in crude oil was about to happen we posted a warning to oil traders two days before the drop started.

When we consider what could happen with oil in the future with regards to over-supply and the potential for constricting global markets, we have to understand that support will likely be identified at levels that are much lower than current price – possibly below $60. Yet, at the same time, we must understand that disruptions in supply and/or regional chaos, such as war or political turmoil, in specific regions could cause the price of oil to skyrocket as these disruptions continue.

RIGHT NOW, THREE KEY ISSUES ARE DRIVING OIL LOWER:

– A stronger US Dollar is making it more expensive for foreign nations to purchase Oil on the open market as well as moving capital away from foreign local investments and migrating capital into the US Equities markets

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

– Supply issues (the increased capacity for greater supply) is resulting in a glut of oil available on the open market when we have dozens of supply ships still waiting to offload throughout the world. In other words, we have an over-supply of oil at the moment.

– A lack of any urgency or crisis event to support Oil above $65 at the moment. Given the slow, but consistent, transition towards cleaner more energy efficient vehicles and energy as well as the lack of any real conflict or crisis event to disrupt supply, it appears there is no real support for Oil above $65 – at least so far.

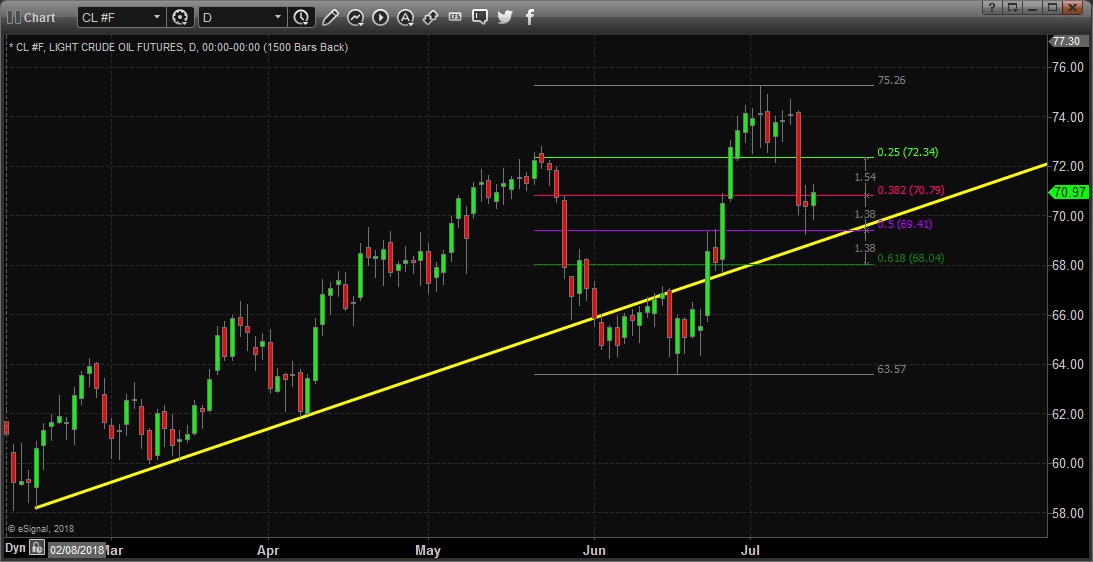

DAILY CRUDE LIGHT CHART

This Daily Crude Light chart shows a simple price channel that correlates recent price lows into a channel and shows a Fibonacci Retracement range for recent price rotations. We can see that the price of Crude is holding just above the 50% retracement level right now and any breach below $70 would be a very strong downside price breakout. Should price drop below $68, we could see a selloff to below $64 as price may attempt to establish a new “price low” to the downside.

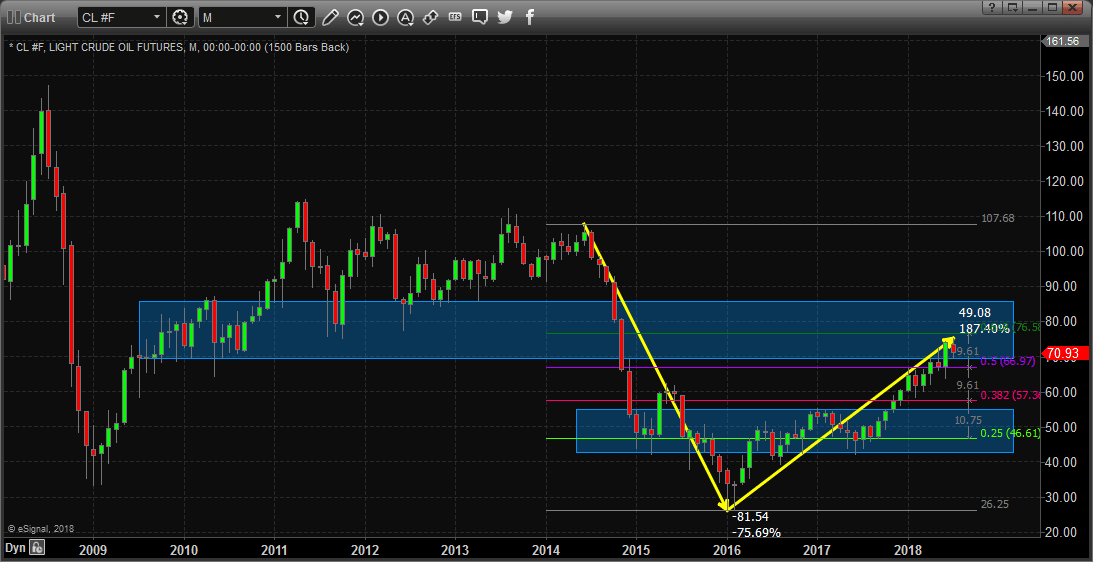

MONTHLY CRUDE CHART

This Monthly Crude chart below shows us where we believe support and resistance price zones are located. You can see from the highlighted areas that resistance is located between $70~86 and support is located between $44~56 on this longer-term monthly chart. You can also see that the Fibonacci retracement levels for the current upside move are currently nearing 55~57% (above the 50% level and nearing the 61.8% level). The combination factor that Crude has recently rotated lower, near the upper price channel, within the resistance zone, above 50% and nearing 61.8% Fibonacci level, strongly suggests that we could see a stronger downside price swing in the near future. Until $60 is breached, consider this move simple rotation. Once $60 is breached to the downside, then consider this a deeper downside price move.

With so many factors in play throughout the world, one has to be aware that Crude Oil is a commodity that correlates to expected economic activities, global crisis events, and supply/demand factors. Right now, an almost perfect storm is setting up for Oil to continue to fall to new lows which will likely push Crude below $60 ppb (eventually) and may push it down to near $55 ppb (our upper support zone). We caution traders/investors through – any crisis news item, war or other disruption in supply could dramatically alter the factor that makes up this price prediction. Right now, without any of these issues, we see Oil continuing to fall towards the $60 price level.

Also, visit www.TheTechnicalTraders.com/FreeMarketResearch to read all of our most recent free research posts. We believe you’ll quickly see the value in what we provide our members and our visitors by reading and understanding how we have continued to stay ahead of these market moves for months.

53 years experience in researching and trading makes analyzing the complex and ever-changing financial markets a natural process. We have a simple and highly effective way to provide our customers with the most convenient, accurate, and timely market forecasts available today. Our stock and ETF trading alerts are readily available through our exclusive membership service via email and SMS text. Our newsletter, Technical Trading Mastery book, and 3 Hour Trading Video Course are designed for both traders and investors. Also, some of our strategies have been fully automated for the ultimate trading experience.

Get our advanced research and market reporting, Daily market videos, detailed trading signals and join the hundreds of other traders that follow our research every day and profit.

Chris Vermeulen

Technical Traders Ltd.