Technology selloff drags US indices

By IFCMarkets

Dollar gains as trade deficit narrows

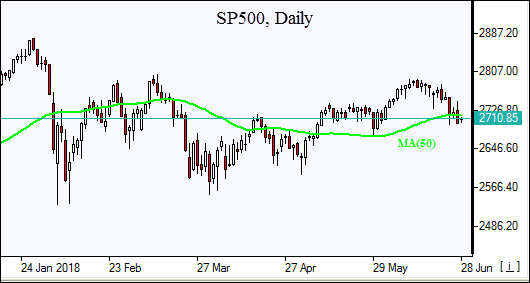

US stock indices erased previous day gains on Wednesday led by technology shares as orders for durable goods fell 0.6% in May following a revised 1% decline in April. The S&P 500 fell 0.9% to 2699.63. The Dow Jones industrial lost 0.7% to 24117.59. Nasdaq composite index dropped 1.5% to 7445.08. The dollar strengthening accelerated as the trade deficit in goods narrowed 3.7% to below expected $64.8 billion in May: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, gained 0.6% to 95.261 and is higher currently. Stock index futures indicate higher openings today.

FTSE 100 leads European indices rebound

European stock indices recovered on Wednesday aided by news President Trump will rely on existing laws rather than new stricter legislation to curb Chinese investments. Both the euro and British Pound accelerated slide against the dollar and both are falling currently. The Stoxx Europe 600 rose 0.7%. Germany’s DAX 30 added 0.9% to 12348.61. France’s CAC 40gained 0.9% and UK’s FTSE 100 jumped 1.1% to 7621.69. Indices opened 0.3% – 0.5% lower today.

Chinese stocks selloff persists

Asian stock indices are mixed today while Chinese stocks selloff continues despite President Trump’s decision to use strengthened national security review process to restrict Chinese investment in US technology firms instead of passing new tougher laws. Nikkei ended 1.38 points lower at 22270.39 as yen climb against the dollar continued. China’s stocks are falling: the Shanghai Composite Index is 1% lower and Hong Kong’s Hang Seng Index is down 0.3%. However Australia’s All Ordinaries Index is up 0.3% with Australian dollar little changed against the greenback.

Brent higher on big US crude stocks draw

Brent futures prices are extending gains today after the US Energy Information Administration reported yesterday that domestic crude supplies fell by above expected 9.9 million barrels. Prices ended higher yesterday: August Brent crude rose 1.7% to $77.62 a barrel on Wednesday.

Market Analysis provided by IFCMarkets

Free Reports:

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.