By IFCMarkets

Fed hikes rates and signals two more increases this year

US stock market pulled back on Wednesday after a Fed rate hike and signal for more aggressive tightening later. The S&P 500 lost 0.4% to 2775.63. The Dow Jones industrial fell 0.5% to 25201.20. Nasdaq composite index slipped 0.1% to 7748.96. The dollar weakened: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, fell 0.3% to 93.51 and is lower currently. Stock index futures indicate lower openings today.

The Federal Reserve raised its benchmark federal funds rate by a quarter percentage point to a range of 1.75% to 2%. While the rate hike was widely expected, there were some speculation the central bank may opt for more aggressive further tightening in light of rising inflation and signs US economy is accelerating to 4%-4.5% growth. And policy makers’ projections for interest rates, known as the dot plot, indicated eight of 15 Fed officials now expect at least four rate hikes will be needed this year, up from seven at the March meeting. The Fed Chairman Jerome Powell also indicated that beginning in January, every Fed meeting would be accompanied by a press conference.

ECB to discuss tapering timetable

European stock indices recovered on Wednesday ahead of the European Central Bank meeting. Both the British Pound andeuro turned higher against the dollar and both are rising currently. The Stoxx Europe 600 added 0.2%. Germany’s DAX 30rose 0.4% to 12890.58. Both France’s CAC 40 and UK’s FTSE 100 slipped less than a point. Indices opened 0.5% – 0.6% lower today.

Weak data limited stock gains: the industrial production in the euro-zone fell by a larger-than-expected 0.9% in April. And UK consumer price inflation remained steady at 2.4% in May, according to the Office for National Statistics. Today European Central Bank meets and it is expected to discuss when to start winding down its 30 billion euros ($35 billion) a month bond buying program. The ECB chief Draghi press conference starts at 14:30 CET.

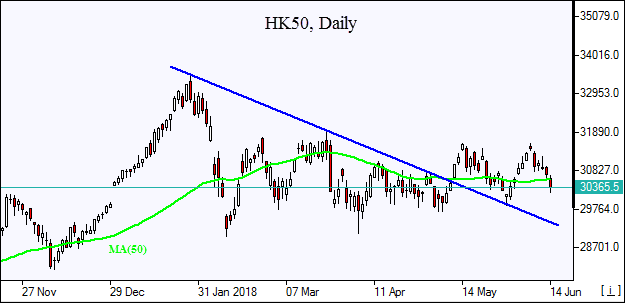

Hang Seng leads Asian indices losses

Asian stock indices are lower today after a Fed rate hike and hawkish update. Nikkei ended 1% lower at 22815.43 as yen climb against the dollar accelerated. China’s stocks are falling: the Shanghai Composite Index is 0.2% lower and Hong Kong’s Hang Seng Index is down 0.9%. Australia’s All Ordinaries Index is down 0.1% as Australian dollar turned lower against the greenback despite a decline in Australia’s unemployment rate in May.

Brent up

Brent futures prices are extending gains today after a surprise drop in US crude oil stock. The US Energy Information Administration reported that domestic crude supplies fell unexpectedly by 4.1 million barrels. Prices ended higher yesterday: August Brent crude rose 1.1% to $76.74 a barrel on Wednesday.

Market Analysis provided by IFCMarkets

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.