By Money Metals News Service

As the BLOOD continues to run on Wall Street, gold and silver were the few assets trading in the green today. As I have mentioned in past articles and interviews, investors need to get used to this sort of trading activity. Even though the Dow Jones Index ended off its lows of the day, it shed another 458 points while the Nasdaq declined 190 points and the S&P fell 60.

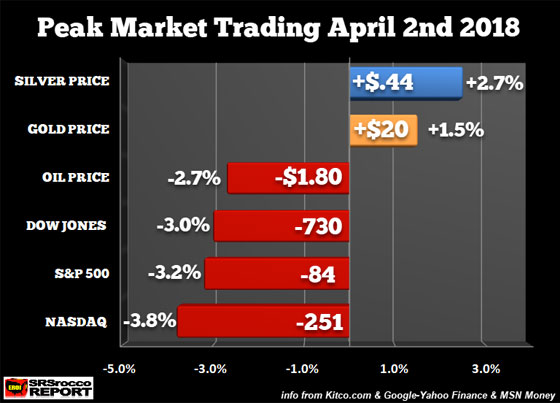

As the broader markets sold off, the gold price increased $15 while silver jumped by $0.25. However, if we look at these markets during their peak of trading, the contrast is even more remarkable:

At the lows of the day, the Dow Jones Index fell 730 points or 3%, while the S&P 500 fell 3.2% and the Nasdaq declined by 3.8%. Also, as I expected, the oil price fell along with the broader markets by dropping 2.7%. If individuals believe the oil price will continue towards $100, due to supply and demand fundamentals put forth by some energy analysts, you may want to consider one of the largest Commercial Net Short positions in history. Currently, the Commercial Net Short position is 738,000 contacts. When the oil price was trading at a low of $30 at the beginning of 2016, the Commercial Net Short position was only 180,000 contracts.

Furthermore, if we agree that supply and demand forces are impacting the oil price to a certain degree, does anyone truly believe oil demand won’t fall when the stock market drops by 50+%??? I forecast that as market meltdown continues, the oil price will decline as oil demand falls faster than supply.

Now, when the markets were at their lows today, gold at its peak was up $20 while silver increased by $0.44. Of course, this type of trading activity won’t happen all the time, and we could see a selloff in all assets some days. But, once the Dow Jones Index falls below 19,000, investors will likely start to move into gold and silver in a much bigger way.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

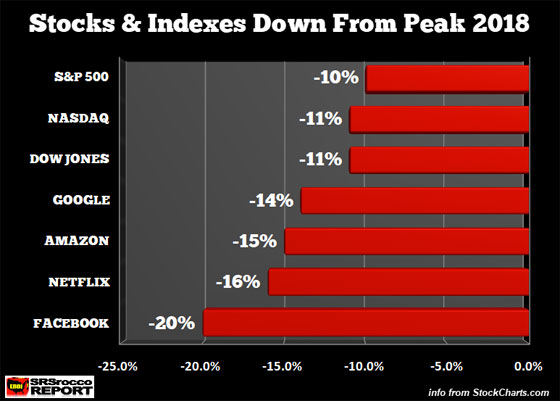

If we look at the following stocks and indexes from the peaks set in 2018, clearly, there’s a long way to go before the bottom is in:

The infamous FANG stocks are down between 14-20% from their highs while the broader markets are down 10-11%. When the Dow Jones Index fell from its high of 14,100 in 2007 to its low of 6,600 in 2009, it lost 53%. However, due to a higher degree of leverage in the markets today, I wouldn’t be surprised to see the Dow Jones Index fall by 60-75%. A 60% decline in the Dow Jones Index from its peak would put it at the 10,000 level… perfectly reasonable in my opinion.

So, what would a 60% selloff in the broader markets due to the gold and silver price?? That’s a good question. If just 1% of the $400 trillion in global assets moved into the precious metals, we could see some insanely higher prices. But, I don’t like to put out price targets because analysts who have done so in the past only frustrate themselves and their followers.

The next two charts show the beginning stage of the MARKET MELTDOWN as it pertains to the grossly overvalued stock called Netflix. When I posted this stock a few weeks ago, Netflix was trading at $310 a share. I mentioned that its recent stock trend resembled the antenna on the Empire State Building in New York City:

Unfortunately, the top of Netflix’s antenna must have been chopped off by some low flying 747 jetliner over the past two weeks:

Since March 19th, when Netflix was trading at $310, it has lost $30 or nearly 10%. If investors believe Netflix is a good BUY THE DIP setup, well then I gather it’s a complete waste of time to suggest acquring some gold and silver instead. However, if you are beginning to get worried that the market has a long WAY TO GO DOWN, then you may want to consider switching from BUILDING WEALTH to PROTECTING WEALTH.

Mark my words… 2018 will be the year that investors started switching from building wealth to protecting wealth. Unfortunately, those who make this change will likely only be a small percentage of the market. Thus, we are probably going to see a lot more BLOOD IN THE STREETS.

The Money Metals News Service provides market news and crisp commentary for investors following the precious metals markets.

The Money Metals News Service provides market news and crisp commentary for investors following the precious metals markets.