By The Gold Report

Source: Clive Maund for Streetwise Reports 02/18/2018

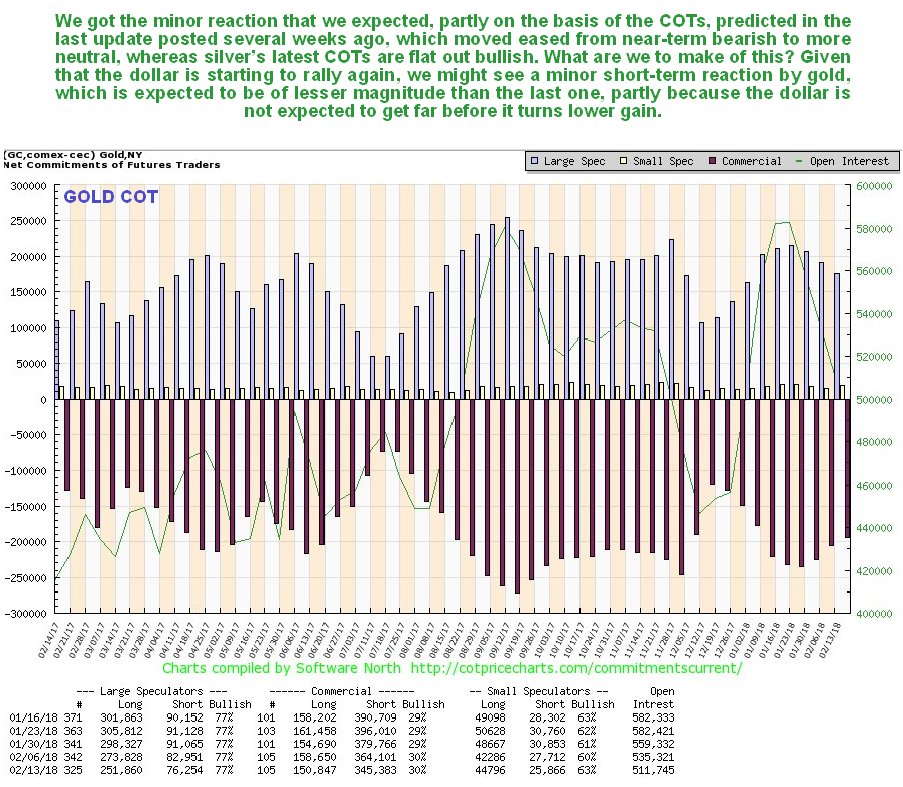

A read of the gold charts is indicating that a breakout and new bull market are simply a matter of time, says technical analyst Clive Maund.

Gold continues to prepare to break out of its giant Head-and-Shoulders bottom pattern. As we can see on its 8-year chart below, this base pattern has been developing for getting on for five years now, so it has major implications. Upside volume has been building for a long time, driving volume indicators higher, a sign that a breakout and new bull market are simply a matter of time, and not much at that now.

Gold does well and has its best bull markets when stocks generally are in a bear market, so don’t get fooled by PM stocks falling with the stock market at this timethat won’t last. Thus it is worth observing that gold has outperformed stocks during the period since the stock market plunge startedit is back where it was before the plunge, which is more than can be said for stocks.

Before looking at gold’s shorter term 6-month chart, it is worth taking a quick detour to see how it is getting on against some other currencies. Over the past year or so the dollar has dropped quite hard, with the prime beneficiary of this drop being the euro, which has risen substantially. Therefore we should not be surprised to see that gold has dropped against the euro during this same period. What is interesting to observe on the 8-year chart for gold in euros, however, is that it has arrived at the lower boundary of a large uptrend that has turned the price back up on two occasions already. This suggests that gold is going to rise even in euros, and since the dollar is expected to continue to drop, regardless of any brief countertrend rally, it means that it should rise faster still against the dollar, which of course is what we would expect to see once it breaks out of its Head-and-Shoulders bottom shown on its normal dollar chart. Before leaving this chart observe how gold is not all that far off making new highs against the yen, shown at the bottom of the chart.

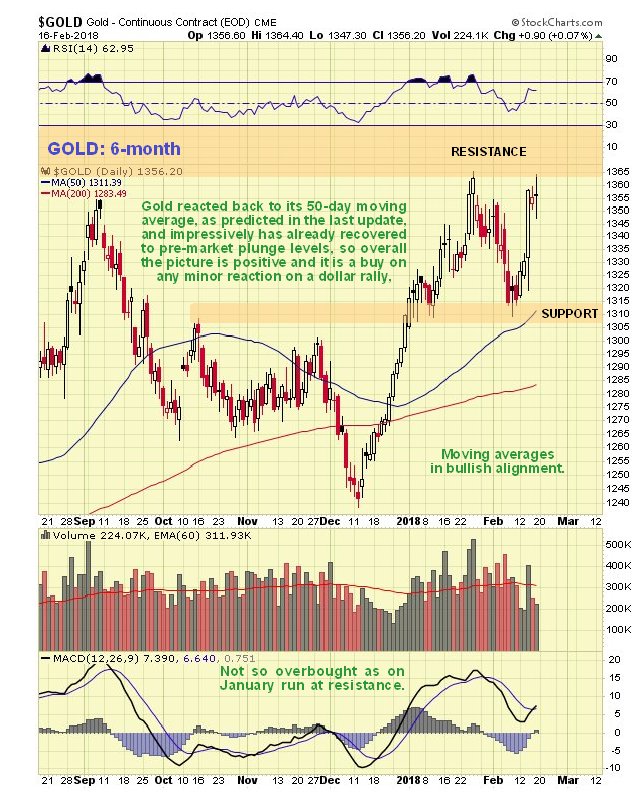

The latest 6-month chart shows that gold reacted just as we expected it to in the last update, back close to its rising 50-day moving average, and the good news is that, as we can see, it has already gotten back to where it was before the stockmarket plunge, an early sign of the outperformance to come. Right now, with the dollar having turned up from support again on Friday and looking set to stage a modest rally, gold looks set to react back again from the resistance shown towards the support once more, which should throw up another opportunity to accumulate the better PM stocks, and they have already started to drop back again.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Many new subscribers have made back the cost of a subscription within a few weeks and often in a matter of days. So if you are not already a subscriber you should “put your best foot forward” and become onedon’t do it to help me outyou owe it to yourself.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years’ experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you’ll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Statements and opinions expressed are the opinions of Clive Maund and not of Streetwise Reports or its officers. Clive Maund is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. Clive Maund was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

Charts provided by the author.

CliveMaund.com Disclosure:

The above represents the opinion and analysis of Mr Maund, based on data available to him, at the time of writing. Mr. Maund’s opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stockmarket analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund’s opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.