By Admiral Markets

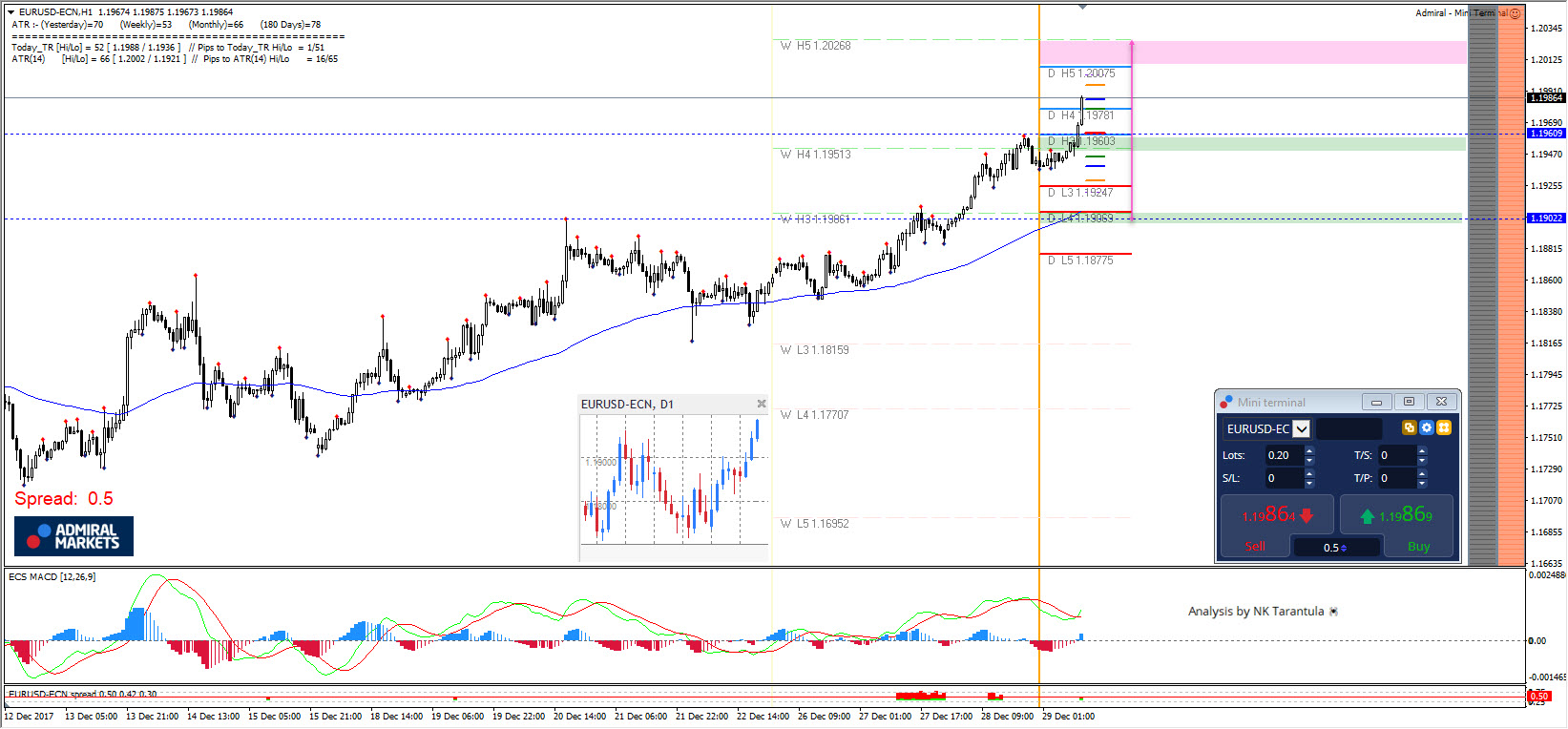

The previous EUR/USD analysis went exactly as expected and EUR/USD is challenging 1.2000 zone. Month’s end fixing and additional yearly profit taking could also spur a new wave of sellers later in the day. Bullish rejections could happen within 1.1950-60 zone and 1.1900-10 while we may see sellers within 1.2007-1.2027. However, if the price proceeds upwards without any sign of making a u-turn, then traders should watch daily resistance levels (historical swing highs) and divergence around that particular levels. An excellent tool to use for a daily chart overlay on a trading timeframe is Admiral Mini Chart.

Watch for volatility today as the New Year is approaching. We might see larger price swings that are almost impossible to predict because they are influenced by the lighter trading volumes.

Happy New Year and see you in 2018!

Article by Admiral Markets

Source: EUR/USD Higher on Year’s End Profit Taking

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Admiral Markets is a leading online provider, offering trading with Forex and CFDs on stocks, indices, precious metals and energy.