By The Gold Report

Source: Clive Maund for Streetwise Reports 11/19/2017

Technical analyst Clive Maund charts silver and finds the signals contradictory.

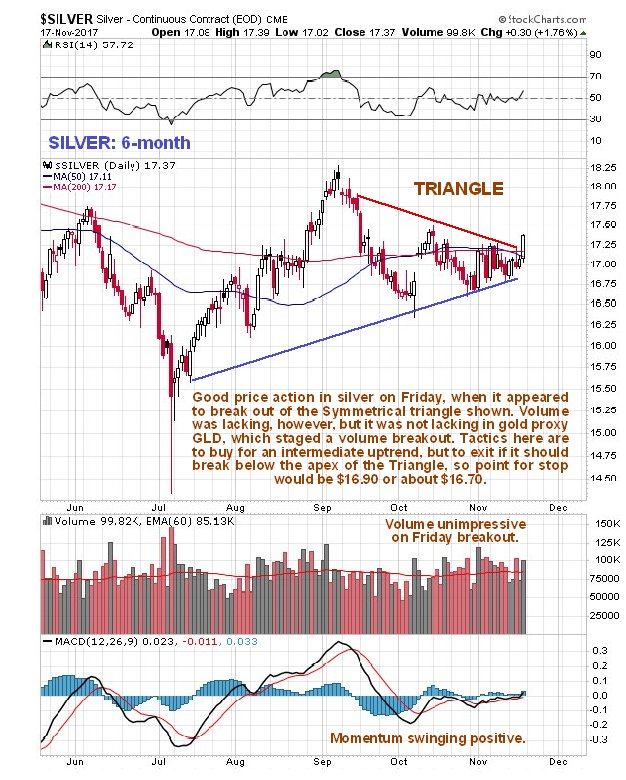

At the same time that gold broke out of a coiling pattern to the upside

on Friday, silver broke out of a Symmetrical Triangle pattern shown on

its 6-month chart below. Volume was lacking on this breakout, however,

and the same reservations that apply to the outlook for gold also apply

to silver, namely that its COTs look more bearish then bullish, and that

Hedgers positions in the dollar index are still calling for it to

rally. On the other hand, gold proxy GLD did make a volume breakout on

Friday, and what’s good for gold is usually good for silver.

Although

these conflicting factors make the situation somewhat ambiguous, there

is a favorable trading setup here, because silver is still quite close

to the apex of the Symmetrical Triangle, so it is possible to open long

positions with fairly close stops beneath the apex of the triangle in

case the breakout was false. Gold’s price pattern now looks quite

favorable, with it looking set to run to a resistance level towards the

top of an uptrend channel, and if that happens, silver should follow

suit and advance towards its early September highs at about $18.25,

perhaps stopping short at about $18.00 for a reason we will observe on

its 2-year chart. Point for a stop for traders going long is about

$16.70.

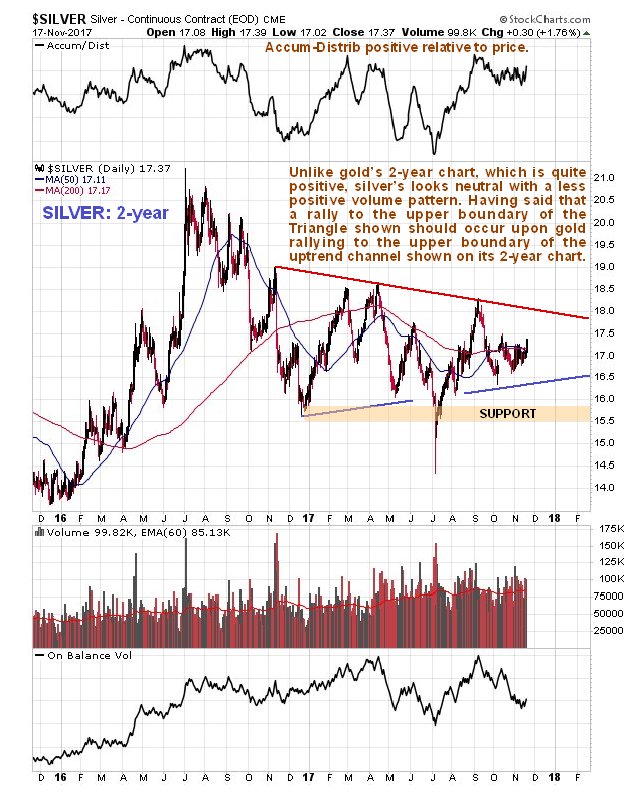

On silver’s 2-year chart we can see that it looks considerably weaker

than gold, and its trend is at best neutral overall, and any short-term

rally is thought likely to top out close to the upper boundary of the

much larger Triangle shown on this chart at about $18.00. Such a rally

would “not be much to write home about.”

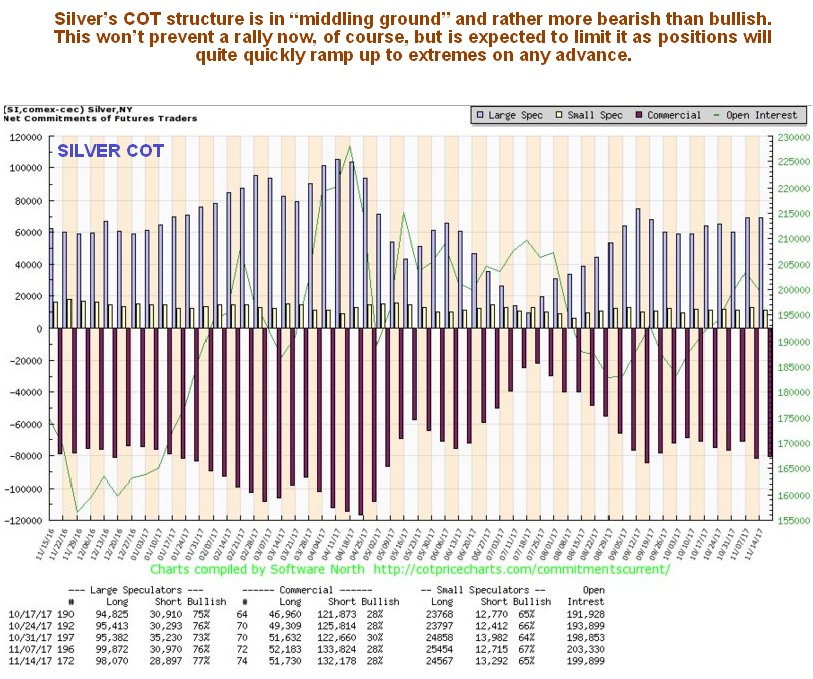

Although a near-term rally in silver in sympathy with gold looks quite

likely, we can see why it is unlikely to get very far on its latest COT

chart. COT positions on this chart look more bearish than bullish, and

any near-term rally is likely to quickly take them to extremes.

The conclusion is that although silver may be starting a rally here, it

still looks weak compared to gold, and so the rally is thought unlikely

to get very far, especially as it is blighted by a still rather bearish

COT structure, and, like gold, continues to be threatened by a dollar

rally. So it looks like it will be going along with gold “just for the

ride.”

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years’ experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Want to read more Gold Report articles like this? Sign up at www.streetwisereports.com/get-news for our free e-newsletter, and you’ll learn when new articles have been published. To see recent articles with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Statements and opinions expressed are the opinions of Clive Maund and not of Streetwise Reports or its officers. Clive Maund is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. Clive Maund was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

Charts provided by the author.