By Admiral Markets

Dear Traders,

The price action trading domain can be made significantly deeper by taking a look at the advanced trading method known a ‘harmonic trading’. Scott M. Carney, President and Founder of HarmonicTrader.com, has defined a system of price pattern recognition and Fibonacci measurement techniques that comprise the Harmonic Trading approach.

He has named and defined harmonic patterns such as the Bat pattern, the

ideal Gartley pattern, and the Crab pattern. He is the author of three books:

The Harmonic Trader; Harmonic Trading of the Financial Markets: Volume One; and Harmonic Trading of the Financial Markets: Volume Two.

This article will shed some light on Mr Carney’s teachings and provide my own look on Harmonic trading.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Harmonic Patterns in Currency Markets

Roots of Harmonic Trading can be tracked down to the Gartley pattern. The Gartley “222” pattern is named for the page number that can be found in H.M. Gartley’s book “Profits in the Stock Market”.

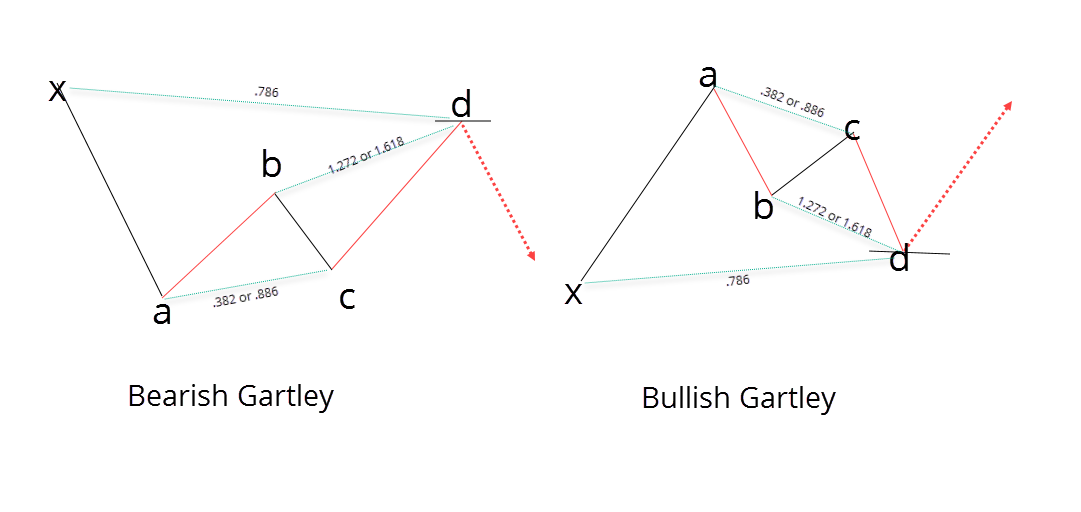

So, what is a Gartley pattern?

A Gartley pattern is very similar to a bullish W or bearish M. It appears when the price has been moving in an uptrend or downtrend but has started to show signs of correction.

Ideal Gartley patterns look like this:

- move AB should be the .618 retracement of move XA.

- move BC should be either .382 or .886 retracement of move AB.

- if the retracement of move BC is .382 of move AB, then CD should be 1.272 of move BC.

- consequently, if move BC is .886 of move AB, then CD should extend 1.618 of move BC.

- move CD should be .786 retracement of move XA.

The Gartley pattern is traded from point D. Traders opt for buy/sell at point D, depending on the pattern direction.

Market Harmonics

As time passed by, the popularity of the Gartley pattern grew and traders came up with their own variations. Scott M Carney and his harmonic trading were among the most popular and successful.

Harmonics is the process of identifying the market’s rhythm or its pulse and exploiting its trading opportunities. They provide us with visual occurrences that have tendencies to repeat themselves over and over again.

This methodology assumes that trading patterns or cycles, like many patterns and cycles in life, repeat themselves. The key is to identify these patterns and to enter or exit a position based on a high degree of probability that the same historic price action will occur.

Although these patterns are not 100% accurate, the situations have been historically proven. If these setups are identified correctly, it is possible to identify significant opportunities with very limited risk.

Harmonic Ratios

In Harmonic trading we distinguish:

- Primary Ratios

- Primary Derived Ratios

- Complementary Derived Ratios.

Primary Ratios

Directly derived from the Fibonacci Number Sequence.

- 0.618 = Primary Ratio

- 1.618 = Primary Projection

Primary Derived Ratios

- 0.786 = Square root of 0.618

- 0.886 = Fourth roof of 0.618 or Square root of 0.786

- 1.130 = Fourth root of 1.618 or Square root of 1.27

- 1.270 = Square root of 1.618

Complementary Derived Ratios

- 0.382 = (1 – 0.618) or 0.618e2

- 0.500 = 0.770e2

- 0.707 = Square root of 0.50

- 1.410 = Square root of 2.0

- 2.000 = 1 + 1

- 2.240 = Square root of 5

- 2.618 = 1.618e2

- 3.141 = Pi

- 3.618 = 1 + 2.618

Harmonic Trading Patterns and PRZ

Harmonic patterns are defined by specific price structures, quantified by Fibonacci calculations. These patterns represent price structures that contain combinations of distinct and consecutive Fibonacci retracements and projections.

If we calculate various Fibonacci aspects of a specific price structure, we can identify harmonic pattern areas that will hint for potential turning points in price action. Scott M. Carney has identified those reversal spots as PRZ—The Potential Reversal Zone.

A well-defined PRZ usually provides some type of initial reaction on the first test of most harmonic patterns. The initial test can occur quickly and on high volatility it can immediately reject the price.

Let’s take a closer look at harmonic patterns as described by Scott M. Carney

The Shark Pattern

The harmonic Shark pattern is identified as shown in the picture below and uses 0, X, A, B, C swing points to name the pivot/swing legs. It is occasionally referred to as an emerging 5-0 pattern.

In the example below, we can see the bearish shark pattern with its PRZ zone.

Source: EUR/USD MT4 chart – Bearish shark pattern

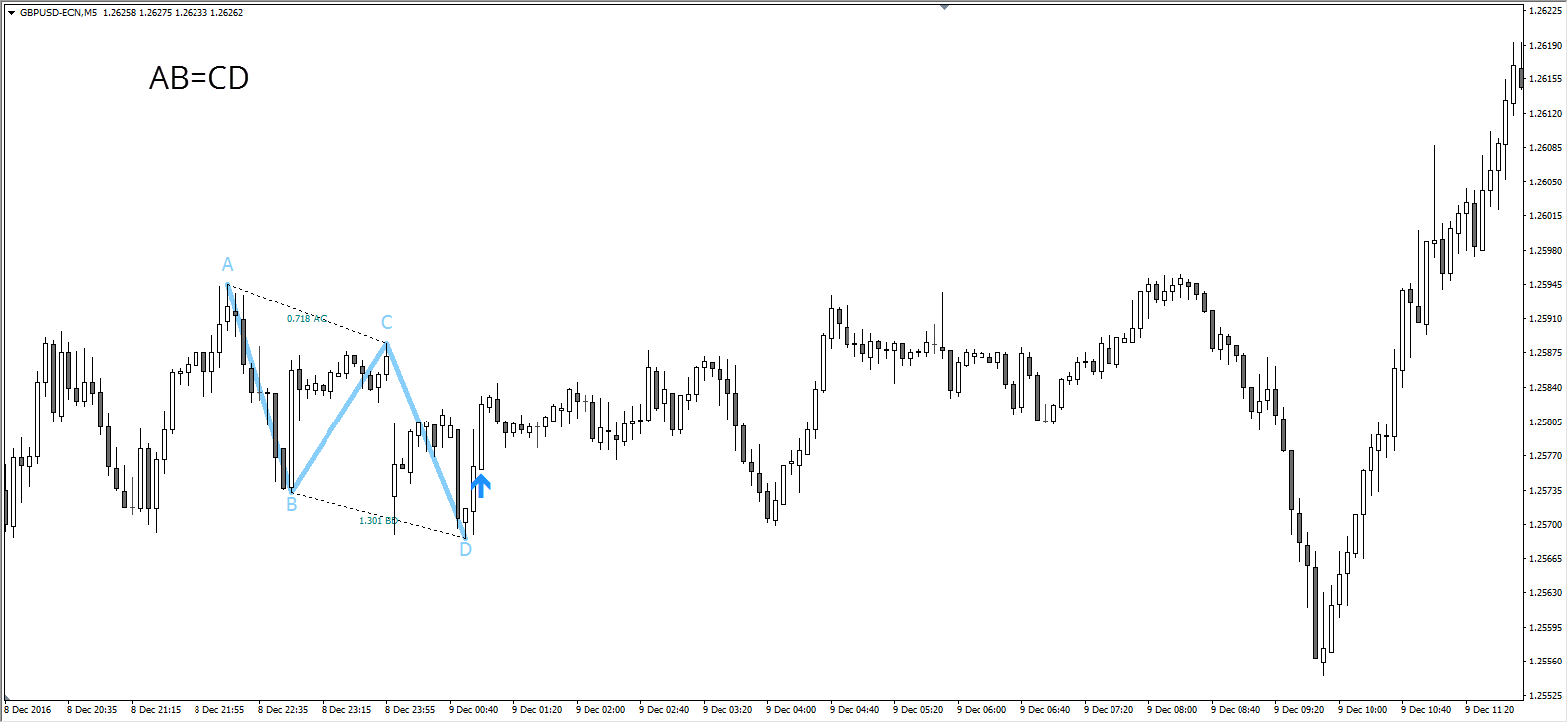

AB=CD Pattern

The AB=CD pattern is a 4-point price structure where the initial price segment is partially retraced and followed by an equidistant move from the completion of the pullback.

In Classic AB=CD, the BC is a retracement of 61.8% – 78.6% of AB, with CD being the extension leg of 127.2% to 161.8% (equal in price distance). In AB=CD extension, CD leg is an extension of AB between 127.2% – 161.8%.

Source: EUR/USD MT4 chart – AB=CD bullish pattern

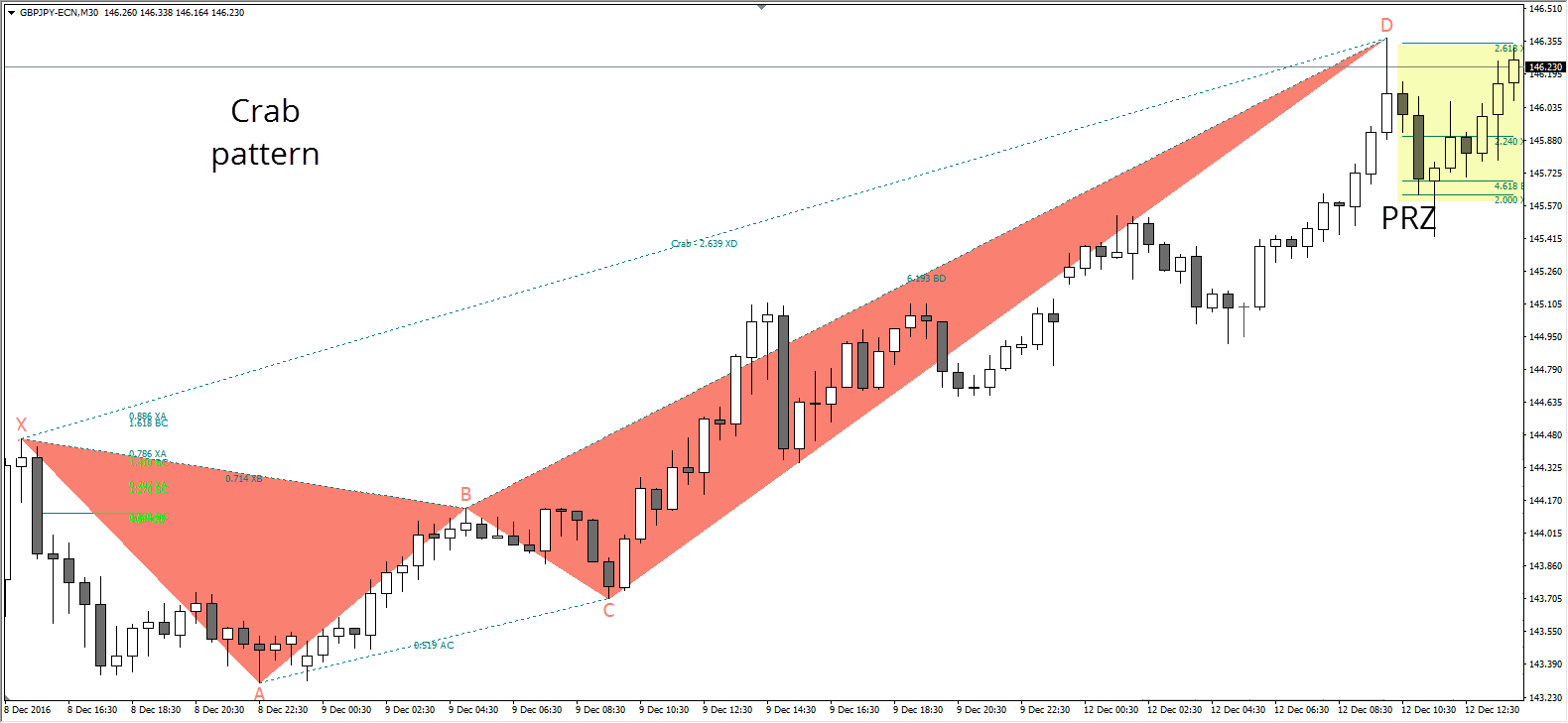

The Crab Pattern

Key elements of the Crab pattern:

- B point that is a 0.618 retracement of XA or less

- extreme BC projection that is typically a 2.618, 3.14, or 3.618

- alternate 1.27 or 1.618 AB=CD pattern required

- 1.618 XA projection as the defining limit with the structure

- C point with range between 0.382 and 0.886.

The pattern can display rapid price action movement, and that often results in fast reversals at the PRZ.

Source: EUR/USD MT4 chart – Crab bearish pattern

The Bat Pattern

The Bat is a very accurate pattern, usually requiring a smaller stop-loss than most

patterns. The pattern incorporates the powerful 0.886 XA retracement as the defining element in the PRZ.

If you’ve been following

my articles, you know that I use 88.6 heavily. Other key elements of the Bat pattern are:

- move AB should be the .382 or .500 retracement of move XA

- BC projection must be at least 1.618

- if the retracement of move BC is .382 of move AB, then CD should be 1.618 extension of move BC

- AB=CD pattern is usually extended

- 0.886 XA retracement

- CD should be .886 retracement of move XA.

Source: EUR/JPY MT4 chart – Bat bearish pattern

The Butterfly Pattern

Scott M. Carney believes that the ideal butterfly pattern needs to have a specific alignment of different Fibonacci measures at each point within the structure.

The Butterfly is similar to the Gartley pattern and PRZ zone is defined by a mandatory retracement of the XA leg as the point. The ideal Butterfly has 0.786 as XB but traders might also use different measurements such as 0.952 of the XB.

The key elements of this pattern are:

- move AB should be the .786 retracement of move XA

- move BC can be either .382 or .886 retracement of move AB

- if the retracement of move BC is .382 of move AB, then CD should be 1.618 extension of move BC

- the move BC is .886 of move AB, then CD should extend 2.618 of move BC

- CD should be 1.27 or 1.618 extension of move XA.

Source: AUD/NZD MT4 chart – Butterfly bullish pattern

The Cypher Pattern

Originally discovered and defined by Darren Oglesbee, the Cypher pattern is a 4-leg pattern.

It is not as common as other patterns, though it’s widely used in Harmonic trading and analysis. Due to its rare occurrence, traders should make room for adjustments to the Fib levels that are used in the pattern charting.

The key elements of this pattern are:

- the Cypher pattern starts with the X and A points

- point B retraces to 0.382 – 0.618 Fibonacci level of the leg XA

- point C is formed when prices extend the XA leg by at least 1.272 or within 1.130 – 1.414 Fibonacci extension

- point D is formed when it retraces 0.782 Fibonacci level of XC.

Source: EUR/JPY MT4 chart – Cypher bullish pattern

Harmonic Patterns: an Easier Way

For all traders that are interested in trading Harmonic patterns, I strongly recommend the

works of Mr. Carney. It is absolutely essential that you read them (at least the first volume) before you begin trading.

When you arm yourself with a proper understanding of patterns, PRZ, terminal bars and all that is important for harmonic trading, only then can you search for automatic harmonic indicators.

There are several harmonic indicators and software programs that will automatically detect various harmonic trading patterns. We’ve covered some in the video below:

Carney introduced a unique position management system based on a 0.382 Trailing Stop, measured from the reversal point to the reversal extreme. I can give you additional profit management tips that should help you understand targets and stops even better.

Trade Management in Harmonic Trading

Source: AUD/NZD MT4 chart—A bullish Butterfly

This is an example of bullish Butterfly pattern. The first target is related to point B on the chart. It is the level which indicates the price drop during the AB decrease.

The second target marks the C point on the chart and the price top after the BC increase. The third target is the high, which appears as a result of the XA increase. Point D is the entry. Stops go below point D.

I advise scaling out and profit stop management as shown in

the video. Have in mind that Harmonic Trading will also be a part of our Price Action Trading School, and you can look forward to it in our live trading sessions.

Have you ever traded with harmonic patterns? What is your experience with them? Are you using top-notch

Forex trading tools? Feel free to share your thoughts in the comments section below.

Cheers and safe trading,

Nenad

Article by Admiral Markets

Source: Harmonic Trading Patterns From Scott M. Carney Explained in Detail

Admiral Markets is a leading online provider, offering trading with Forex and CFDs on stocks, indices, precious metals and energy.