By IFCMarkets

SP 500, Dow fall while Nasdaq ends at record high

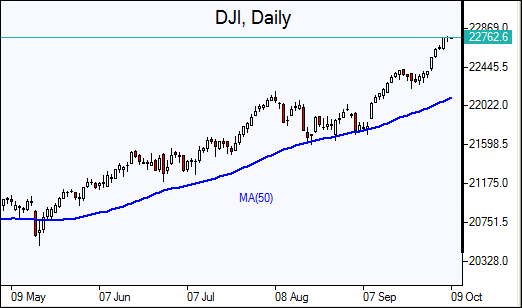

US stocks closed lower on Friday on weak September jobs report. The dollar was little changed as nonfarm payrolls shrank 33 thousand though a 80 thousand gain was expected : the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, inched down 0.01% to 93.803. S&P 500 fell 0.1% to 2549.33, with eight out of 11 main sectors finishing in the red. Dow Jones industrial average lost 2 points to 22773.67. The Nasdaq composite index rose 0.1 % to record high 6590.18.

European stocks retreat

European stocks ended lower on Friday as Spain and Catalonia looked for a way out of the political crisis provoked by Catalonia independence referendum and Madrid apologized for the violent police crackdown on referendum. The euro rebounded against the dollar while British Pound slipped on speculation UK Prime Minister Theresa May might resign after her “disastrous” speech at the Tory party conference on Wednesday and continued gridlock with Brussels over Brexit. The Stoxx Europe 600 index ended the session down 0.4%. The DAX 30 lost 0.1% to 12955.94. France’s CAC 40 fell 0.4% while UK’s FTSE 100 rose 0.2% to 7522.87. Indices opened mixed today.

Asian markets up despite weak Chinese data

Asian stock indices are mostly higher today in thin trading with markets in Japan and South Korea closed for holiday. Chinese services activity survey indicated Caixin services PMI fell to a 21-month low at 50.6 in September from 52.7 in August. The composite index came in at 51.4 from 52.4 in August. A reading above 50 indicates expansion.The Shanghai Composite Index is up 0. 8% after opening following a week-long holiday, while Hong Kong’s Hang Seng Index is 0.4% lower. Australia’s All Ordinaries Index is up 0.5% supported by a weaker Australian dollar against the greenback.

Oil higher

Oil futures prices are edging higher today on expectations that Saudi Arabia would continue to restrain its output to support the market. Prices fell Friday as traders anticipated lower demand for crude on refinery shutdowns as hurricane Nate approached US Gulf coast. December Brent ended 2.1% lower at $55.62 a barrel on Friday, falling 2.1% for the week.

Market Analysis provided by IFCMarkets

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Note:

This overview has an informative and tutorial character and is published for free. All the data, included in the overview, are received from public sources, recognized as more or less reliable. Moreover, there is no guarantee that the indicated information is full and precise. Overviews are not updated. The whole information in each overview, including opinion, indicators, charts and anything else, is provided only for familiarization purposes and is not financial advice or а recommendation. The whole text and its any part, as well as the charts cannot be considered as an offer to make a deal with any asset. IFC Markets and its employees under any circumstances are not liable for any action taken by someone else during or after reading the overview.