Daily Forex Market Preview, 06/10/2017

The US dollar managed to maintain its bullish momentum on Thursday after economic data released showed that the trade deficit narrowed to $42.2 billion in the month of August. This marked the lowest levels since a year. Orders for capital goods excluding non-defense rose 1.1% in August beating estimates of 0.9%. The US House of Representatives approved the fiscal 2018 budget draft which is expected to pave way for the government to go ahead with the tax reforms.

Elsewhere, the ECB’s meeting minutes revealed that the central bank is on path to tapering QE but that it could happen at a gradual pace.

Looking ahead, the September payrolls report will be released today. According to the estimates, the US economy is expected to add 82k jobs for the month of September which is below the average trend. On the upside, wages are expected to grow 0.3% on the month while the unemployment rate is expected to remain steady at 4.4%. Canada will also be releasing its jobs report today, and the Canadian unemployment rate is expected to tick higher to 6.3% from 6.2% in the previous month.

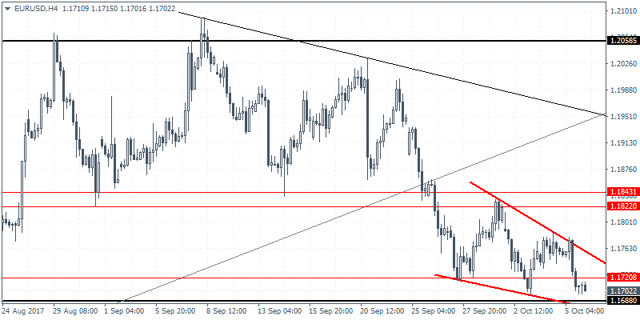

EURUSD intraday analysis

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

EURUSD (1.1702): The common currency weakened yesterday as price action was seen giving up the gains from the previous days. Support at 1.1688 is relatively close and could be tested in the short term. EURUSD continues to consolidate inside the descending wedge pattern as long as price remains supported above or close to 1.1688. A breakdown below this support could signal further declines invalidating the potential bullish outlook. To the upside, a breakout could result in EURUSD testing the resistance level at 1.1822 where resistance is most likely to be formed.

GBPUSD intraday analysis

GBPUSD (1.3097): The British pound broke past the support level at 1.3236 as price continued to push lower. Even the minor support level at 1.3161 was also breached. This signals a continued downside momentum. GBPUSD will be seen testing the lower support at 1.2980 region. Any short-term retracements are likely to be limited to the recently breached support level at 1.3236. Establishing resistance here could confirm the downside in the GBPUSD.

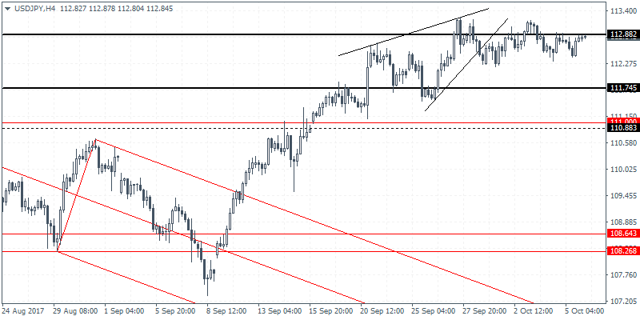

USDJPY intraday analysis

USDJPY (112.84): The USDJPY has remained steady near the 112.88 – 113.00 level for the past few sessions. This marks the long-term test of the falling trend line as well which is currently acting as a dynamic resistance. A breakout off this level can only come by on an improved sentiment in the US dollar. This coincides with today’s payrolls report. However, a disappointing payrolls data despite the short-term influence of the hurricanes could see the USDJPY remain range bound with the downside bias seeing a test of 111.74 support.