By CountingPips.com

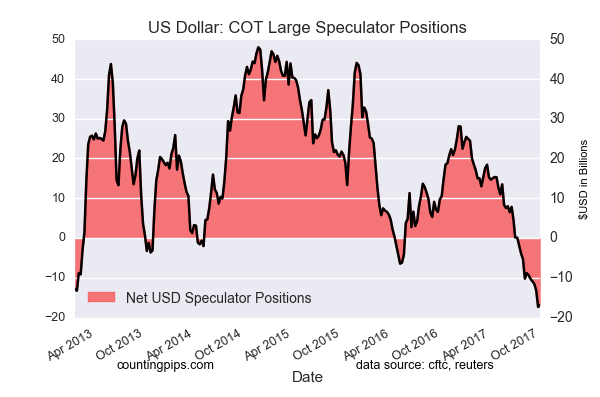

– US Dollar Speculators decreased their USD bearish bets for 1st time in 7 weeks

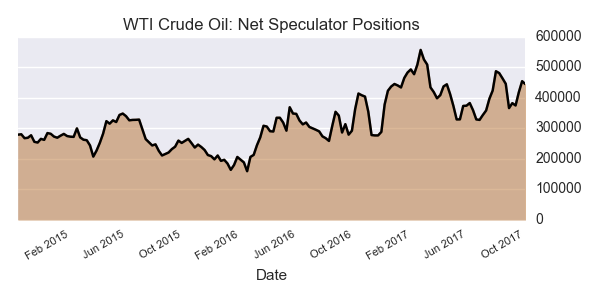

– WTI Crude Oil Speculator bets fell after 2 weeks of gains

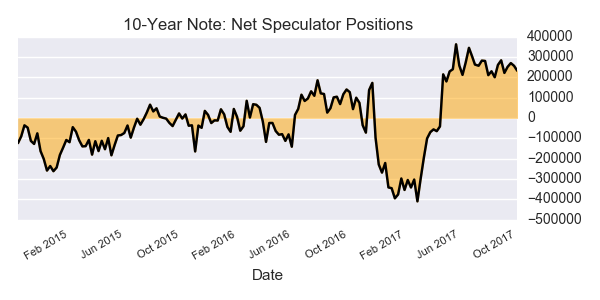

– 10-Year Note Speculators decreased bullish bets for 2nd week

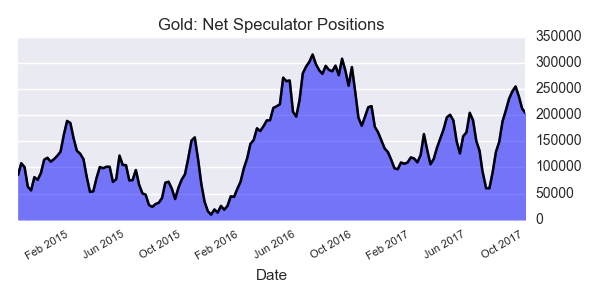

– Gold speculators dropped bullish bets for 3rd week

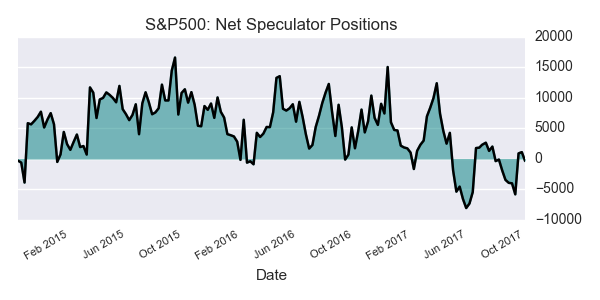

– Large S&P500 Speculators went into small short position

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

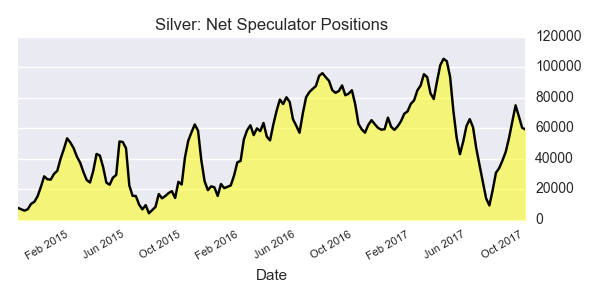

– Silver Speculator bets declined for 3rd week

– Copper Speculators raised bullish bets after 3 down weeks

Forex Speculators raised US Dollar bets for 1st time in 7 weeks

US Dollar net speculator positions leveled at $-16.83 billion as of Tuesday

The latest data for the weekly Commitment of Traders (COT) report, released by the Commodity Futures Trading Commission (CFTC) on Friday, showed that large traders and currency speculators raised their bets for the US dollar last week following six straight weeks of declines. See full article

WTI Crude Oil Speculator bets fell for 1st time in 3 weeks

The non-commercial contracts of WTI crude futures totaled a net position of 444,316 contracts, according to data from last week. This was a slide of -9,792 contracts from the previous weekly total. See full article

Gold Speculators cut back on bullish net positions for 3rd week

The large speculator contracts of gold futures totaled a net position of 203,855 contracts. This was a weekly decline of -8,739 contracts from the previous week. See full article

10-Year Note Speculators lowered bullish net positions for 2nd week

The large speculator contracts of 10-year treasury note futures totaled a net position of 232,156 contracts. This was a weekly reduction of -24,470 contracts from the previous week. See full article

S&P500 Speculators reduced their net positions to a short position

The large speculator contracts of S&P 500 futures totaled a net position of -376 contracts. This was a decrease of -1,458 contracts from the reported data of the previous week. See full article

Silver Speculators cut back on bullish net positions for 3rd week

The non-commercial contracts of silver futures totaled a net position of 59,179 contracts, according to data from last week. This was a weekly fall of -1,081 contracts from the previous totals. See full article

Copper Speculators lifted net positions for 1st time in 4 weeks

The large speculator contracts of copper futures totaled a net position of 33,829 contracts. This was a weekly boost of 3,693 contracts from the data of the previous week. See full article

Article by CountingPips.com

The Commitment of Traders report data is published in raw form every Friday by the Commodity Futures Trading Commission (CFTC) and shows the futures positions of market participants as of the previous Tuesday (data is reported 3 days behind).

To learn more about this data please visit the CFTC website at http://www.cftc.gov/MarketReports/CommitmentsofTraders/index.htm