By IFCMarkets

Higher expected global demand bullish for cocoa prices

Cocoa world demand is expected to rise in 2017-18. Will cocoa prices continue rising?

While cocoa harvest volumes in world major producing countries in West Africa are expected to be good to very good this year, cocoa demand is expected to rise globally too. World cocoa demand is expected to grow 2-3% in 2017-18, with Asian demand seen up 3-4% according to Harold Poelma, president of Cargill’s cocoa and chocolate division. Cargill is a major international food conglomerate, ranking number 15 as of 2015 on the Fortune 500. Growing world demand is bullish for cocoa prices.

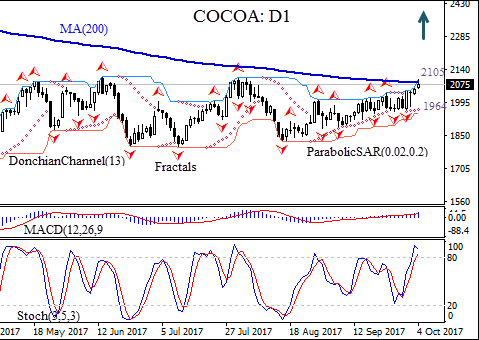

On the daily timeframe the COCOA: D1 has been rising toward the 200-day moving average MA(200).

- The Parabolic indicator gives a buy signal.

- The Donchian channel is tilted higher, signaling uptrend.

- The MACD indicator gives a bullish signal: it is above the signal line and the gap is widening.

- The Stochastic oscillator is in the overbought zone which is bearish.

We expect the bullish momentum will continue after the price breaches above MA(200) and the upper Donchian bound at 2095.00 . A price above this level can be used as an entry point for a pending order to buy. The stop loss can be placed below the fractal low at 1964.00. After placing the pending order, the stop loss is to be moved to the next fractal low, following Parabolic signals. By doing so, we are changing the probable profit/loss ratio to the breakeven point. If the price meets the stop loss level (1964.00) without reaching the order, we recommend canceling the position: the market sustains internal changes which were not taken into account.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Technical Analysis Summary

| Position | Buy |

| Buy stop | Above 2105 |

| Stop loss | Below 1964 |

Market Analysis provided by IFCMarkets