By Orbex Blog

Daily Forex Market Preview, 01/09/2017

The common currency recovered after falling to a 4-day low yesterday as data showed that the Eurozone flash inflation estimates accelerated stronger than expected. Headline inflation was seen rising 1.5%, more than the median estimates and rising higher from 1.3% in July. Core inflation, however, rose 1.2% as expected.

In the US, the commerce department reported that personal spending accelerated in July with personal incomes rising as well. However, personal consumption expenditure continued to rise unchanged at 1.4% on an annual basis. On the political front, the US Treasury Secretary, Steven Mnuchin said that President Trump is on track to implement the tax reforms by the end of the year.

Looking ahead, the economic calendar today will see the US nonfarm payrolls. According to the median estimates, the US economy is expected to add 180k jobs for August. The unemployment rate is expected to remain steady at 4.3% while the wages are expected to rise 0.2%, slightly slower than 0.3% increase seen the month before. Later in the day, the ISM manufacturing PMI data will also be released.

EURUSD intraday analysis

The common currency closed with a doji pattern yesterday. The brief strength in the US dollar made the EURUSD to fall to a 4-day low before prices recovered. Currently, the upside momentum is taking shape which could potentially see some retracement. Resistance level at 1.1927 is most likely to be targeted after price slipped to the support level of 1.1882 – 1.1825. A reversal at 1.1927 region is required in order for EURUSD to correct lower. Failure to reverse near the resistance level could keep the common currency on track to post further gains. Below the support level, EURUSD could be falling towards 1.1688 support.

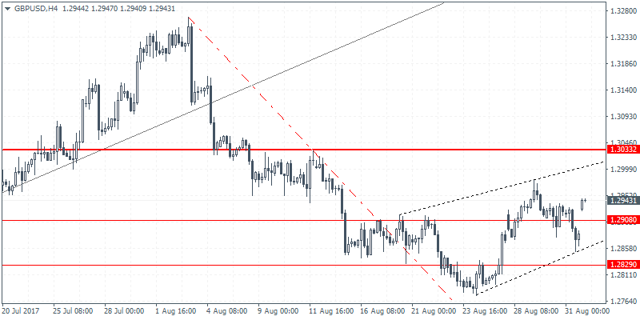

GBPUSD intraday analysis

GBPUSD (1.2943): The British pound continues with its consolidation above 1.2850. Price action gapped higher on the open today as the cable broke past the support level of 1.2908. In the near term, GBPUSD could maintain its sideways range within the resistance level of 1.3033. However, there is a potential bearish pattern forming. The rising wedge pattern could signal a downside breakout in GBPUSD as the currency pair looks to rebound to the upside. Still, the support at 1.2908 needs to be breached in order for the downside to continue. Below the support, GBPUSD could be seen falling towards 1.2829.

USDJPY intraday analysis

USDJPY (110.02): The USDJPY rallied to an 11-day high yesterday before closing on a weaker note. Price action remains bullish, trading above 109.15 support. In the near term, USDJPY is seen falling to the breakout level of the falling trend line at 109.75. A reversal here could signal potential upside in the US dollar. However, this needs to be followed through by a breakout of the resistance at 109.75. This will most likely give way for USDJPY to retest the next resistance level at 113.00. To the downside, in the event of a break down below 109.75, expect some consolidation up to 109.15.