Daily Forex Market Preview, 07/09/2017

The Bank of Canada’s monetary policy decision yesterday saw the central bank hiking the key interest rates by 25 basis points. The markets were expecting another rate hike from the BoC but only later in the year. The central bank signaled that the decision to hike interest rates came from the better than expected GDP numbers. The BoC, however, toned down its forward guidance noting that rate hikes were not on a preset course. Still, the surprise rate hike sent the Canadian dollar to rise 1.2% on the day.

In the US, the ISM’s non-manufacturing index advanced to 55.3 in August up from 53.9 in July, but the US dollar was seen trading subdued.

Looking ahead, investors will be closely watching the press conference by ECB President Mario Dragi and the ECB’s monetary policy statement today. Questions about the ECB tapering its QE program will be on the agenda which has helped fuel the euro rally since July. However, with the euro surging to levels of $1.20, questions on the exchange rate also increases the risks.

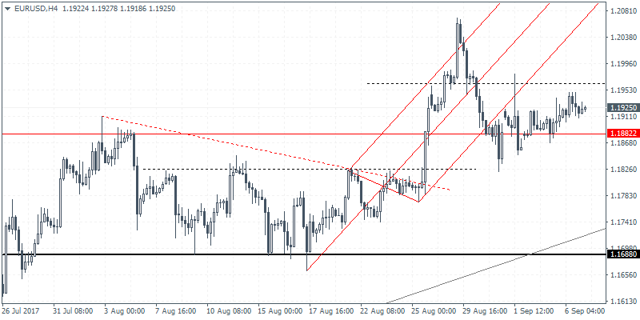

EURUSD intraday analysis

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

EURUSD (1.1925): The EURUSD has been largely muted this week with price action still confined to last Friday’s range. This suggests a near-term breakout in price. To the upside, the minor resistance that was briefly tested last week could once again come into focus. A reversal at 1.1963 suggests a possible decline on a breakdown of support at 1.1882. This will potentially expose further downside in EURUSD towards 1.1688. To the upside, price action will need to break past 1.2000 level in order to maintain the bullish momentum to the upside.

GBPUSD intraday analysis

GBPUSD (1.3048): The British pound was seen trading near the 1.3033 resistance level yesterday. Price action briefly posted a 23-day high as GBPUSD traded at 1.3059 before easing back. In the short term, price action at the resistance level of 1.3052 – 1.3033 could potentially post a reversal. This will push GBPUSD down to 1.2908 support in the short term. However, with the daily chart suggesting a potential head and shoulders pattern evolving, further downside could send GBPUSD lower towards 1.2829 support where the possible neckline support could be coming into focus. Alternately, a close above 1.3052 could see further gains coming in the currency pair.

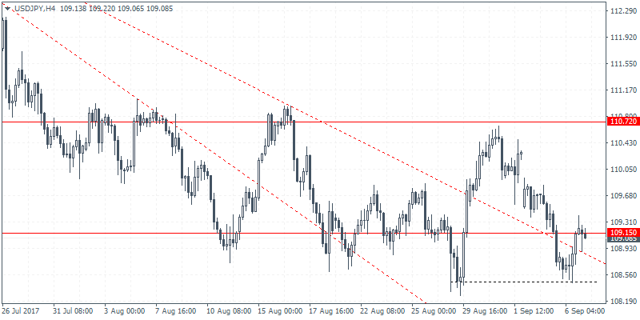

USDJPY intraday analysis

USDJPY (109.08): The USDJPY managed to post some gains yesterday as price action continues to consolidate near the major support zone of 109.15 – 108.26. A follow through from here is required in order for the US dollar to post some recovery. On the 4-hour chart, despite price briefly breaking past the falling trend line, the reversal at 108.45 suggests a possible double bottom pattern. USDJPY will need to continue to push higher in order to break above the resistance level of 110.72 to validate this double bottom pattern.