By The Gold Report

Source: Streetwise Reports 08/30/2017

A past-producing mine in Arizona comes back to life with a new, well-financed and disciplined management team.

Kerr Mines Inc.’s (KER:TSX; KERMF:OTC) Copperstone project in Arizona is an example of the old mining adage, “The best place to look for a new mine is near the headframe of an old mine.” The project is a historical 500,000-ounce gold producer with blue-sky exploration that has significant development and production infrastructure in place and ready for use.

Copperstone was mined by Cyprus Minerals as a heap-leach surface mine from 1989 to 1993, when it was decommissioned. Between 2010 and 2014, American Bonanza developed a small underground operation that was put on care and maintenance due to engineering and financial issues, as well as a downward trending gold price.

The previous owners of the mine had made large investments in infrastructure. The existing underground access, mill, surface impoundments and related infrastructure are well built and are in sound working condition, according to the company. The infrastructure investments were made relatively recently, and cost the previous operator between CA$50 million and CA$60 million; today they would cost over CA$100 million to replicate, Kerr CEO Claudio Ciavarella told Streetwise Reports.

Free Reports:

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your charts when you join our Weekly Newsletter

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

Get our Weekly Commitment of Traders Reports - See where the biggest traders (Hedge Funds and Commercial Hedgers) are positioned in the futures markets on a weekly basis.

In 2014, Kerr Mines acquired the fully permitted property. Kerr kept the property in care and maintenance until early 2016. At that point, it began a complete financial restructuring that elevated Copperstone to the sole priority focus.

Kerr Mines plans to focus its efforts on better definition of the resources at Copperstone. In early August, the company announced that it had appointed Hard Rock Consulting to conduct a prefeasibility study (PFS) on the mine. In the news release Kerr stated that the prefeasibility study “will be the basis for the decision to proceed towards production of the Copperstone Mine.” The study is expected to be completed by Q1/18.

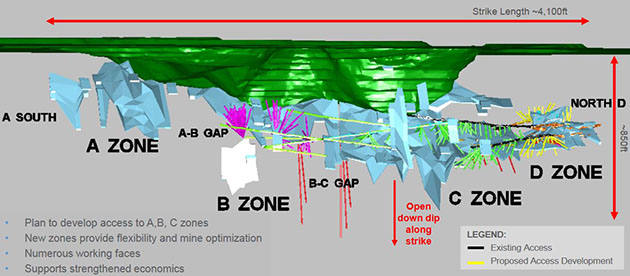

In the same announcement, Kerr Mines reported that it awarding a contract to Godbe Drilling to conduct surface and underground drill programs, and to DMC Mining Services Corp. for underground development. “The inclusion of the underground development allows the 2017 Copperstone Mine exploration program to access high-priority targets previously unavailable,” the company stated.

The company reported on Aug. 15 that it had initiated the first phase of surface drilling at Copperstone: “Approximately 15,000 feet of drilling is allocated to the first phase with the goals of further defining the parallel Footwall Zone and increasing the existing resource in the Copperstone Zone.” Kerr noted that the objective of the drilling is to “continue to build from prior successful drilling results in the Footwall Zone, which has indicated similar inclination attitude, rock type, alteration, width and grade as is seen the Copperstone Zone. It is also designed to strengthen the Copperstone Zone along strike and increase its down dip extension.”

Martin Kostuik, president of Kerr Mines, commented that “the 2017 Copperstone exploration program is the cornerstone for the forthcoming pre-feasibility study and is a key component to the strategy of advancing the Copperstone Mine project towards a production decision.”

On Aug. 21, Kerr reported that the underground drill access mine development has begun. According to the company, “approximately 1,200 feet of new exploration drift is planned to be completed in the first phase. This drift will provide first-time underground drill access to facilitate further definition of the parallel Footwall Zone and to enhance the existing resource in the Copperstone Zone.”

The recently completed financing provides insight into the optimism of management and inside investors for the project. The initial goal was to raise $5 million. Actual receipts were $8 million. The offering price was $0.18, yet the stock maintained strength in the $0.22–24 range until drifting slightly lower in the last few weeks to around $0.20, and then surging on Aug. 24 to $0.27.

More than two-thirds of the outstanding stock of Kerr is tightly held. The three largest shareholders—CEO Claudio Ciavarella, Chairman of the Board Fahad Al Tamimi, and Eric Sprott—own 42% of the outstanding shares, which provides a clear indication of their commitment and alignment with shareholders. Another small group of institutional owners owns an additional 20%. Additionally, the debt is friendly as it is held by both the Chairman and CEO.

Glenn Olnick, a long-time investor in the project, told Streetwise Reports that the project has a lot going for it: “Copperstone is in the U.S., is high grade, is permitted, has lots of water, and has power on site. There is a mill and labs; all the infrastructure is there, which the company is basically getting for free. Cyprus produced 0.5 Moz gold there, so we know that there is gold and that it can be produced.”

“The project was never drilled out properly; at long last we are going to drill it using all the science that we can,” Olnick concluded.

Technical analyst Clive Maund noted in June that Kerr shares were “basically driven into the ground by a combination of adverse sector conditions and bad management, but what has happened since is that management has been cleaned up, the company has acquired a fully permitted mine in mining friendly Arizona that can brought to production relatively quickly, and lately some powerful and well-known investors have been taking positions, investors who are not renowned for getting it wrong.”

Want to read more Gold Report articles like this? Sign up at www.streetwisereports.com/get-news for our free e-newsletter, and you’ll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Patrice Fusillo compiled this article for Streetwise Reports LLC and provides services to Streetwise reports as an employee. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) Alec Gimurtu conducted research for this article for Streetwise Reports LLC and provides services to Streetwise reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: Kerr Mines. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: None. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this interview, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Kerr Mines, a company mentioned in this article.

( Companies Mentioned: KER:TSX; KERMF:OTC,

)